Gst Revenue Neutral Transactions

Theoretically gst should have been revenue neutral.

Gst revenue neutral transactions. Allowing for some leakages the combined rnr could be in the range of 12. 11 200 as percent of 1763 is 11 3. The court s conclusion in storage equities was that the land value is the amount expected to be received on the sale of the land including any gst which the vendor may be liable to pay. It would bring about uniformity in tax rates across the country integrate the country into a common market end the cascading of taxes widen the tax base and raise government revenues.

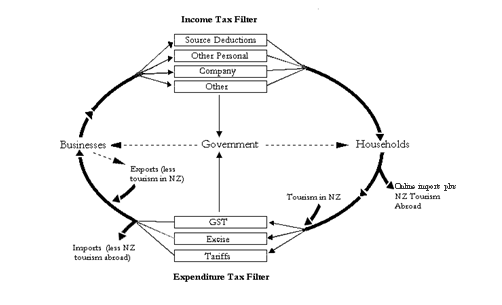

06 may 2008 gst revenue neutral corrections on 5 may 2007 the ato published practice statement ps la 2008 9 entitled gst revenue neutral corrections. Iv estimating india s revenue neutral rate rnr under the gst 15 macro approach 16 indirect tax turnover approach 17. 5 20 if inland revenue were given earlier notice of a property transaction it would be possible to detect transactions that might be viewed as detrimental to the gst base at a much earlier stage. This effectively makes the transaction gst neutral from inland revenue s point of view.

Gst for overseas businesses there are 4 types of gst registration for non resident businesses. These values yield a revenue neutral gst rate of approximately 11 200 as per cent of 1 763 is 11 3. Zero rating of the transaction means the gst component of the purchase price amounts to zero. These values yield a revenue neutral gst rate of approx.

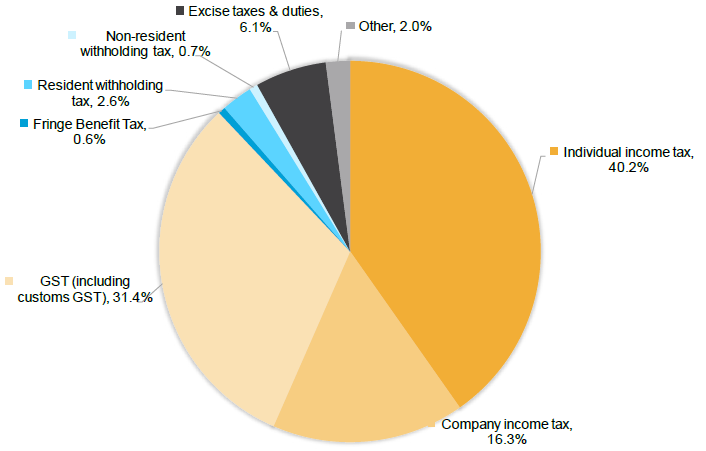

Report on the revenue neutral rate and structure of rates for the goods and services tax gst december 4. The centre excise duty rates have been reduced substantially the standard rate reduced from 16 to 10 since 2005. Allowing for some leakages the combined rnr could be in the range of 12. In determining value by reference to comparable sale transactions no adjustment should be made to those transactions on account of any gst liability of the vendor see para 48.

The purpose of the practice statement is to outline the ato policy on remission of general interest charge gic imposed for the shortfall period on corrections of transactions where the correction involves equal and offsetting primary gst. Revenue neutral rate is an important concept in gst regime as per law lexicon dictionary by p. The rnr for the centre is 5 and for the states 6 3. Gst groups if you have many gst registered entities you can form a gst group to reduce compliance costs.

Transactions difficult to manage. 5 21 the intention of using caveats would not be to enforce the collection of gst but to provide inland revenue with information that a transaction is likely to occur and that output tax is payable. These estimates are by no means precise. In theory the shift to gst made eminent sense.

The vendor does not have to pay gst output tax on the transaction but equally the purchaser cannot claim gst input tax. Ramanath aiyar changes in the tax law which result in the same amount of overall total revenue.