How To Calculate Revenue Recognition

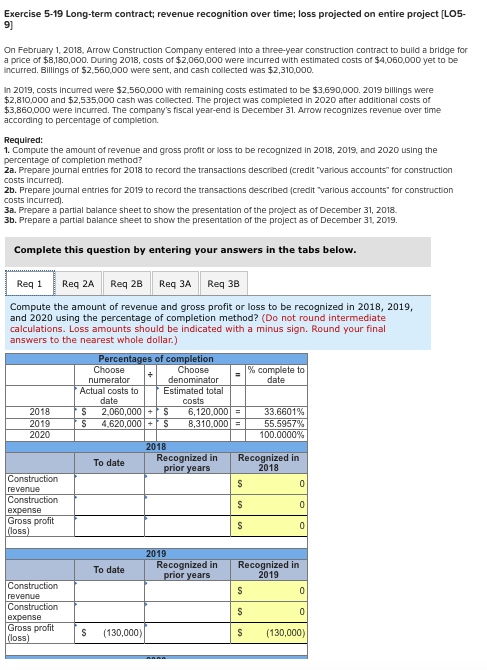

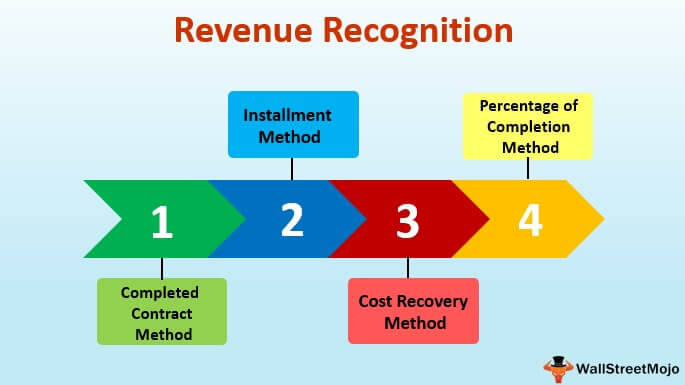

In case of long term contracts accountants need a basis to apportion the total contract revenue between the multiple accounting periods.

How to calculate revenue recognition. Revenue recognition is an accounting principle that outlines the specific conditions under which revenue sales revenue sales revenue is the income received by a company from its sales of goods or the provision of services. It s become tricky for me because revenue recognition is pro rated based on the date ordered i e. There is a standard way that most companies calculate revenue. This expense is called the cost of goods and services and includes any materials purchased to create the product being sold.

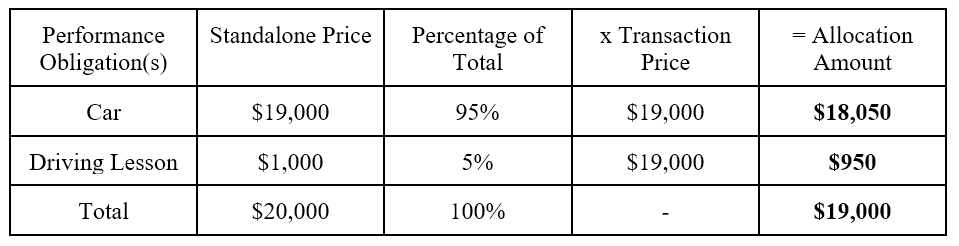

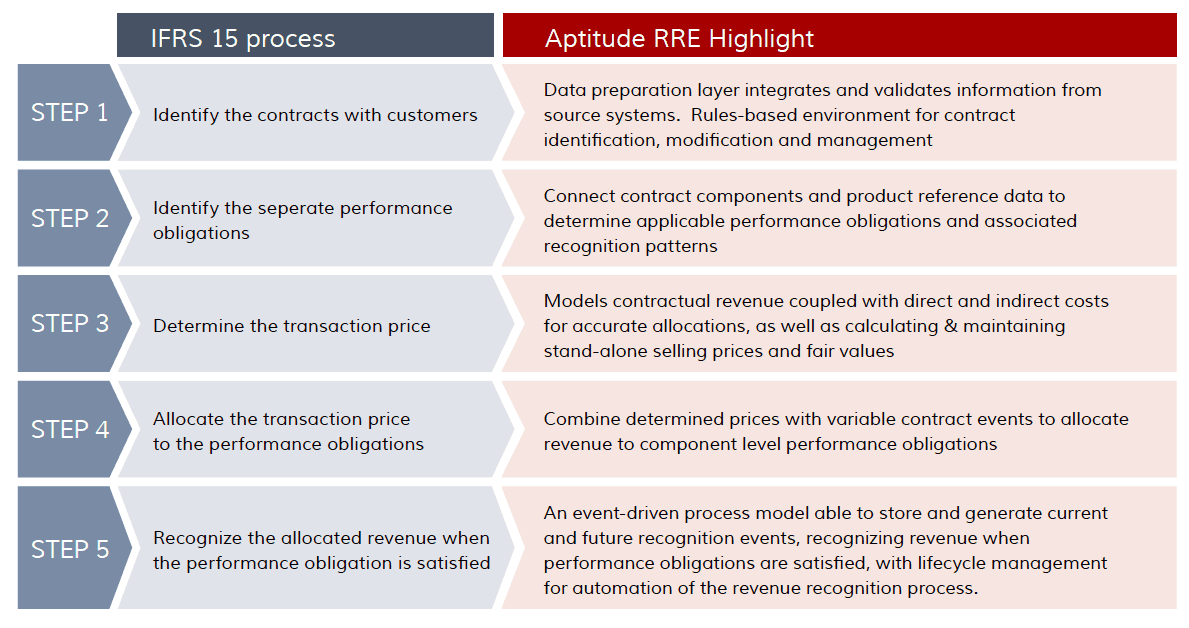

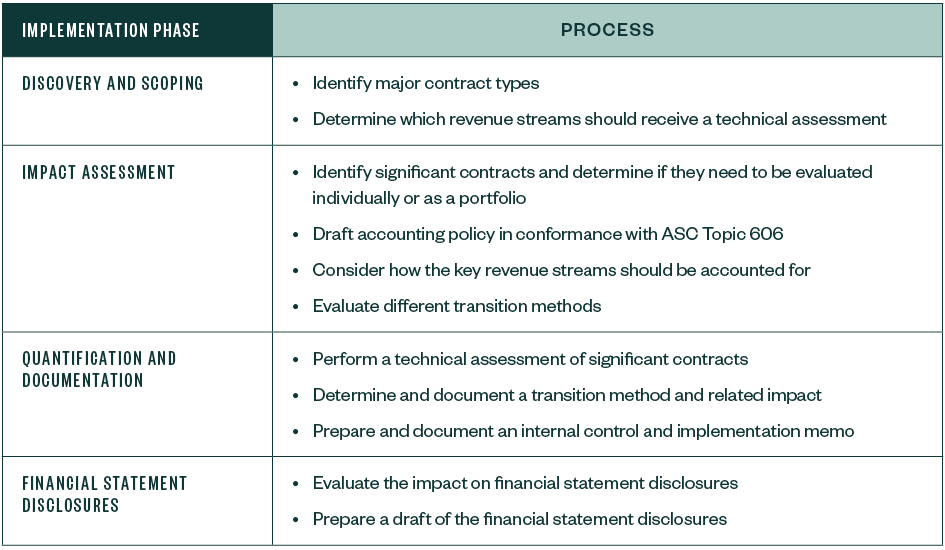

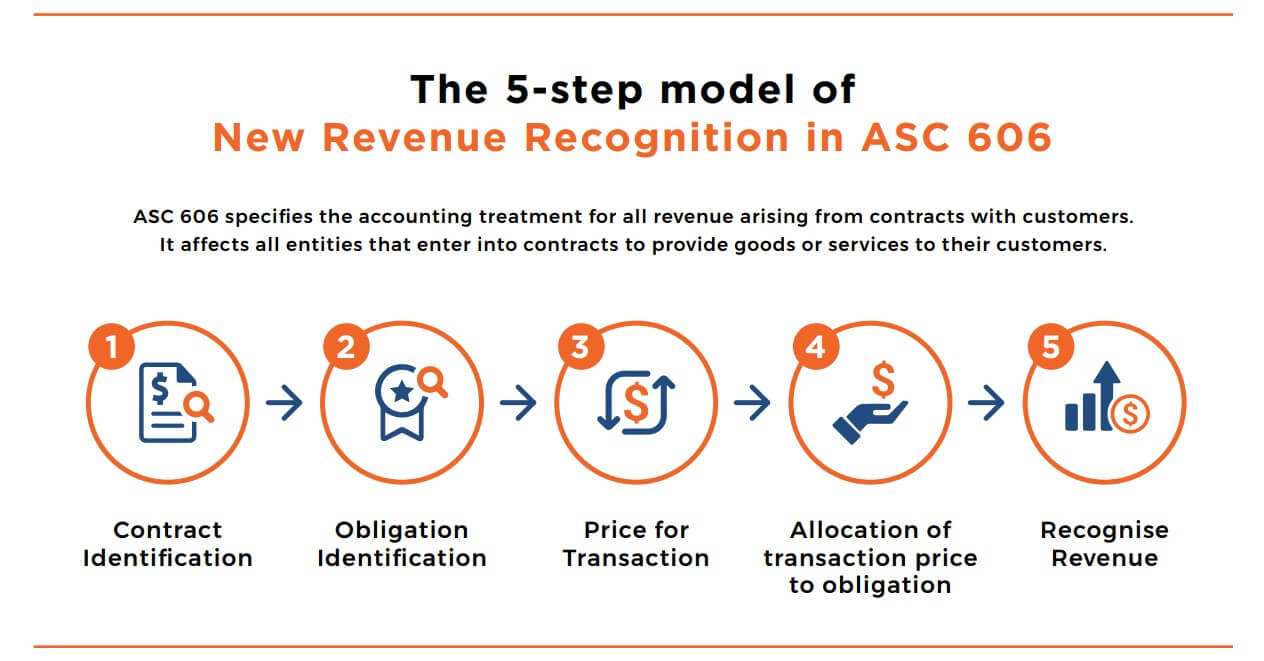

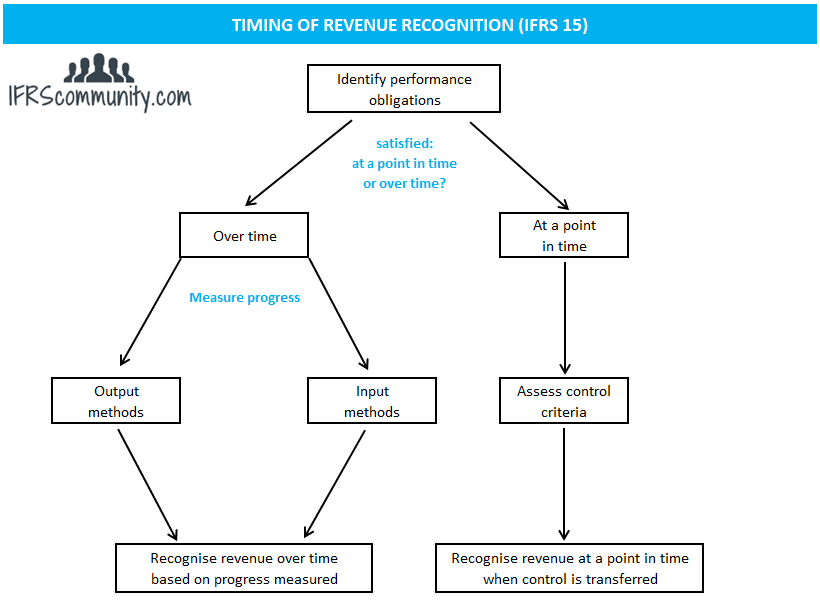

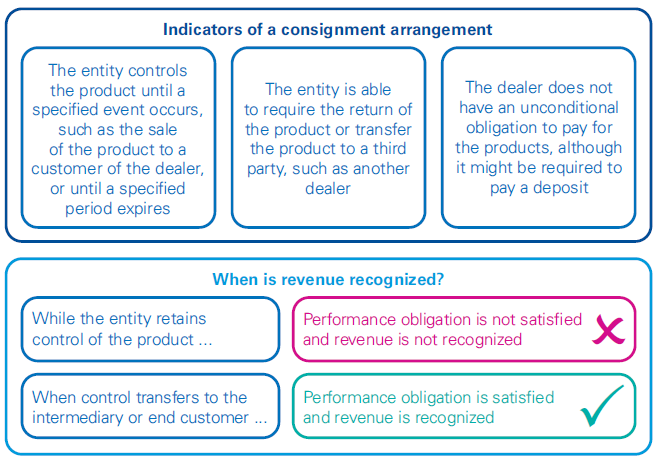

The standard provides a single principles based five step model to be applied to all contracts with customers. In accounting the terms sales and revenue can be and often are used interchangeably to mean the same thing. In theory there are various options. Profitwell s rigorous and precise revenue recognition service recognized is also an industry wave maker to keeping track of your revenue.

How to calculate revenue. One method could be to recognize the revenue when the owner actually pays the bill. Order on the 20th of a month so at the end of the month 1 3 of the month is recognized as revenue i m looking for something that will populate the percentage of the order amount each month that will be recognized. Where r revenue q quantity p price revenue recognition principle according to the revenue recognition principle revenue is recorded when the benefit of sales is generated and risks of ownership are transfer from buyer to seller when goods and services are delivered to the seller when the product is sold revenue is recorded in the balance sheet and cash also increase in the balance sheet.

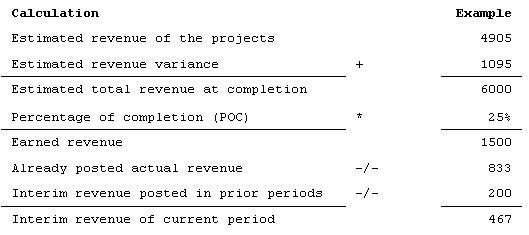

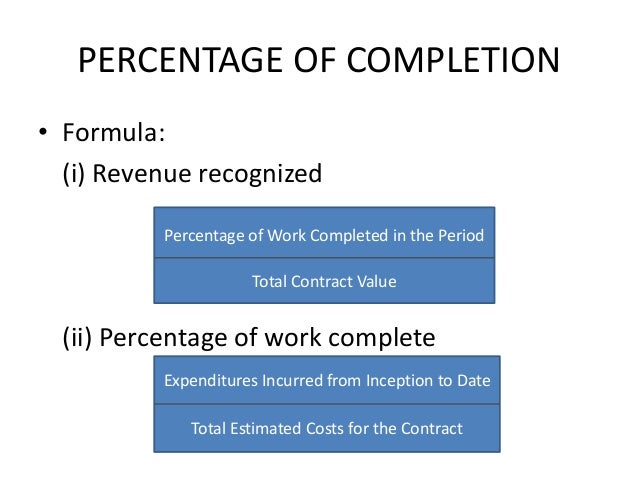

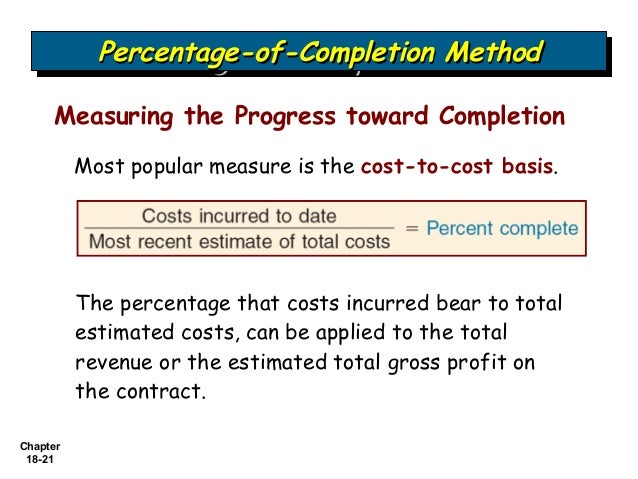

Percentage of completion method. Percentage of completion method is a basis for revenue recognition in long term construction contracts which span over more than one accounting periods. Revenue recognition the term revenue recognition refers to the question of when an accounting system will recognize that project revenue has been earned by the construction business. The bakery owner spends 6 000 on supplies every quarter to produce his goods.

The sales revenue formula helps you calculate revenue to optimize your price strategy plan expenses determine growth strategies. Ifrs 15 specifies how and when an ifrs reporter will recognise revenue as well as requiring such entities to provide users of financial statements with more informative relevant disclosures. The revenue recognition principle using accrual accounting. Ifrs 15 was issued in may 2014 and applies to an annual reporting period beginning on or.

Understanding revenue can take time time that can be used vitally.