On An Income Statement Net Sales Revenue Minus Cost Of Goods Sold Is

However some companies with inventory may use a multi step income statement.

On an income statement net sales revenue minus cost of goods sold is. Gross profit is calculated as net sales minus. The same goes for calculating the gross margin sales revenue minus the cost of goods sold divided by sales revenue and operating margin gross profit minus selling general administrative. Gross profit is net sales minus cost of goods sold. Look at a multiple step income statement for clarification.

Apart from material costs cogs also consists of labor costs and direct factory overhead. Gross profit will appear on a company s income statement and can be calculated by subtracting the cost of goods sold from revenue sales. The income statement of a service company consists of service revenue minus any expenses related to that service which results in net income another way to look at it is that inventory never. On most income statements cost of goods sold appears beneath sales revenue and before gross profits.

From revenue cost of goods sold is deducted to find gross profit. It tells you how much money a company would have made if it didn t pay any other expenses such as salary income taxes copy paper electricity water rent and so forth for its employees. Product costs affect only the income statement c. Sales revenue and the income statement.

This would result in a gross profit of 100 sales minus cost of sales. Period costs affect only the balance sheet d. You can determine net income by subtracting expenses including cogs from revenues. Gross revenue is the total sales income from the primary business activity.

These figures can be found on a company s income statement. The gross profit of a business is simply revenue from sales minus the costs to achieve those sales. This is important for two reasons. Cost of goods sold does not include general expenses such as wages and salaries to office staff advertising expenses etc.

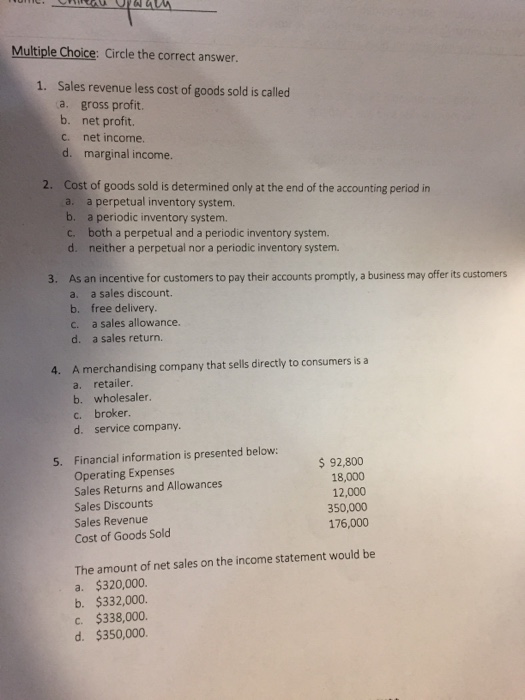

First it marks the starting point for arriving at net income. So our sales would be 400 and our cost of the goods we sold cost of sales would amount to 300. Sales revenue less cost of goods sold is referred to as operating income a. Cost of goods sold cogs is the total value of direct costs related to producing goods sold by a business.