Outstanding Revenue Journal Entry

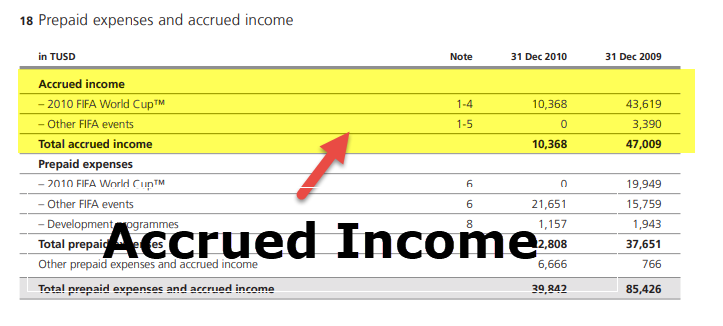

Examples of accrued income interest on investment earned but not received.

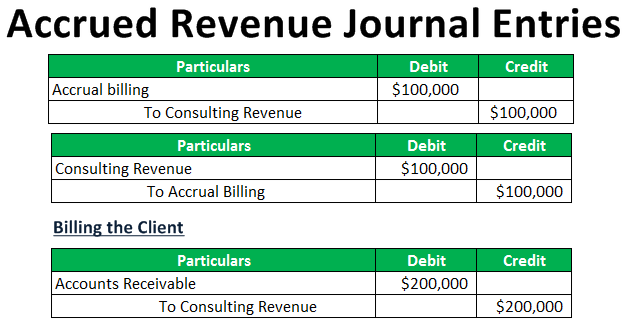

Outstanding revenue journal entry. How to record the journal entries. Journal entry for outstanding expenses with the golden rule. Journal entry for outstanding expenses. Journal entry for accrued revenue.

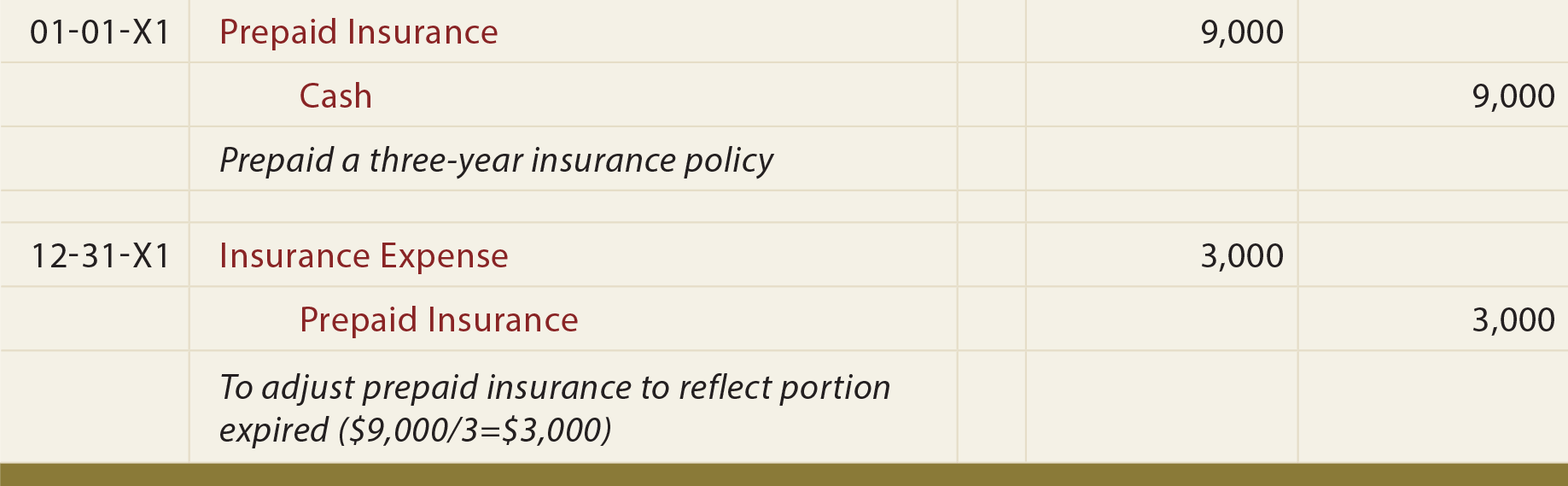

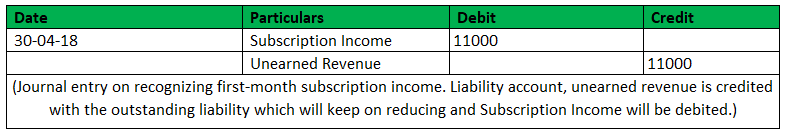

Let s walk through the process of recording revenue recognition journal entries with the following journal entries. 01 02 2018 rent earn but not received yet from the tenant for rs 1 500. Once you ve identified exactly how the standard will affect your industry and your business it s time to identify how to make a more accurate journal entry for revenue recognition. Accrued revenue is often used for accounting purposes to determine the matching concept.

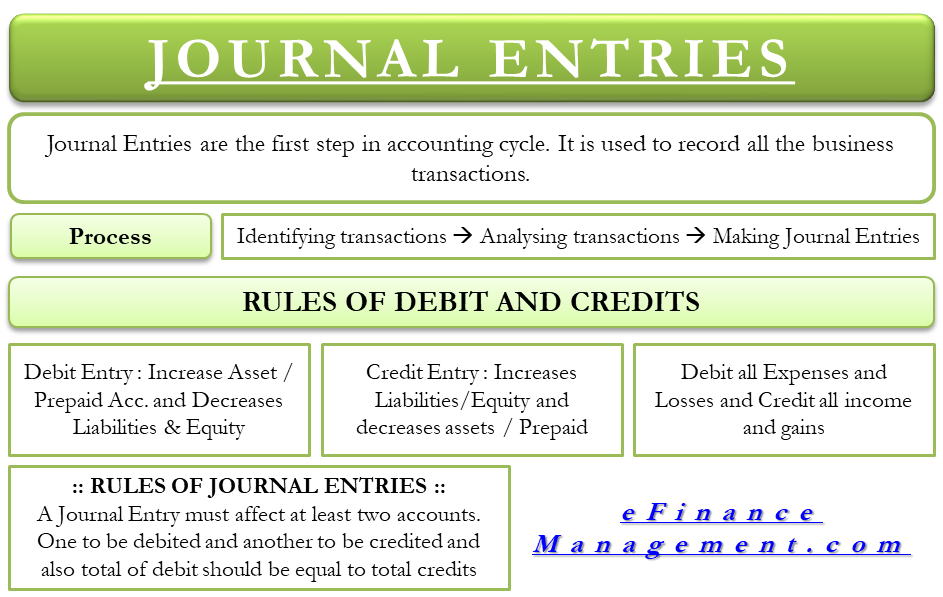

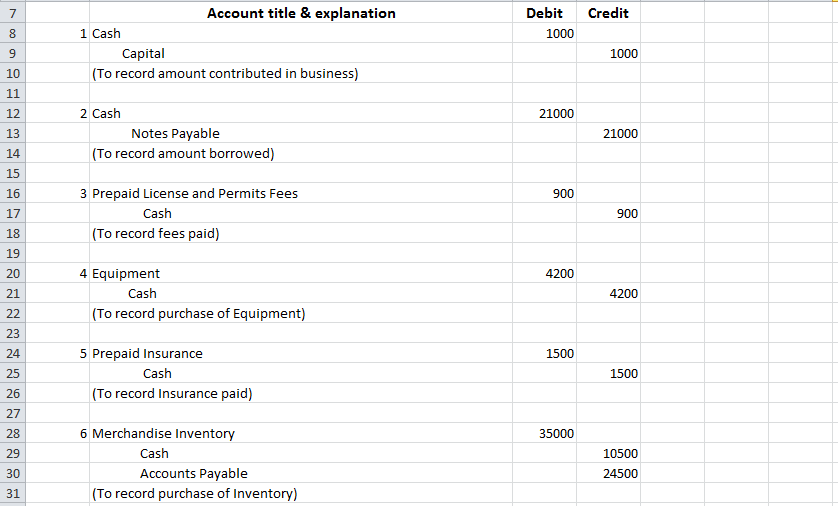

Journal entry for accrued income. Basics of journal entries accounting journal entry examples. The recordation of a sale. The content of the entry differs depending on whether the customer paid with cash or was.

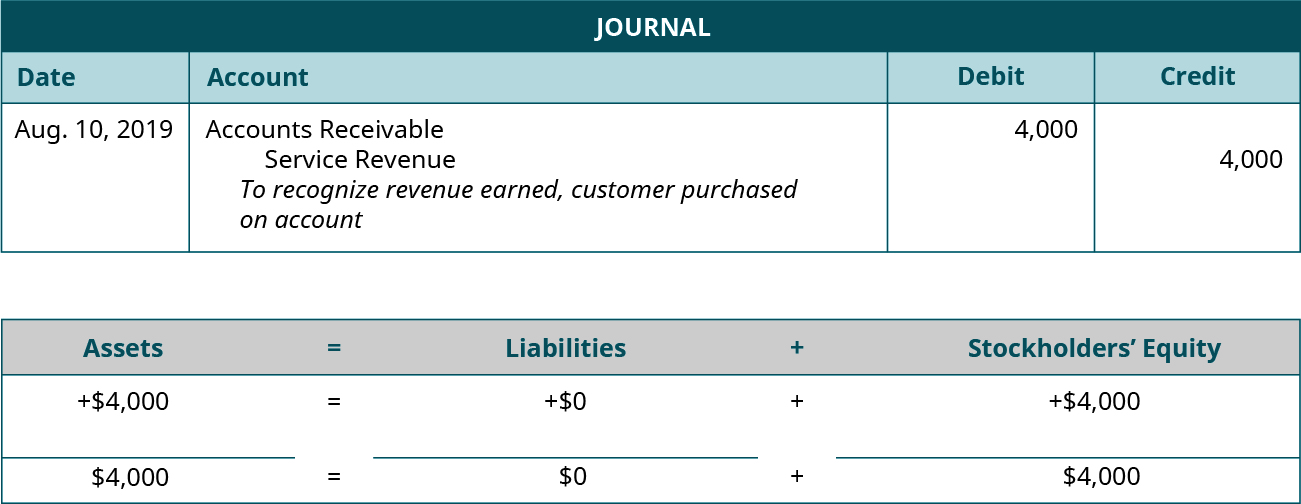

The recordation of a reduction in the inventory that has been sold to the customer. Accrued revenue is the income that is recognized by the seller but not billed to the customer. A sales journal entry records the revenue generated by the sale of goods or services. It is income earned during a particular accounting period but not received until the end of that period.

So in this transaction according to the first step of our treatment of business transaction with the golden rules of accounting we find two accounts which are involved in the transaction. The first account is salary it will be treated as like simple expense entry shown below. The recordation of a sales tax liability. More examples of journal entries accounting equation double entry recording of accounting transactions debit accounts credit accounts asset accounts liability accounts equity accounts revenue accounts expense accounts.

In each case the accounts receivable journal entries show the debit and credit account together with a brief narrative. The accounts receivable journal entries below act as a quick reference and set out the most commonly encountered situations when dealing with the double entry posting of accounts receivable. It is treated as an asset for the business. Salary expense a c nominal rule expense met by business debit all expenses losses.

Salary for the month of jan 18 rs 50 000 due but not paid yet. Journal entry for accrued income recognizes the accounting rule of debit the increase in assets modern rules of accounting. Adjusting journal entries. It is treated as an asset in the balance sheet and it is normal in every business.

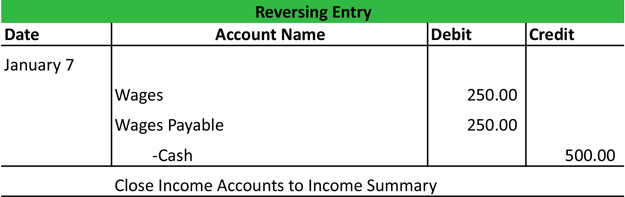

Outstanding expenses are those expenses which are due in the current accounting period but not paid the benefits of such expenses have been consumed although due to some reason they are not paid until the end of the accounting period. Journal entry for accrued income with the golden rule.