Unearned Service Revenue Debit Or Credit

The balance of unearned revenue is now at 24 000.

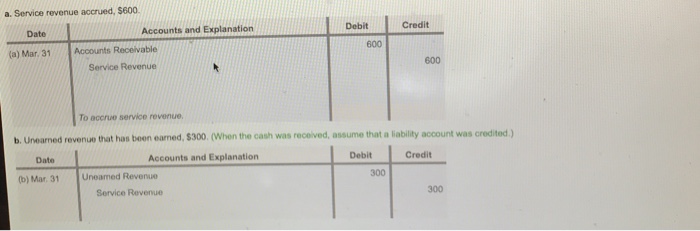

Unearned service revenue debit or credit. When you record unearned fees or revenue it only hits the balance sheet. Of the 30 000 unearned revenue 6 000 is recognized as income. Unearned revenue is a liability for the recipient of the payment so the initial entry is a debit to the cash account and a credit to the unearned revenue account. The owner then decides to record the accrued revenue earned on a monthly basis.

This is advantageous from a cash flow perspective for the seller who now has the cash to perform the required services. At the end of 12 months all the unearned service revenue unearned will have been taken to the service revenue account earned. It is recorded on a company s balance sheet as a liability. From the accounting point of view the unearned service revenue account is credited 1 200.

The incurring of obligation to perform future advertising service increases a liability an unearned service revenue of 1 200 in fac. Unearned services revenue is that part of revenue which is not yet earned and as it is not yet earned then it is liability for business and hence like all other liabilities it has credit balance. A similar situation occurs if cash is received from a customer in advance of the services being provided. The business owner enters 1200 as a debit to cash and 1200 as a credit to unearned revenue.

Debit cash or ar asset account credit unearned revenue liability it is a liability until the. Unearned revenue is money received from a customer for work that has not yet been performed. Credit unearned revenue current liability to reflect that goods still have to be provided for against the cash received subsequently when the company completes the transaction it can be seen that they reflect this amount in the income statement which can be reflected in the following journal entry. We are simply separating the earned part from the unearned portion.

Unearned revenue is money received by an individual or company for a service or product that has yet to be provided or delivered. The earned revenue is recognized with an adjusting journal entry called an accrual. The debit credit rule also requires the increase in liabilities to be credited.