Reporting Deferred Revenue On Balance Sheet

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

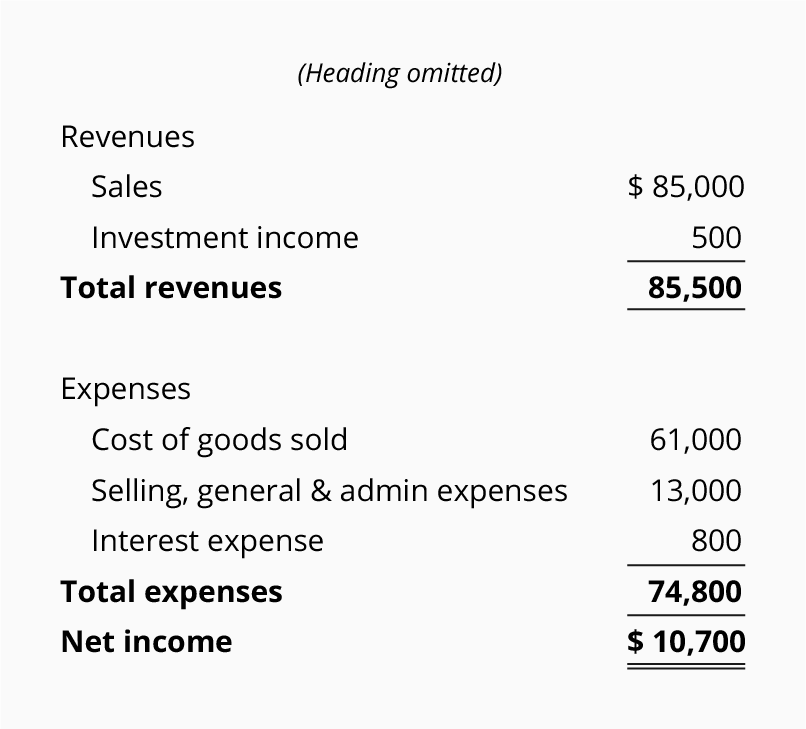

True or false true false if revenues are not growing faster than expenses then net income will decrease.

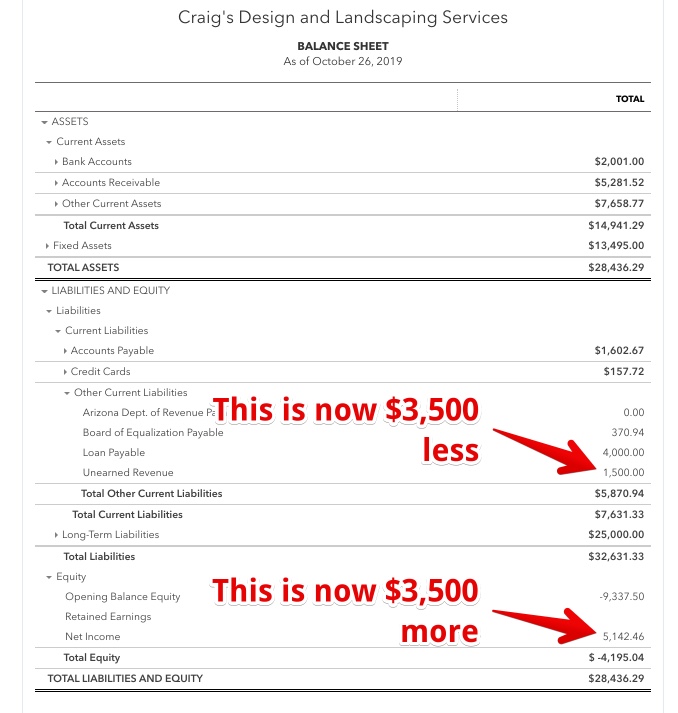

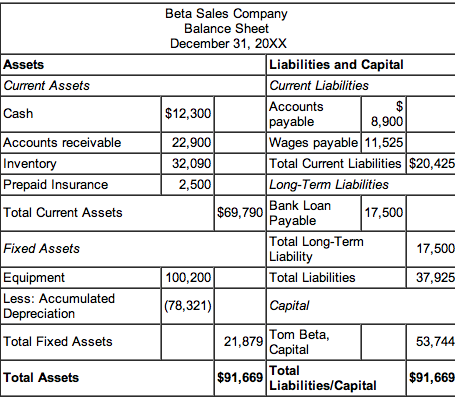

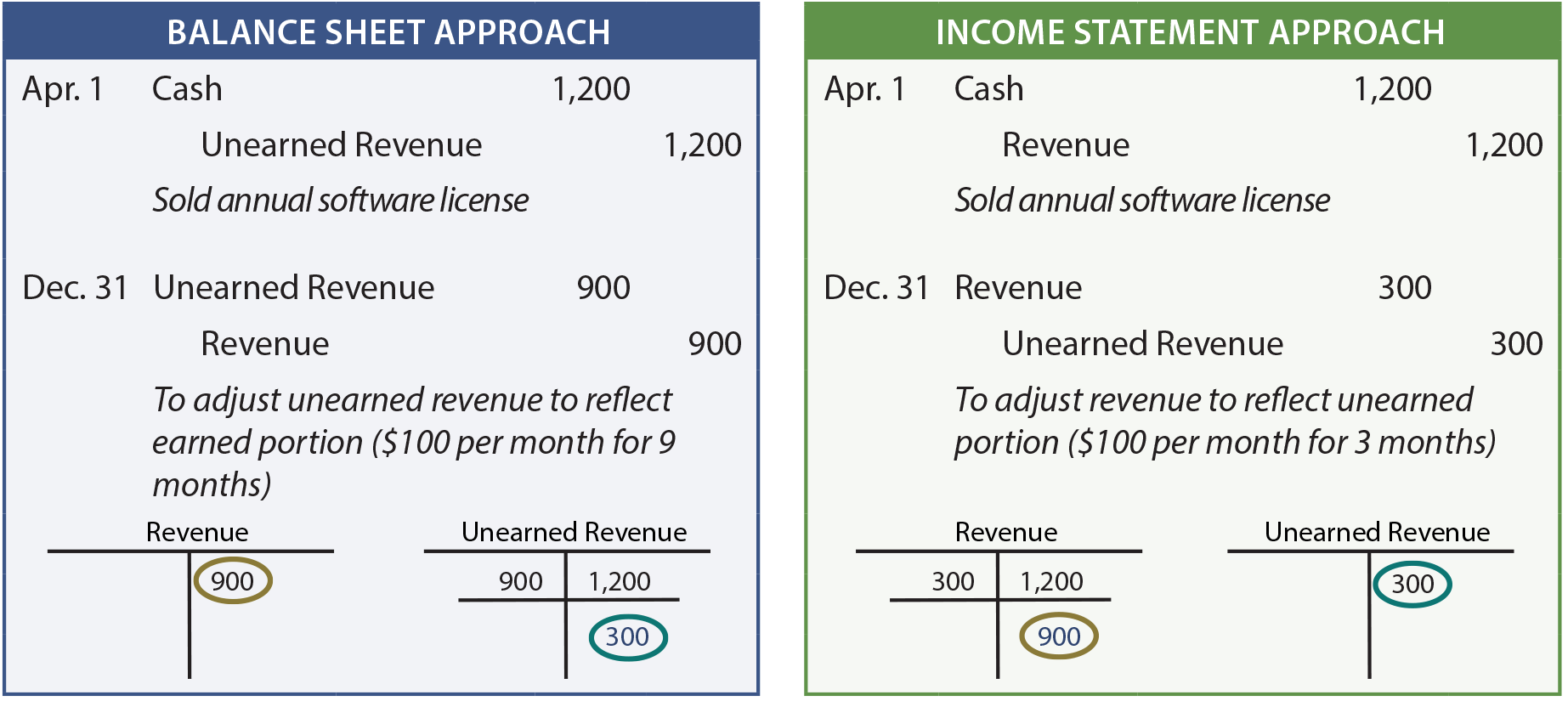

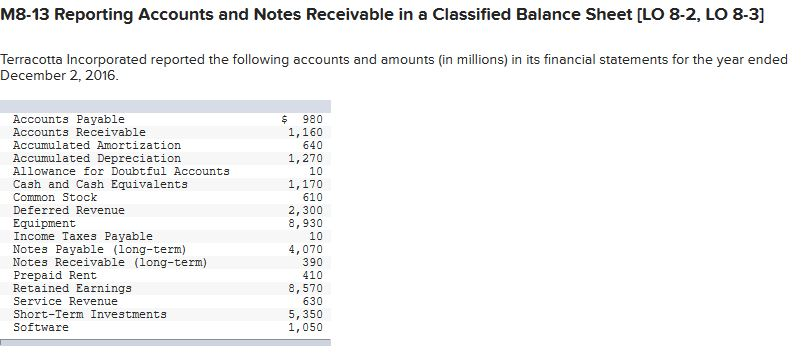

Reporting deferred revenue on balance sheet. It is considered as deferred revenue. In our example above this would be done monthly for 12 months. When a company receives advance payment from a customer before the product service has been delivered. Deferred revenue holds significance for the company as they finance operations thus relieving the burden on other assets or avoiding taking a loan.

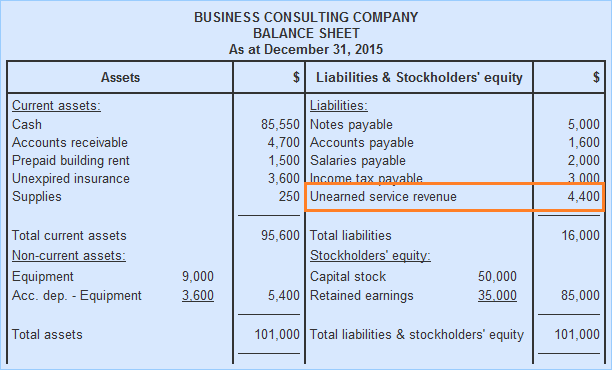

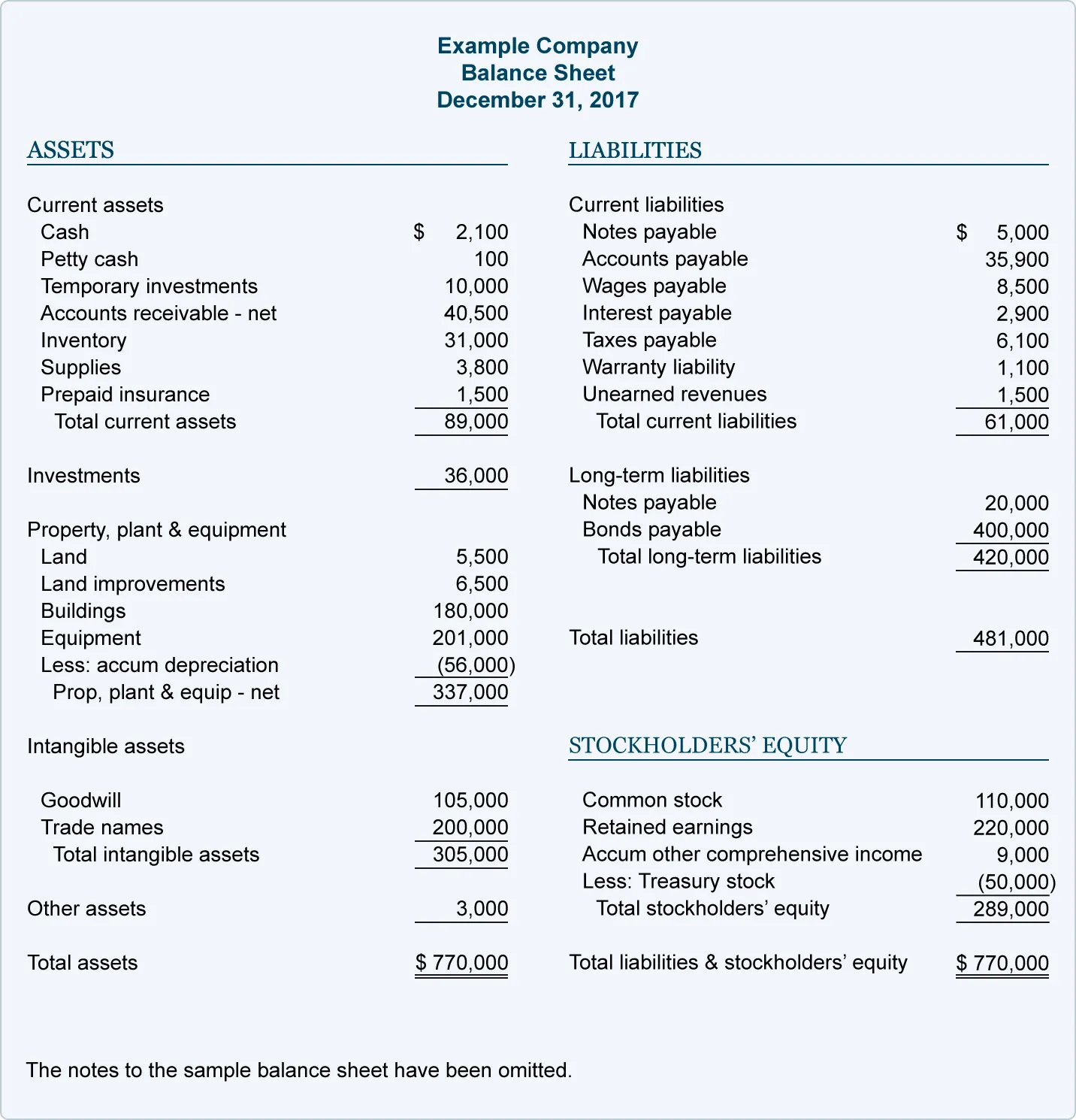

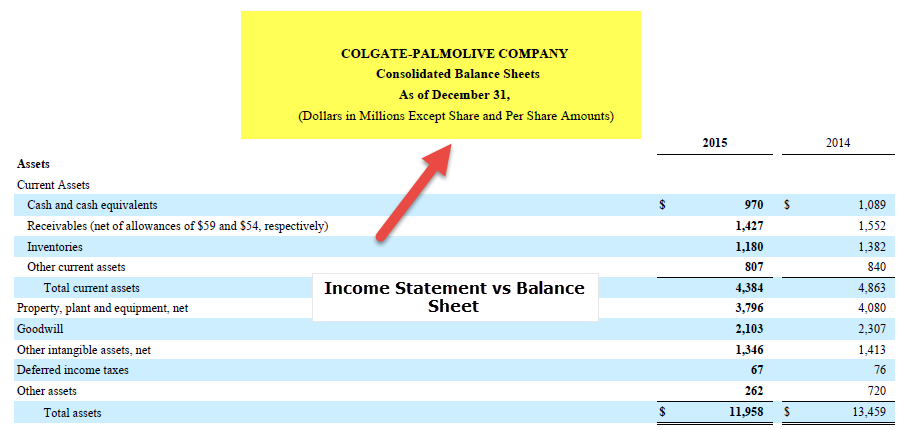

Deferred revenue is a current liability account used in financial reporting. Deferred revenue is listed as a liability on the balance sheet because under accrual accounting the revenue recognition process has not been completed. True or false true false true false gaap does not allow cash basis accounting to be used in external financial reports. Therefore it avoids overvaluing the company s net worth.

Deferred revenue is listed as liabilities on the balance sheet. Deferred revenue or unearned revenue refers to advance payments for products or services that are to be delivered in the future. The recipient of such prepayment records unearned revenue as a. By reporting deferred revenue on the liability side of the balance sheet the company avoids reporting unearned income in the asset.

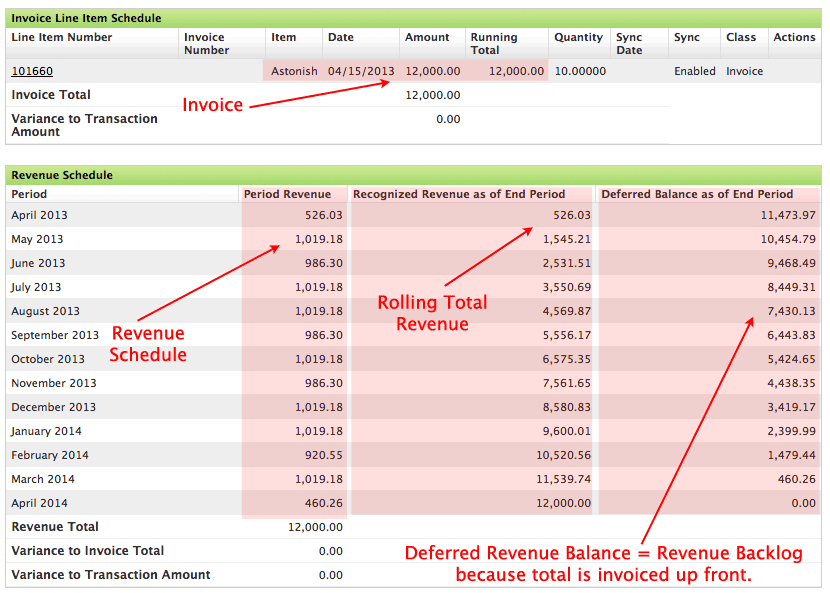

Deferred revenue on balance sheet typically it is reported under current liabilities. Deferred revenue appears on the balance sheet and is calculated as follows. Deferred revenue is reported on the balance sheet as a liability. The sum of the total of invoices for all contract elements for a single contract minus the total of recognizable revenue for all contract elements for a single contract.

In order to record deferred revenue against your company s balance sheet you would record the following journal entry.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)