Revenue Canada Payroll Remittance

From the role tailored client page navigate from payroll periodic activities rq remittance.

Revenue canada payroll remittance. There are a couple of things that can happen when remitting your payments. Posted on july 23rd 2020 in business support services domestic tax general business. As an employer in canada the canada revenue agency cra requires that you remit file payroll taxes accurately and on time. Allow employers with a revenue decline of less than 30 per cent to access cews.

Operating a business in canada means complying with all pay regulations dictated by the canada revenue agency cra including required deductions and remittances. This report can be filtered by employee or. In this post we ll outline the types of payroll deductions you need to make along with which kind of remittance schedule you ll need to follow. This purpose of this document is to assist the payroll processor with the preparation of the required remittance of source deductions.

Paying payroll taxes to the government known as payroll remittances can get confusing. Allow the extension of the cews until december 19 2020 including redesigned program details until november 21 2020. Learn the basics of payroll remittances and when they re due. This article applies to wave payroll in canada.

Learn what payroll deductions are the various types associated with them and the remittance schedule you must follow as required by the cra. Let s talk about remittance methods first. Make a payment to the cra through online banking the same way you pay your phone or hydro bill. You assume the risks associated with using this calculator.

Use the payroll deductions online calculator pdoc to calculate federal provincial except for quebec and territorial payroll deductions. Pay by online banking. Payroll is one of those programs where canada revenue agency cra can get real cranky when it s not done right and fine you even for a day late. Fillable and printable payroll remittance form 2020.

When you registered your business with the cra see getting your cra business number they sent you information about when to remit your remittance frequency and type. How to make a payment with canada revenue agency for your business. Canada emergency wage subsidy proposed to be redesigned extended until december 19 2020. When and how to send us cpp contributions ei and income tax deductions report a nil remittance correct a remittance.

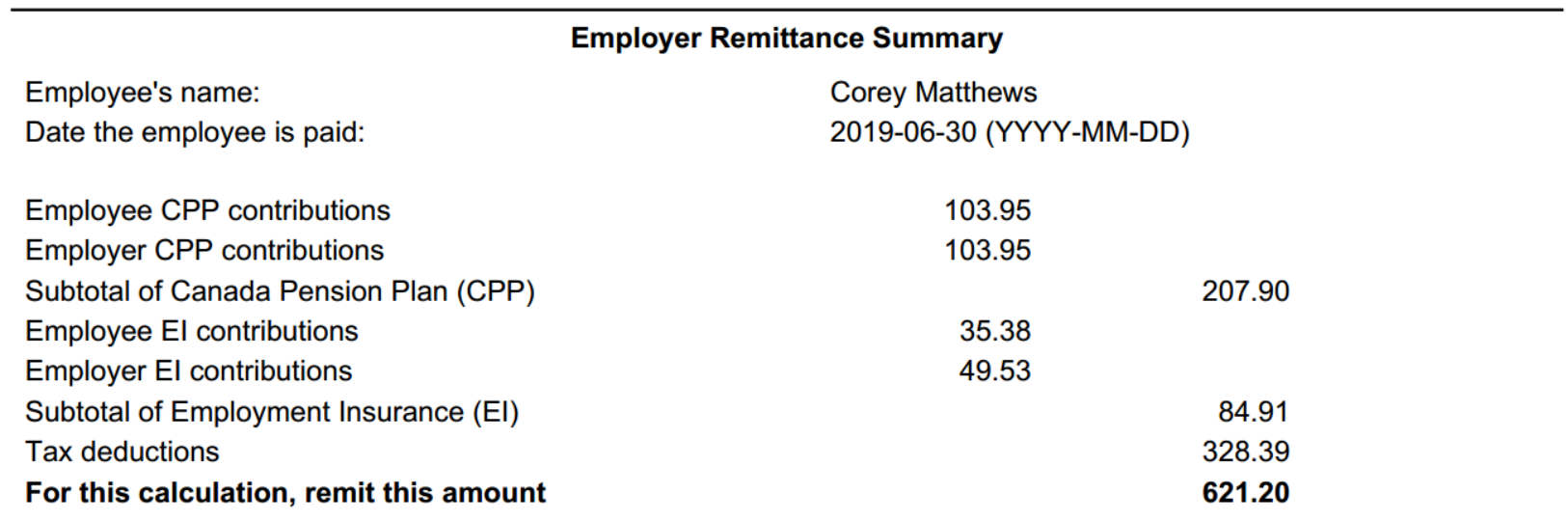

The following have been proposed in the draft legislature. You under remitted over remitted or paid the wrong account. It will confirm the deductions you include on your official statement of earnings.