Revenue Canada Tax Brackets

29 on the next 63 895 of taxable income on the portion of taxable income over 150 473 up to 214 368 plus.

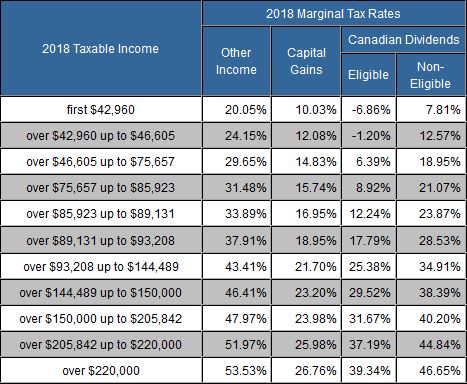

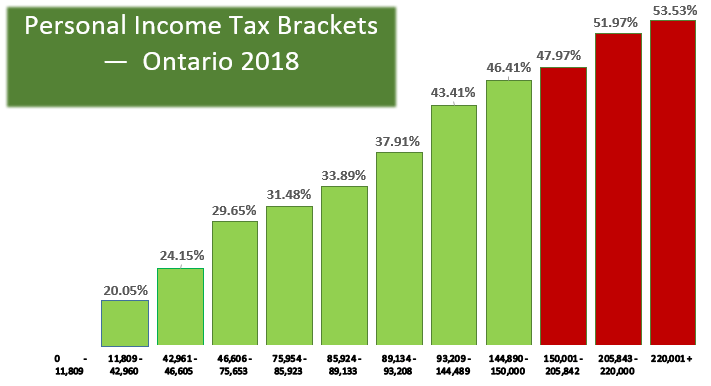

Revenue canada tax brackets. 20 5 on the portion of taxable income over 48 535 up to 97 069 and. Here s a list of the 2017 canada tax rates tax brackets and deductions you can take to lower your bill. In tax year 2019 canada s income tax brackets were. The chart below reproduces the calculation on page 7 of the income tax and benefit return to calculate net federal tax.

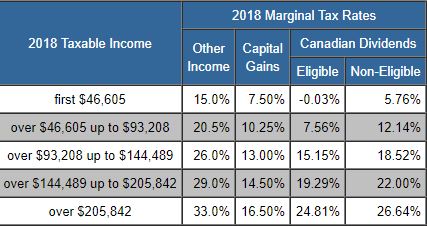

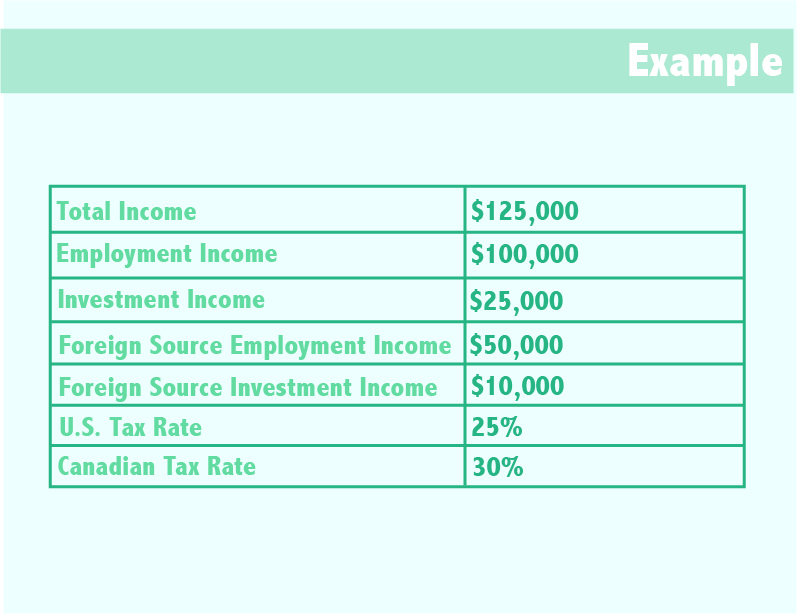

At the 26 bracket the tax on dividends paid would be 6 900 x 26 1036 37 5 000 15 15. 29 on the portion of taxable income over 150 473 up to 214 368 and. Here s a list of the 2017 canada tax rates tax brackets and deductions you can take to lower your bill. The federal tax brackets and personal tax credit amounts are increased for 2021 by an indexation factor of 1 010.

15 on the first 48 535 of taxable income and. 15 on the first 47 630 of taxable income plus 20 5 on the next 47 629 of taxable income on the portion of taxable income over 47 630 up to 95 259 plus. Canadian income tax rates for individuals current and previous years with more than 20 years experience helping canadians file their taxes confidently and get all the money they deserve turbotax products including turbotax free are available at www turbotax ca. Over 75 181 up to 134 224.

Total federal tax payable. Pay 15 on the amount up to 47 630 or 7 145 00. For the other tax brackets we will assume that you are getting paid 5 000 in dividends to keep the calculations simple. 26 on the portion of taxable income over 97 069 up to 150 473 and.

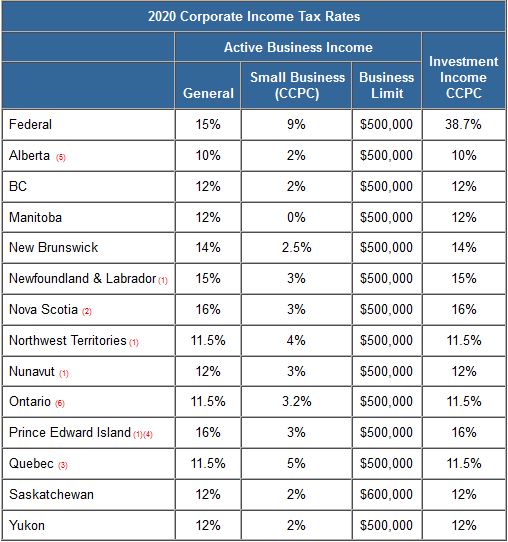

Over 37 591 up to 75 181. Pay 20 5 on the amount between 47 630 to 95 259 or 485 85. The following are the federal tax rates for 2020 according to the canada revenue agency cra. The indexation factors tax brackets and tax rates have been confirmed to canada revenue agency information.

2020 income tax in canada is calculated separately for federal tax commitments and province tax commitments depending on where the individual tax return is filed in 2020 due to work location. This is how the calculation looks on page 2 of canada revenue agency fillable saveable t1 general schedule 1 for non residents and deemed residents of canada. The newfoundland and labrador tax rates for 2019. 33 of taxable income over 214 368.

Tuesday november 17 2020.