Revenue Definition Accrual Accounting

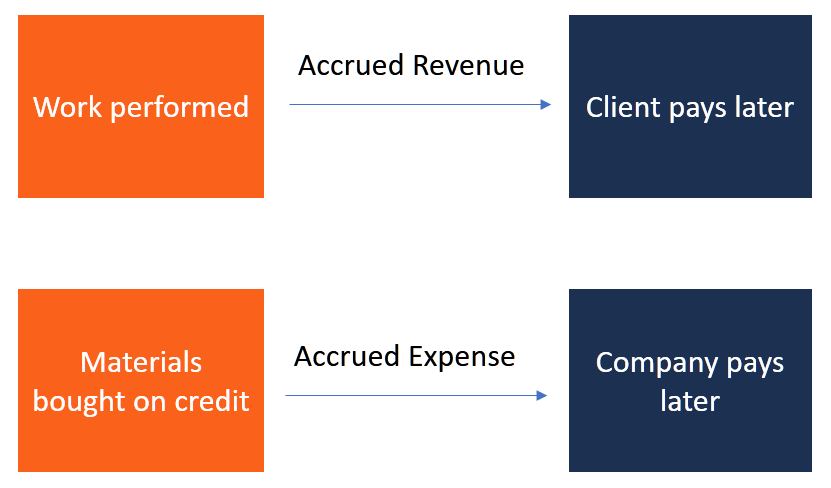

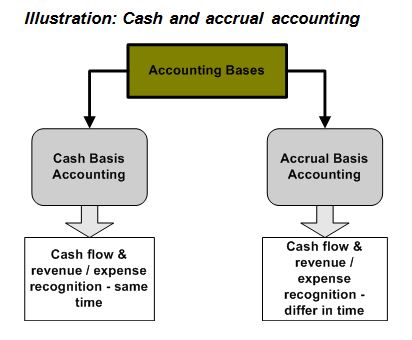

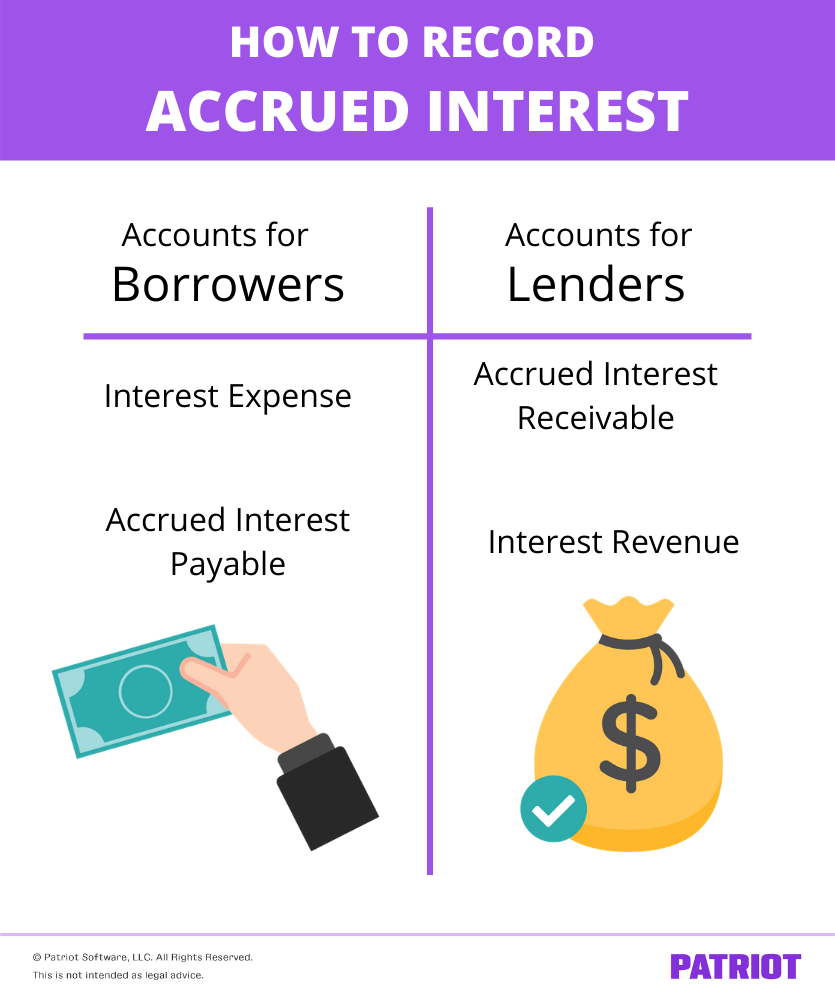

Accrual refers to an entry made in the books of accounts related to the recording of revenue or expense paid without any exchange of cash.

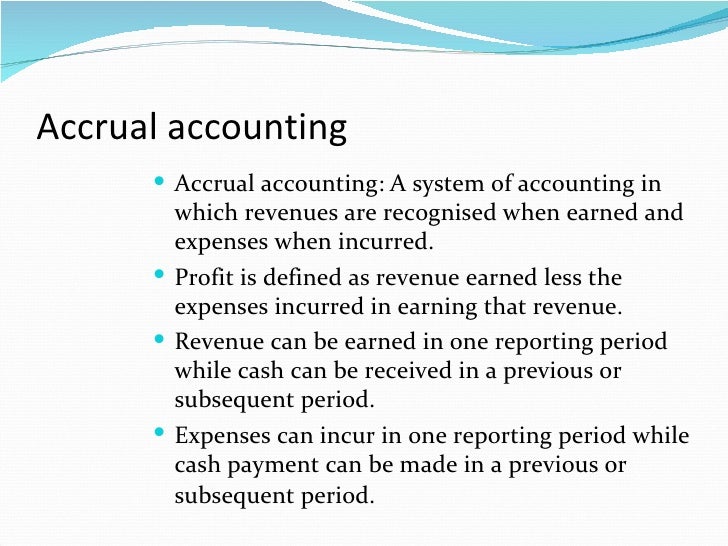

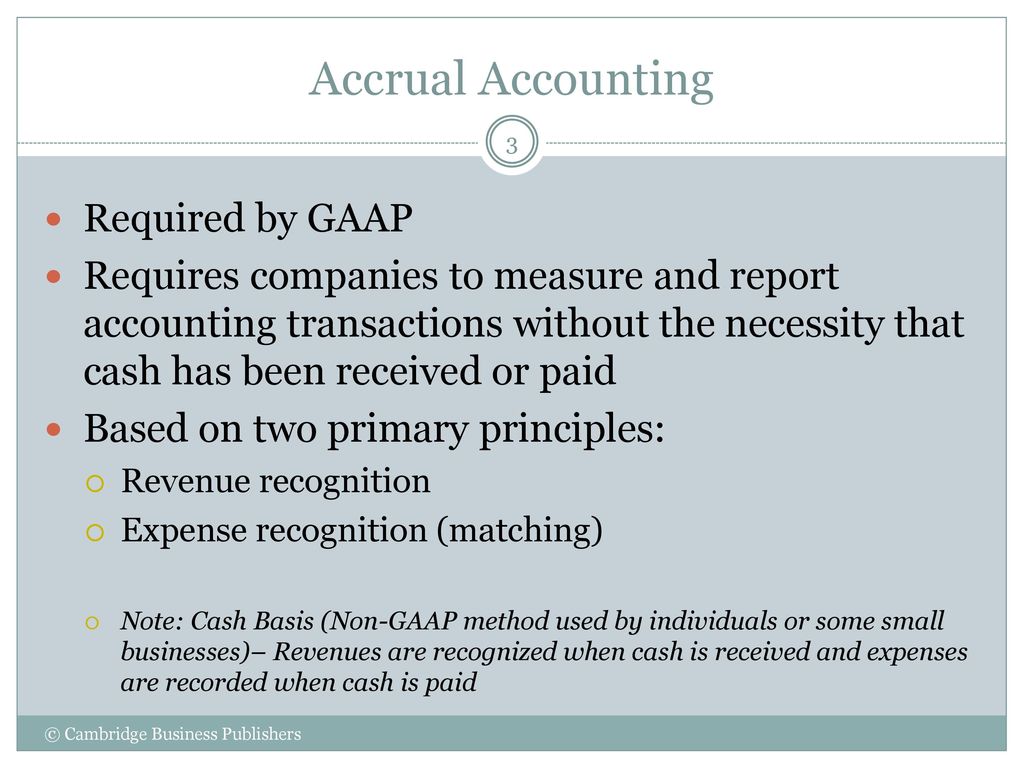

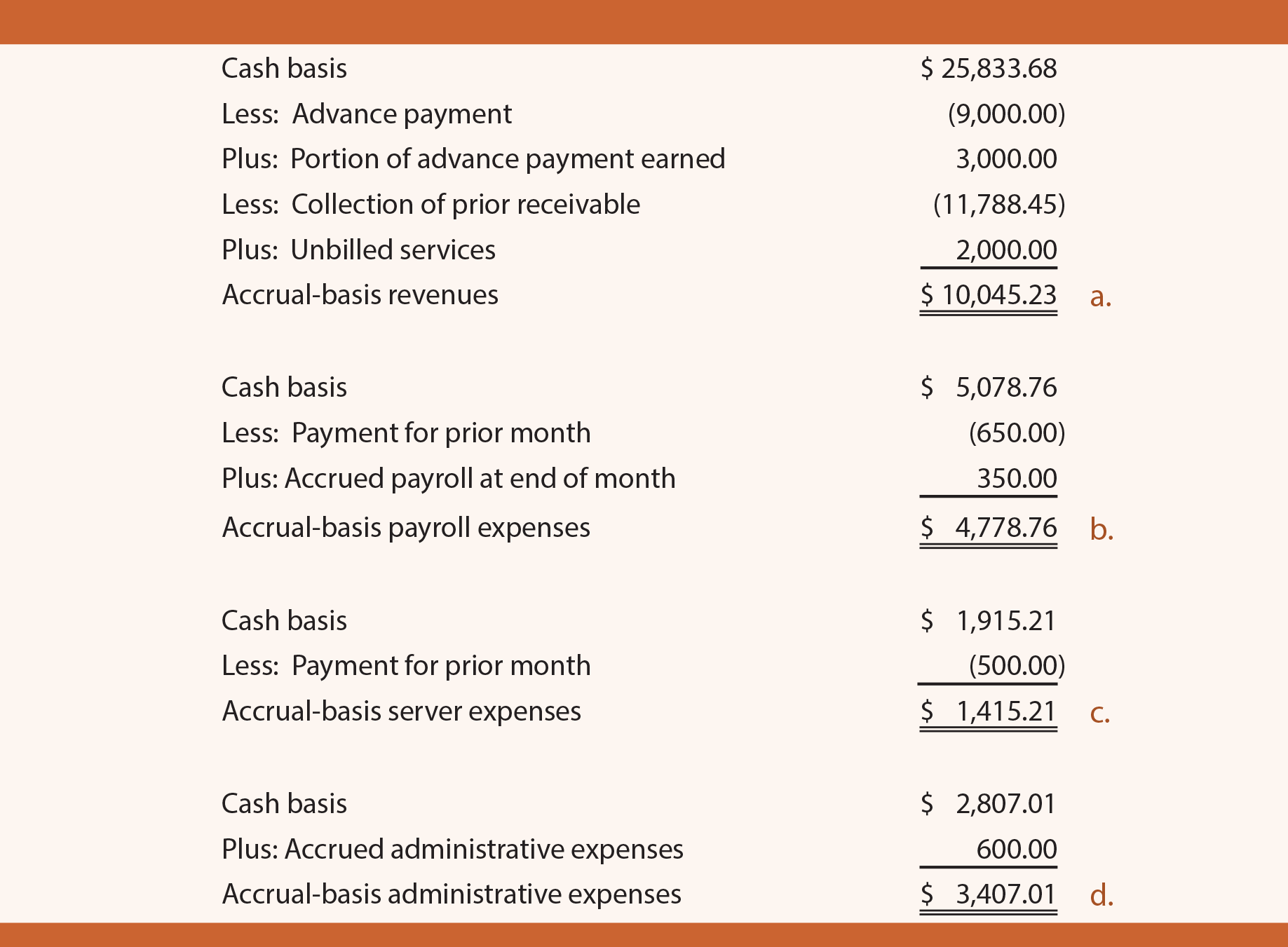

Revenue definition accrual accounting. The accounting and bookkeeping term accruals refers to adjustments that must be made before a company s financial statements are issued. Revenues and assets that have been earned but. Revenue recognition is a generally accepted accounting principle gaap that stipulates how and when revenue is to be recognized. The use of accrual accounting is typically useful in businesses where there are a lot of credit transactions or the goods and services are sold on credit which simply means that there was no exchange of cash.

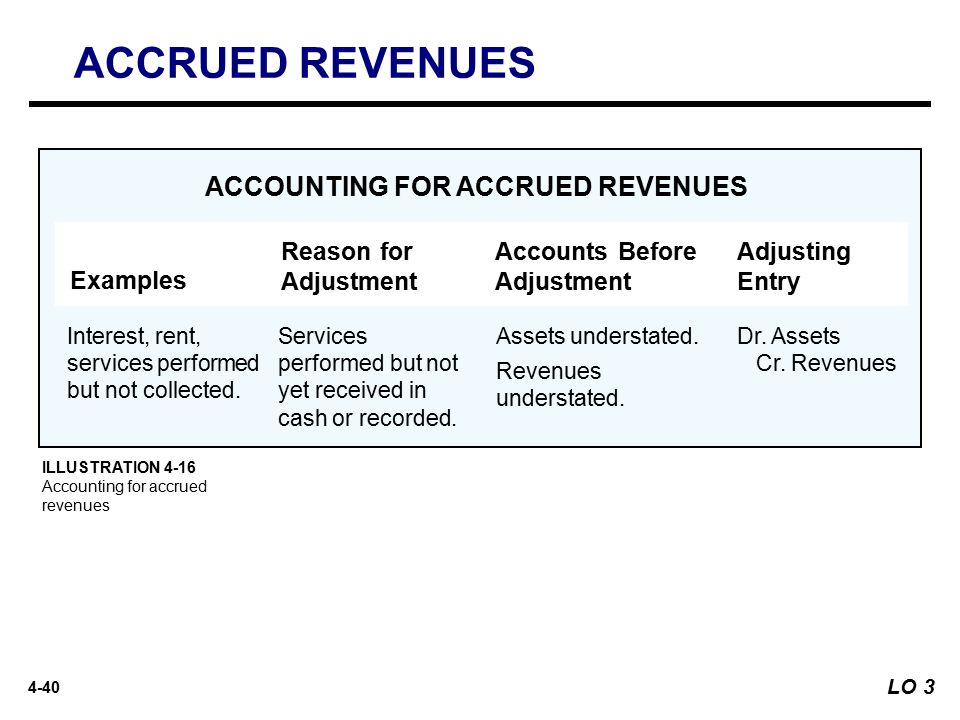

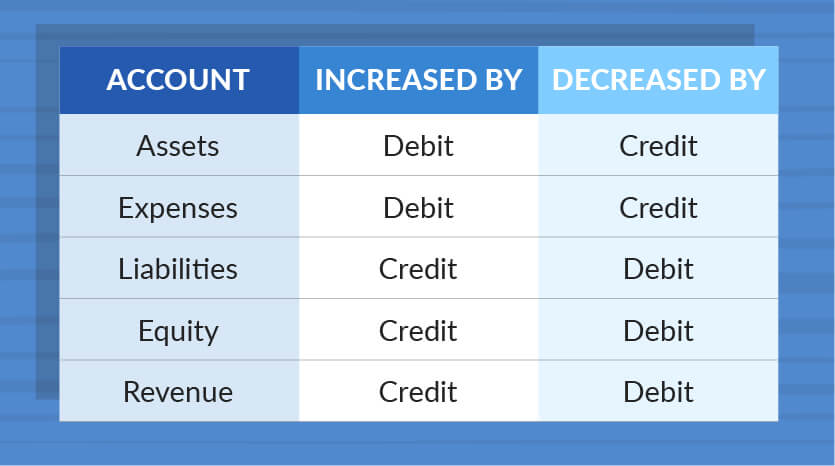

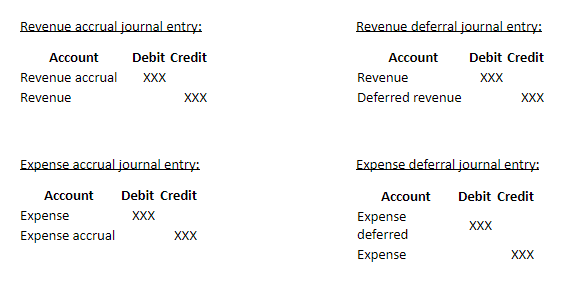

Accruals involve the following types of business transactions. Expenses losses and liabilities that have been incurred but are not yet recorded in the accounts and. The revenue recognition principle using accrual accounting. Accrued revenue is not recorded in cash basis accounting since revenue is only recorded when cash is received from customers.

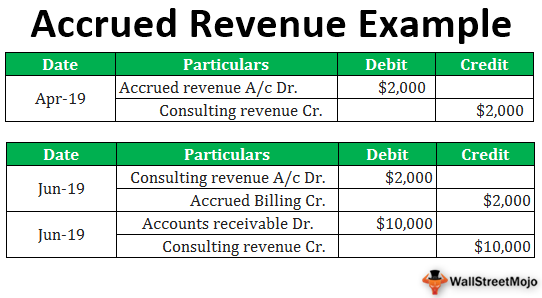

The revenue recognition principle requires that revenue. Blick records the accrual in an adjusting journal entry by debiting the accrued revenue receivable account and crediting the revenue account. Accrual accounting method. Typically revenue is recorded before any money changes hands.

Accrued revenue is the product of accrual accounting and the revenue recognition and matching principles. This guide will help you understand the main principles behind financial accounting theory accruals refer to the recording of revenues sales revenue sales revenue is the income received by. Under accrual accounting any event that generates a sale constitutes the requirement for recognition of. Understanding accrued revenue.

Accrual accounting is an accounting method where revenue or expenses are recorded when a transaction occurs rather than when payment is received or made. In financial accounting financial accounting theory financial accounting theory explains the why behind accounting the reasons why transactions are reported in certain ways. Accrued revenue means a receivable recorded for services and goods that have been rendered to customers but the customers have no paid for them yet. Revenue is accounted for when it is earned.

Revenue recognition at the time of sale is a primary component of accrual accounting.