Revenue In Final Accounts

The revenue account is an equity account with a credit balance.

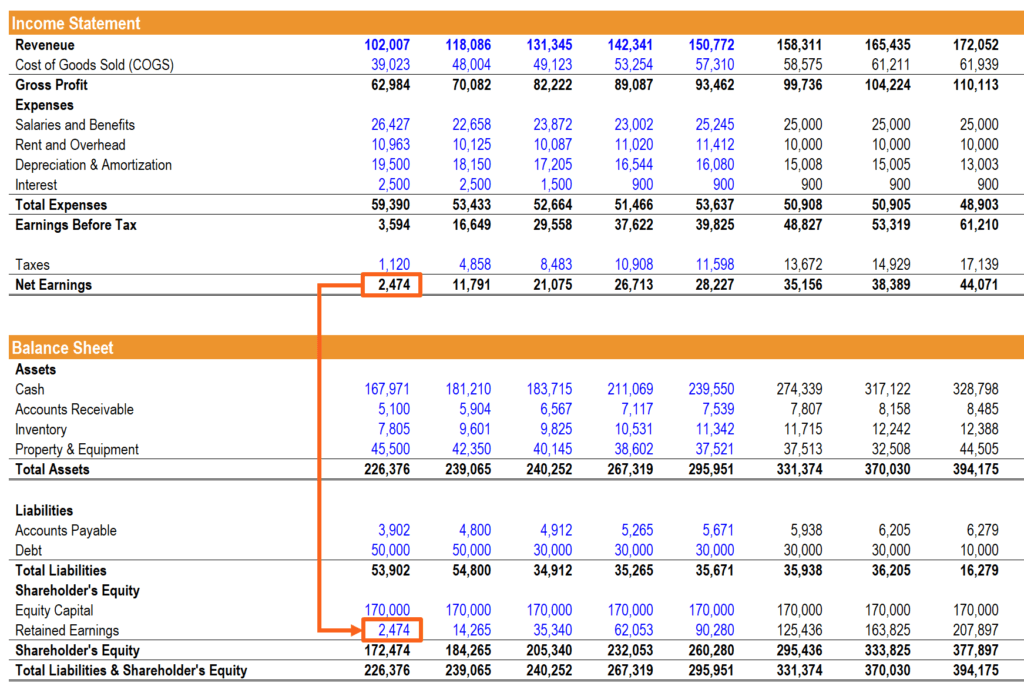

Revenue in final accounts. However it is calculated before deducting payroll taxation overhead and other interest payments. Financial accounting final accounts final accounts are the accounts which are prepared at the end of a fiscal year. The following points highlight the four components in preparation of final accounts under double account system. Gross profit gross profit is the difference of revenue and the cost of providing services or making products.

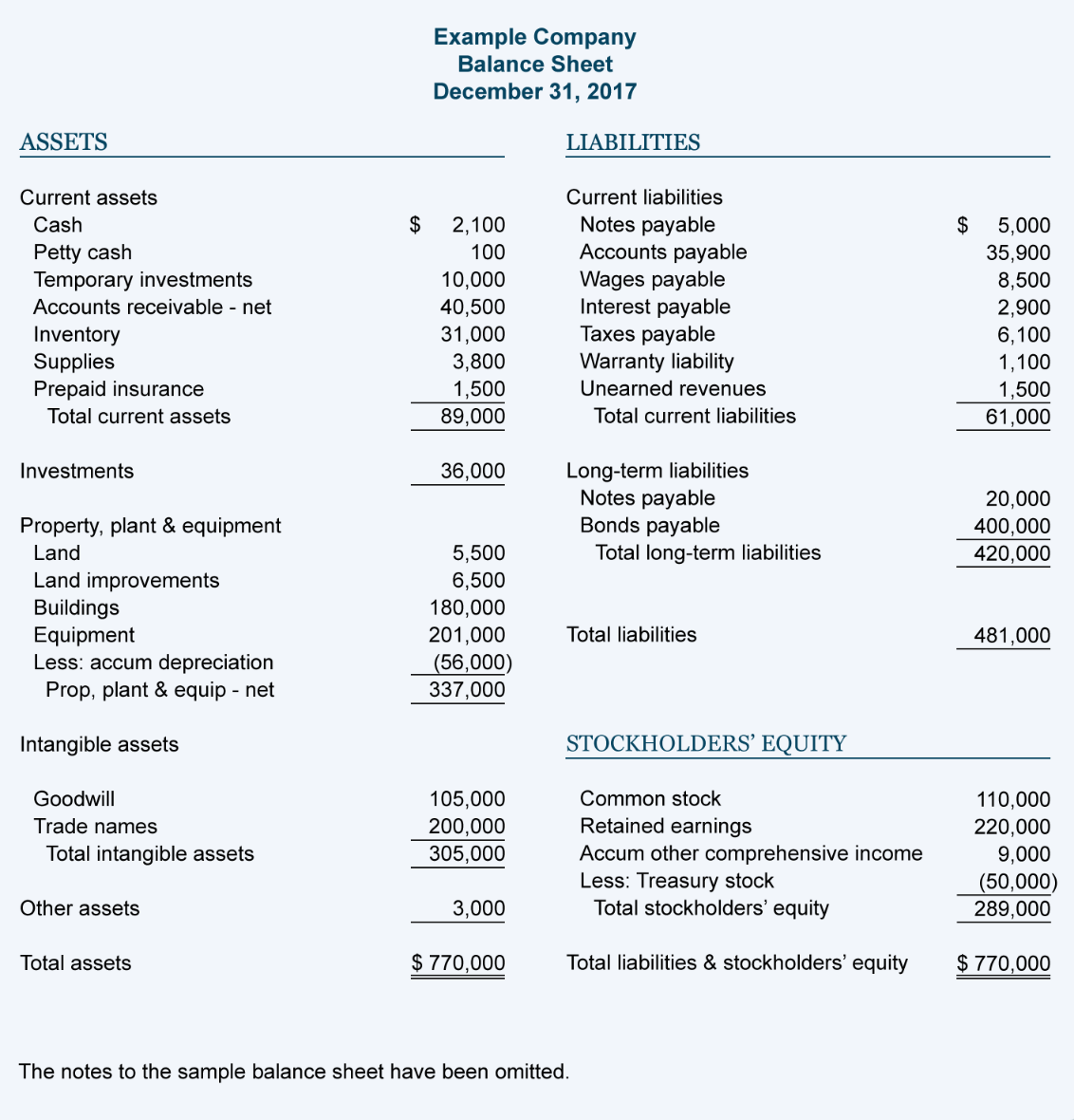

Only revenue expense and dividend accounts are closed not asset liability common stock or retained earnings accounts. 1 revenue account 2 net revenue account 3 capital account and 4 general balance sheet. Financial accounting capital and revenue. A survey produced quarterly by the census bureau that provides estimates of total operating revenue and percentage of revenue by customer class for communication key.

Recognizing revenues and expenses revenue recognition we have delivered the product to our customer so i think we should record the revenue earned. Unlike other accounts revenue accounts are rarely debited because revenues or income are usually only generated. Final accounts free download as powerpoint presentation ppt pdf file pdf text file txt or view presentation slides online. The purpose of creating final accounts is to provide a clear picture of the financial position of the organisation to its management owners or any other users of such accounting information.

Revenue recognition is a generally accepted accounting principle gaap that identifies the specific conditions in which revenue is recognized and determines how to account for it. This means that a credit in the revenue t account increases the account balance. Trading account profit and loss account and balance sheet together are called final accounts. It corresponds with the ordinary profit and loss account prepared under single account system where.

The four basic steps in the closing process are. Closing the revenue accounts transferring the credit balances in the revenue accounts to a clearing account called income summary. One of the major aspects of preparing a correct financial statement is to distinguish revenue and capital in regard to revenue income revenue expenditure revenue payments revenue profits and revenue losses of the company with capital income capital. Final accounts are those accounts that are prepared by a joint stock company at the end of a fiscal year.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_What_Is_the_Difference_between_Revenue_and_Sales_Oct_2020-012-e50d6c289ebf4d00987fbae938815fd4.jpg)