Revenue Is Calculated By Subtracting Expenses From Profit

Figures the answers are.

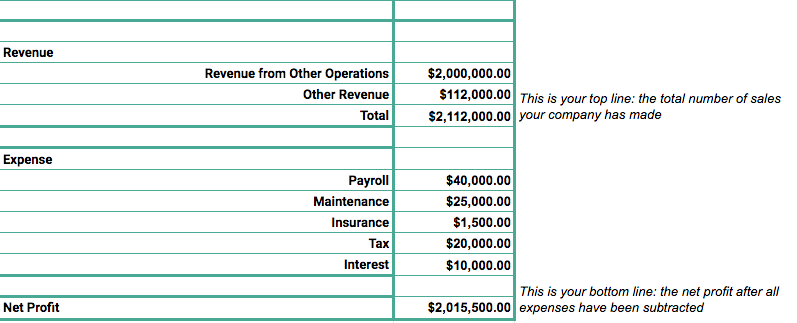

Revenue is calculated by subtracting expenses from profit. The higher the profit the higher the tax. Profit is the bottom line or net income after accounting for all expenses debts and operating costs. Profit total sales total expense. Then divide the value obtained previously by the total revenue then multiply it by 100 in order to have it as percentage.

Gross profit expressed as a percentage by dividing the amount of gross profit by net sales. Again the formula for profit per unit can be derived by deducting the cost price of production from the selling price of each unit as shown below. B after the adjusted trial balance is prepared. Revenue is the total amount of income generated by a company.

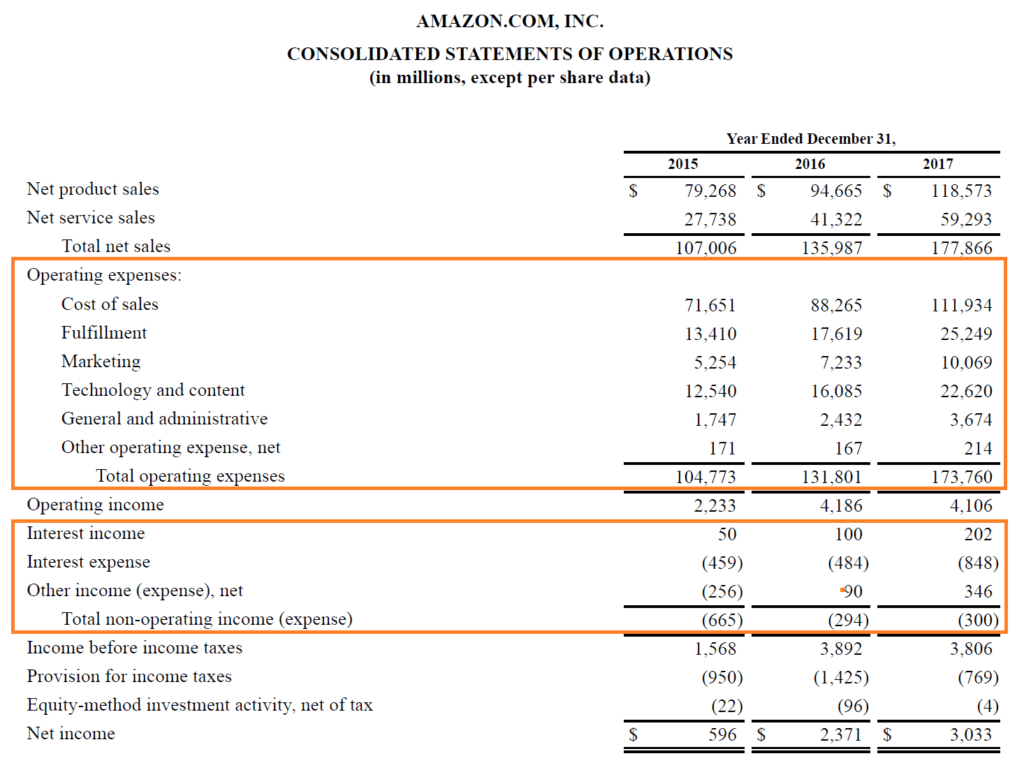

First subtract from the total revenue the total expenses figure. We know the company s total revenue was 1 million so we can subtract net income from that to calculate the company s total expenses for this period. The profit or loss is determined by taking all revenues and subtracting all expenses from both operating and non operating activities this statement is one of three statements used in both corporate finance including financial modeling and accounting. What is income from operations.

In the case of multiple steps first the gross profit is calculated by subtracting the cost of goods sold from revenues. Mathematically it is represented as net income revenues expenses. Income from a company s principle operating activity. This is calculated by subtracting expenses from the gross profit.

D cost of merchandise sold. The profit and loss statement shows only deductible expenses. Finally the formula for profit can be derived by subtracting the total expenses step 2 from the total revenue step 1 as shown below. Deductible expenses overheads are those expenses that your tax department has approved the use of to reduce the net profit.

Gross profit margin which is calculated in 2 steps. 1 million minus 450 000 gives us total. Net profit is calculated to determine how well a company has done financially over a period of time. Determined by subtracting cost of goods sold and operating expenses from net sales.

In the accounting cycle closing entries are journalized and posted a after adjusting entries are posted to the general ledger.

/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

/IncomestatementApple-83dd63870e72405e87749f33fd8e35af.jpg)