Revenue Minus Cost Of Goods Sold Is Called Select All That Apply

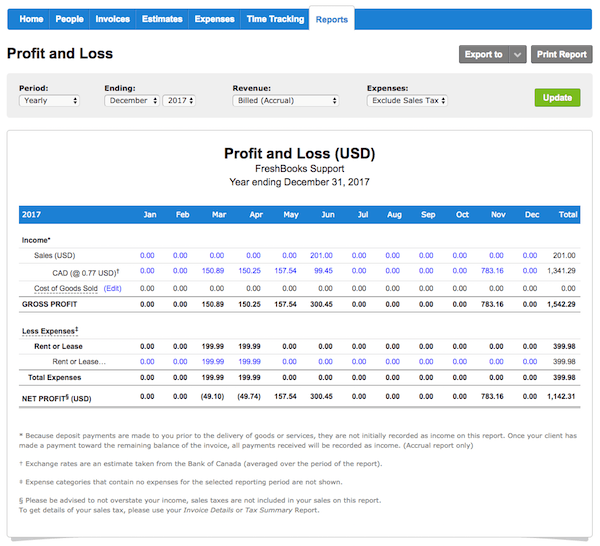

Your saas gross margin is simply total revenue minus cost of goods sold cogs.

Revenue minus cost of goods sold is called select all that apply. Cost of goods sold is used to figure gross profit. That margin is called the keystone price. Net profit is total revenue minus all expenses. Ending when a company using the perpetual inventory system pays cash to purchase inventory the balance in the.

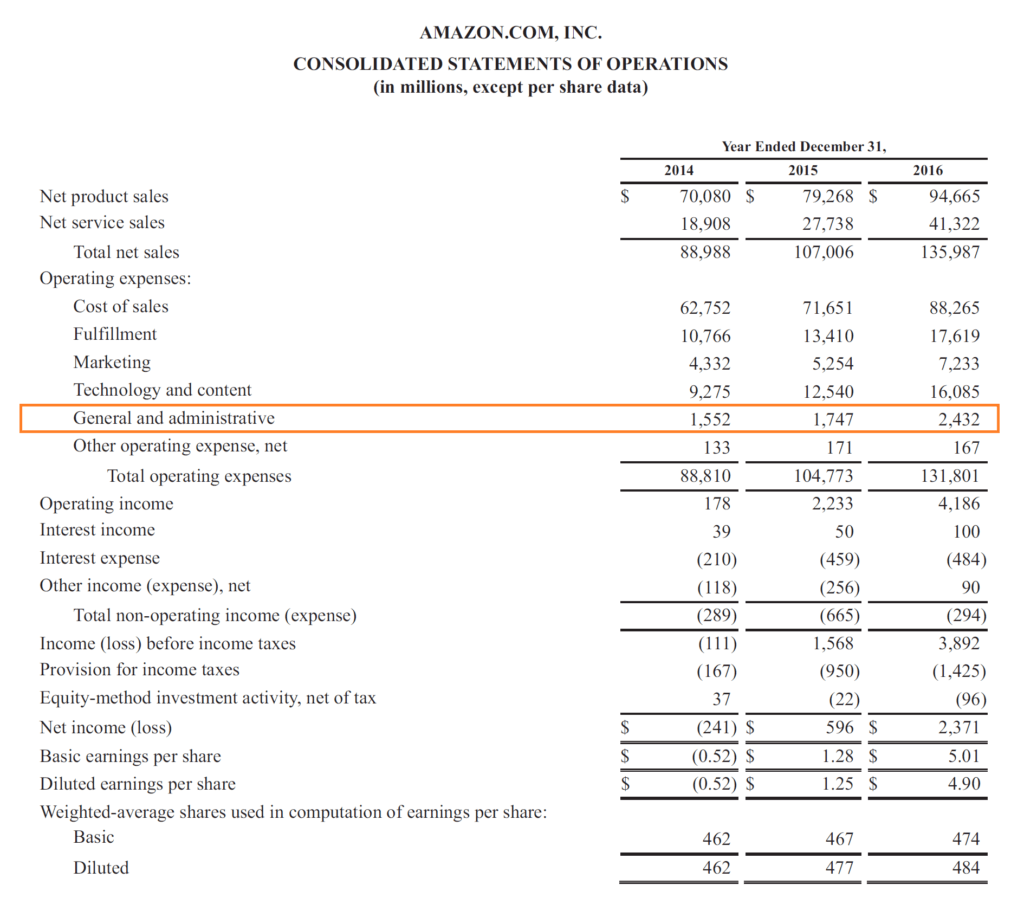

So for example we may have sold 100 units this year at 4 each and these 100 units that we sold cost us 3 each originally. Let s start with your overall saas gross margin. Gross margin equates to net sales minus the cost of goods sold. Cost of goods sold is an important figure for investors to consider because it has a direct impact on profits.

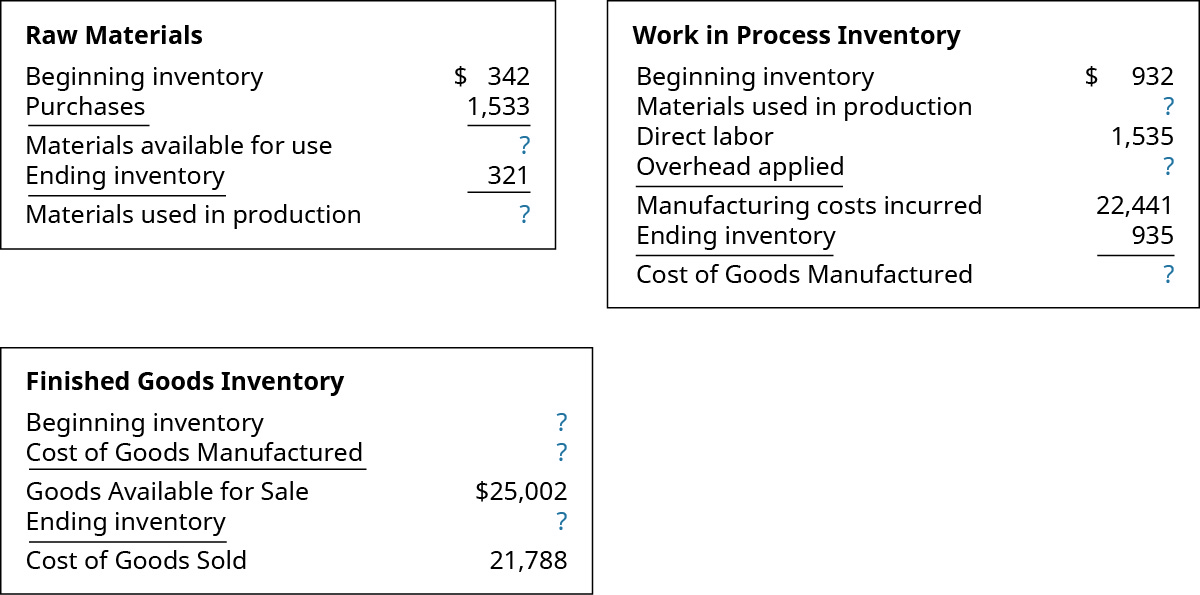

Direct factory overhead refers to the direct expenses in the manufacturing process that includes energy costs water a portion of equipment depreciation and some others. Cost of goods sold is also called cost of sales. If you roast and sell coffee like coffee roaster enterprises for example this might include the cost of raw coffee beans wages and packaging. Gross profit in turn is a measure of how efficient a company is at managing its operations.

Apart from material costs cogs also consists of labor costs and direct factory overhead. Cost of goods sold is deducted from revenue to determine a company s gross profit. Cogs it s such an old school term but this is your bucket of expense that directly supports all of your revenue streams. The gross profit margin shows the amount of profit made before deducting selling general and administrative costs.

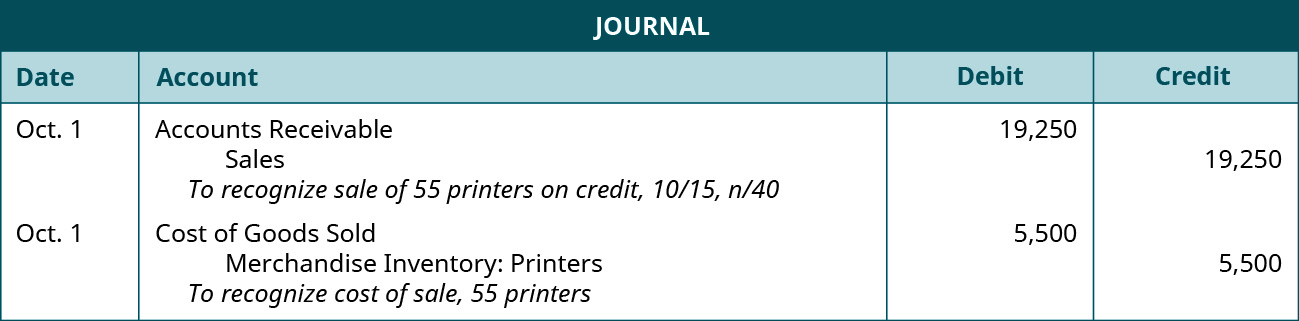

Cost of goods sold is an expense reported on the income statement. Cogs can also be called our cost of revenue. Cost of goods sold. A business s revenue left after deducting all expenses from total sales divided by net revenue.

Gross profit only includes variable costs and does not account for fixed costs. Cost of goods available for sale minus beginning ending inventory equals cost of goods sold. Cost of goods sold includes the expenses of buying and preparing an item for sale. Also called gross income gross profit is calculated by subtracting the cost of goods sold from revenue.

Often shortened to cogs this is how much it cost to produce all of the goods or services you sold to your customers. And is also known as cost of sales. Cogs only involves direct expenses like raw materials labour and shipping costs. So our sales would be.

Select all that apply. This margin includes both costs of goods sold costs associated with selling and administration.

/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)