Revenue Recognition Principle Services

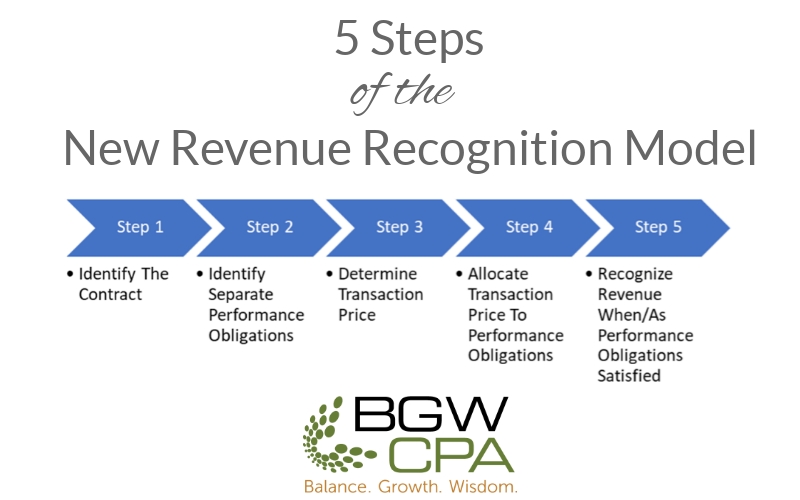

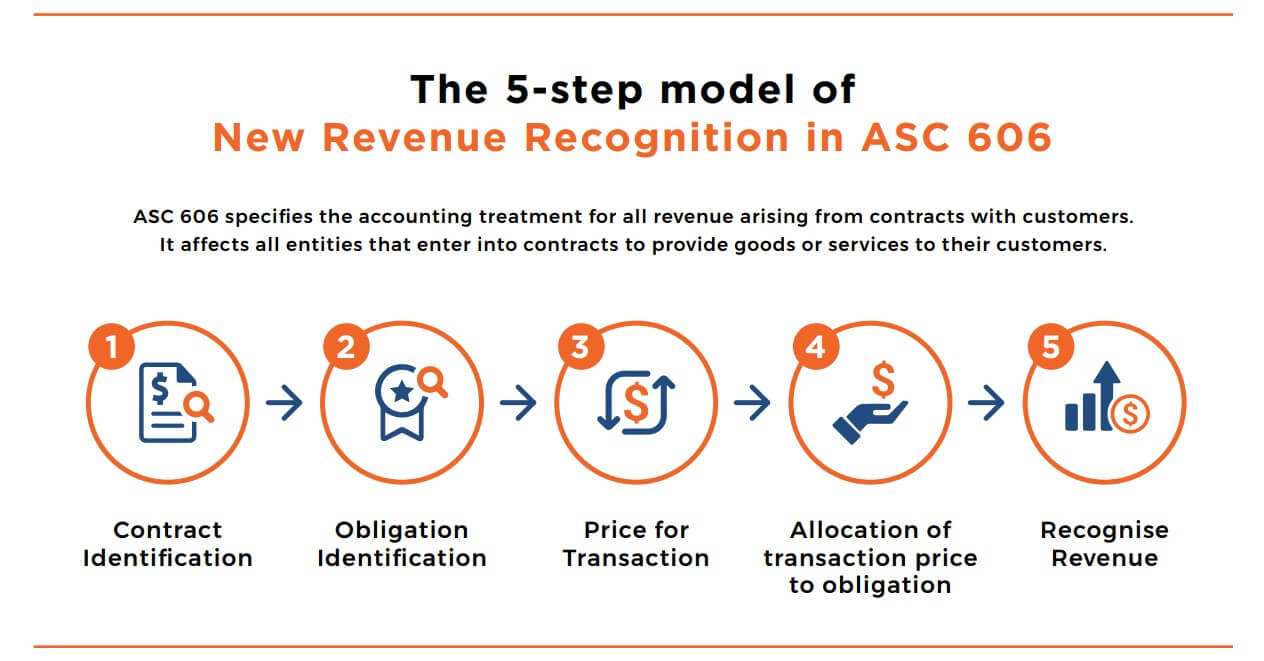

Ifrs 15 specifies how and when an ifrs reporter will recognise revenue as well as requiring such entities to provide users of financial statements with more informative relevant disclosures.

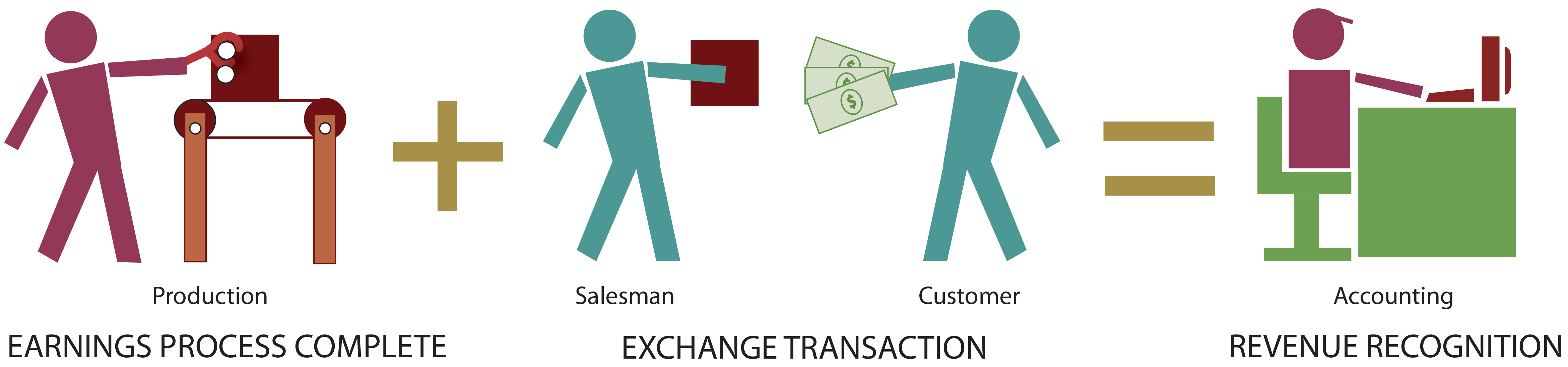

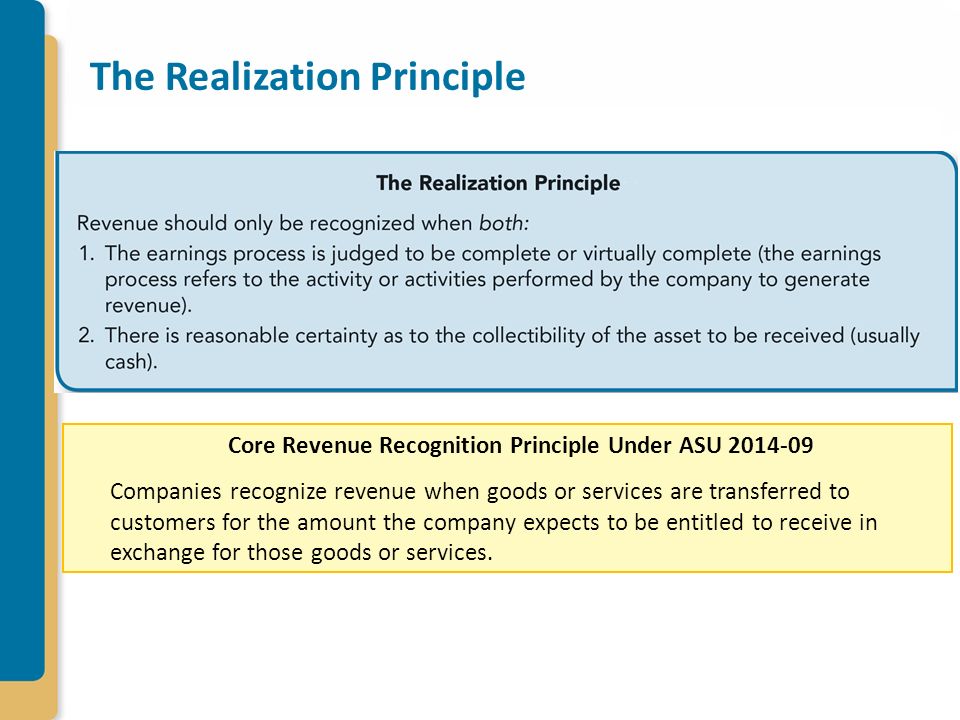

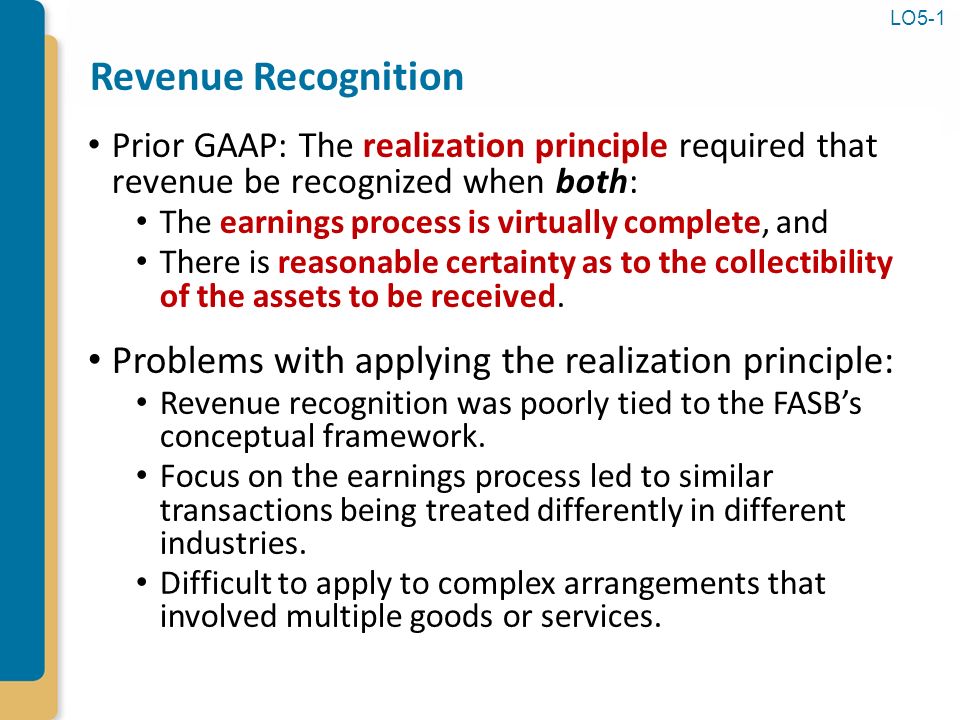

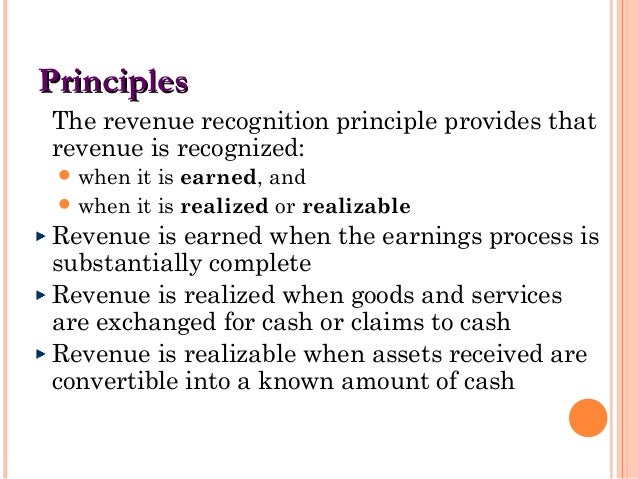

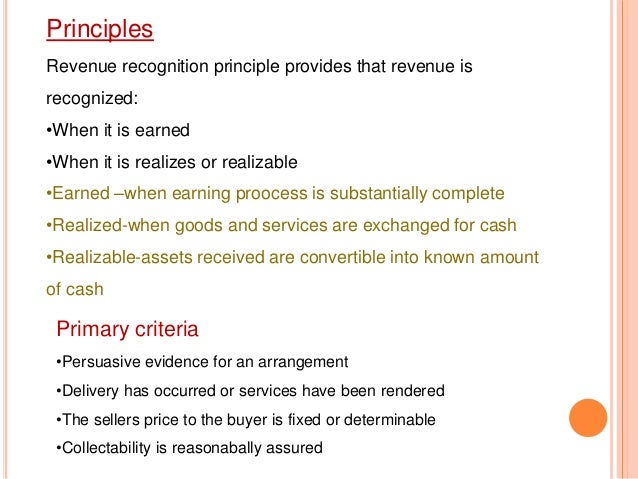

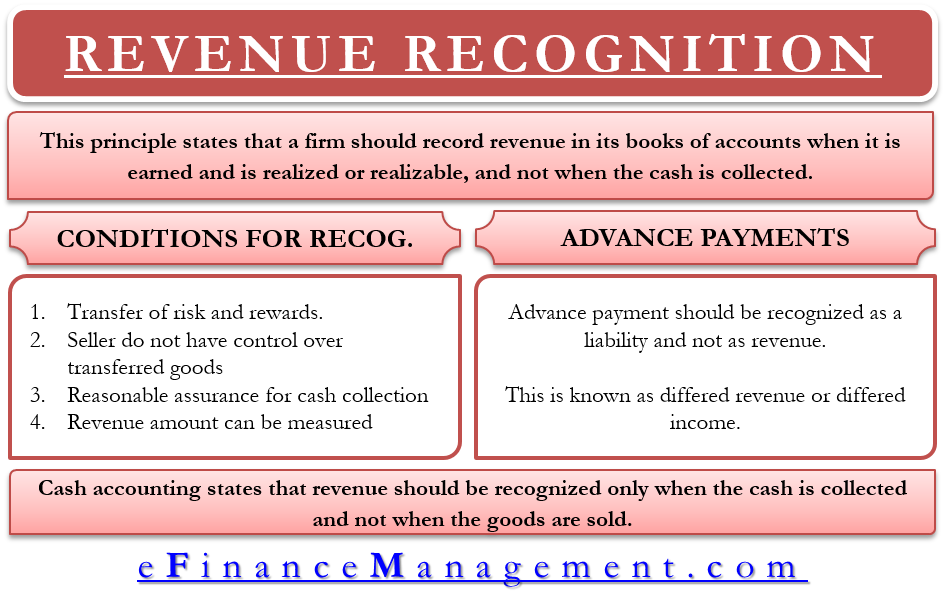

Revenue recognition principle services. The revenue recognition principle of asc 606 requires that revenue is recognized when the delivery of promised goods or services matches the amount expected by the company in exchange for the. The revenue recognition principle states that revenue should be recognized and recorded when it is realized or realizable and when it is earned. The revenue recognition concept is part of accrual accounting meaning that when you create an invoice for your customer for goods or services the amount of that invoice is recorded as revenue at. The method selected should be based on the type of services performed as noted below.

The revenue is referred to have been realized when goods are sold or services are provided in exchange of cash or claims to cash i e accounts receivable. Revenue recognition principle for the provision of services one important area of the provision of services involves the accounting treatment of construction contracts. The standard provides a single principles based five step model to be applied to all contracts with customers. Ifrs 15 was issued in may 2014 and applies to an annual reporting period beginning on or.

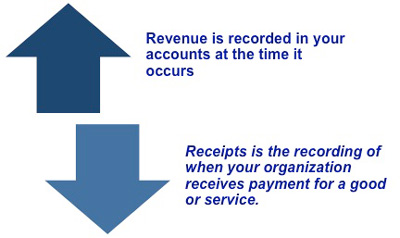

According to the principle revenues are recognized when they are realized or realizable and are earned usually when goods are transferred or services rendered no matter when cash is received. These are contracts dedicated to the construction of an asset or a combination of assets such as large ships office buildings and other projects that usually span multiple years. The revenue recognition principle states that revenue should only be realized once the goods or services being purchased have been delivered. According to revenue recognition principle the revenue is recognized when the entity is entitled to receive it not at the time when it is actually received.

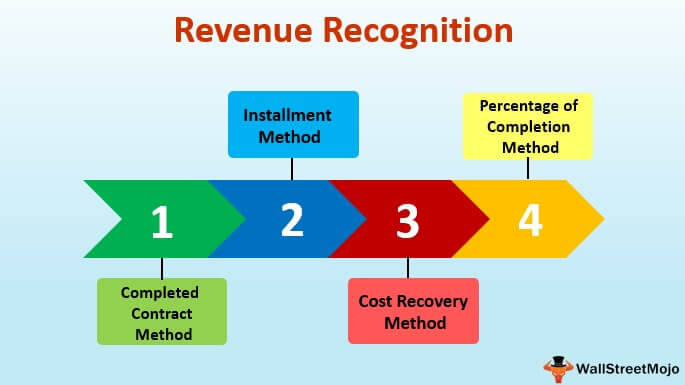

Services revenue recognition november 24 2018 steven bragg. In other words companies shouldn t wait until revenue is actually collected to record it in their books. When a business is selling services to its customers it should use one of the following methods to recognize the resulting revenue. Revenue recognition is a generally accepted accounting principle gaap that determines the process and timing by which revenue is recorded and recognized as an item in the financial statements.

The revenue recognition principle is a cornerstone of accrual accounting together with the matching principle they both determine the accounting period in which revenues and expenses are recognized.