Revenue Recognition Accounting Journal Entry

Revenue transactions occur continuously throughout the lifetime of a business.

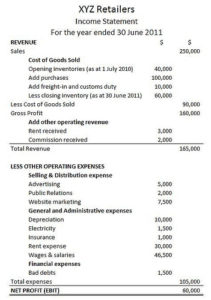

Revenue recognition accounting journal entry. On january 1 2019 control of the equipment is transferred to the customer and payment of 4 000 is received. The first scenario occurs after all the contractual obligations are met when the deferred revenue is recognized by creating a revenue recognition journal that is based on the details of the revenue. Asc 606 replaces the ad hoc industry specific rules based approach of legacy gaap with a principles based approach that applies to all industries. Here are some additional guidelines that need to be followed in regards to the revenue recognition principle.

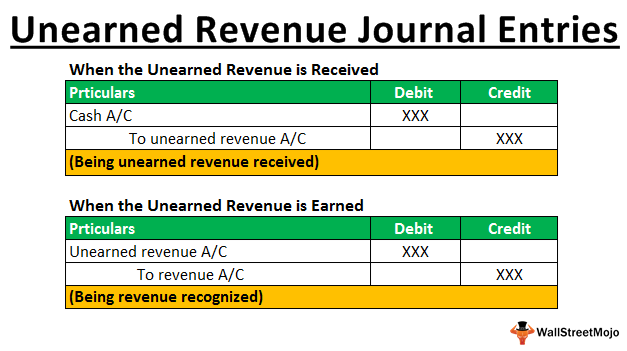

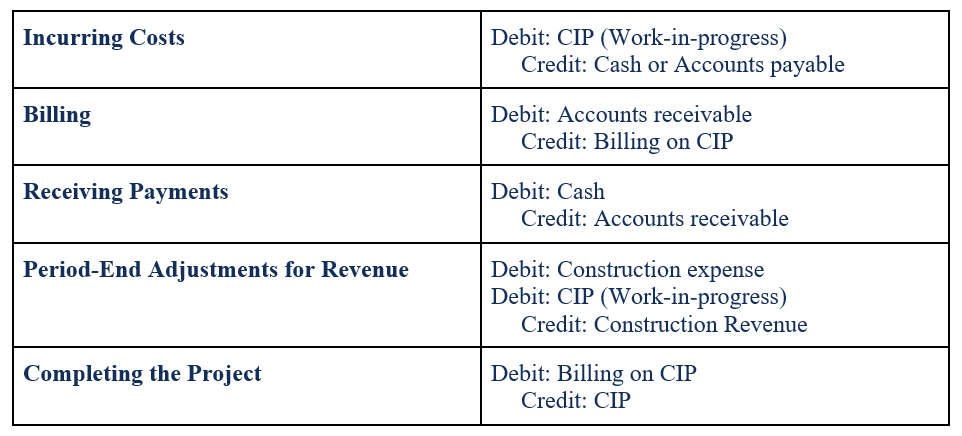

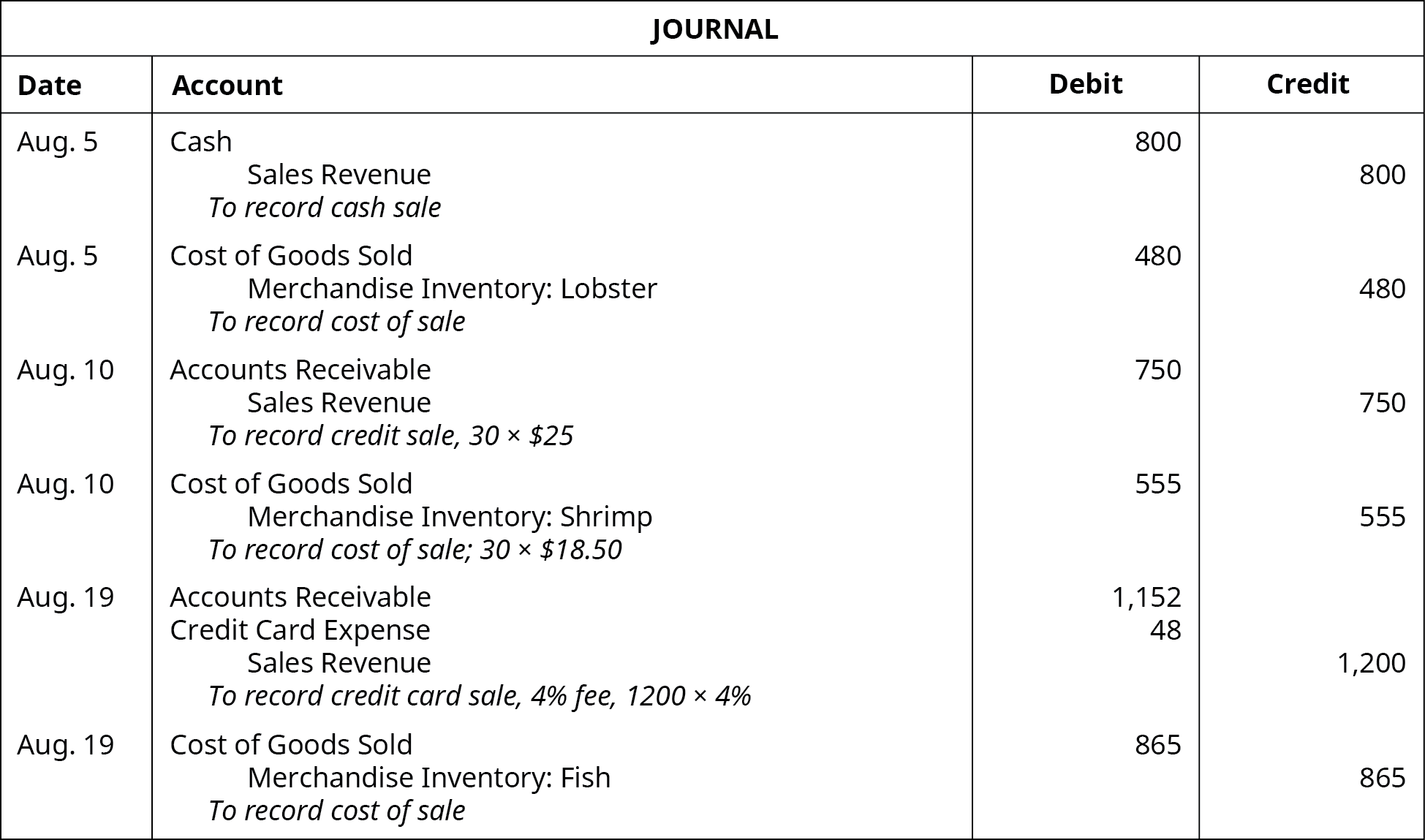

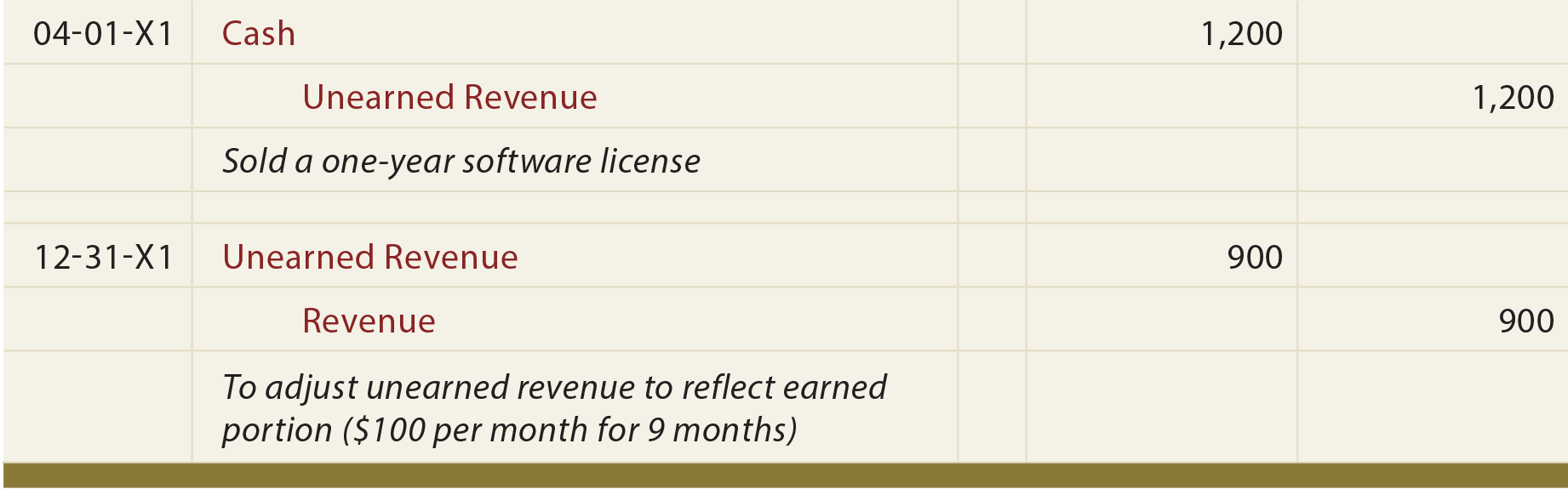

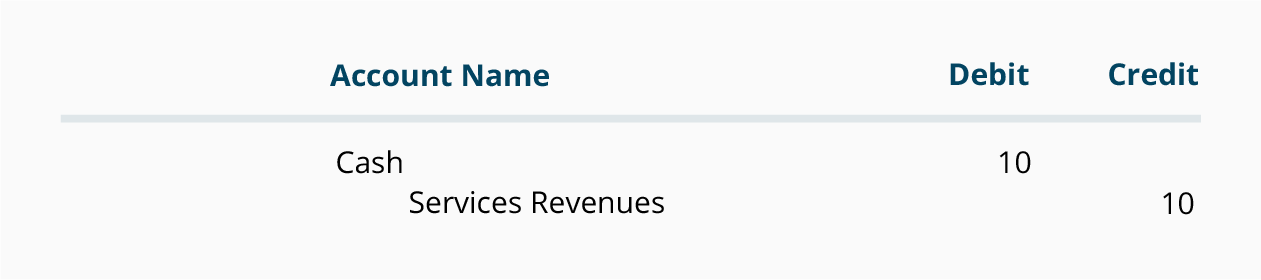

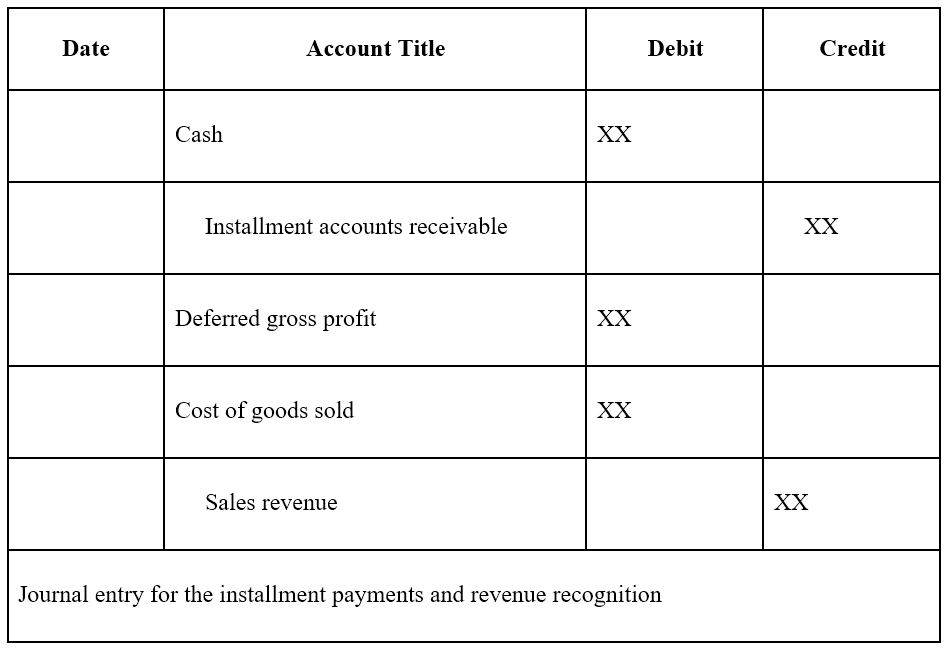

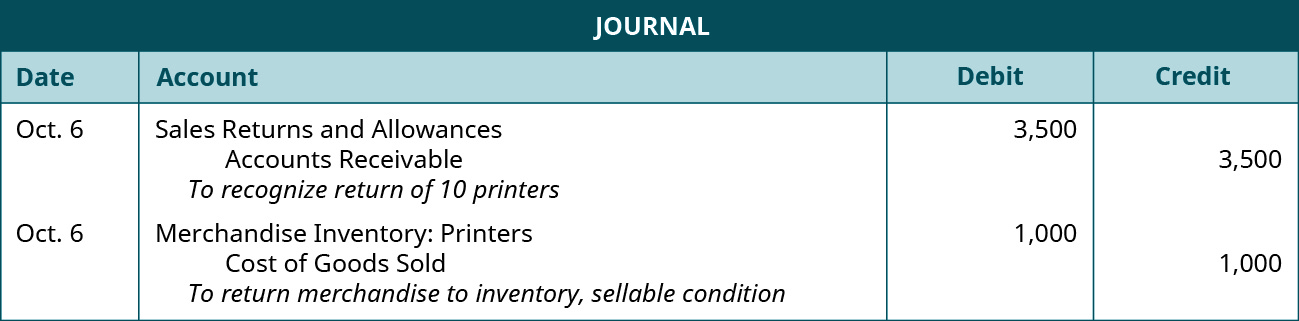

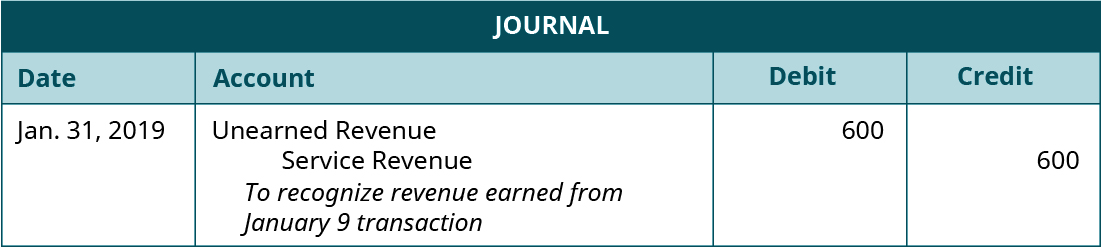

The following journal entries are made to account for the contract. The revenue recognition principle requires that you use double entry accounting. The following unearned revenue journal entry example provides an understanding of the most common type of situations where such a journal entry account for and how one can record the same as there are many situations where the journal entry for unearned revenue pass it is not possible to provide all the types of examples. Journal entry to record the estimated amount of accounts receivable that may be uncollectible.

Same as revenues the recording of the expense is unrelated to the payment of cash. Asu 2014 09 topic 606 asc 606 revenue from contracts with customers has been called the biggest change to financial accounting standards in the last 100 years. Journal entries of unearned revenue. Next costs of software to be sold leased or marketed asc 985.

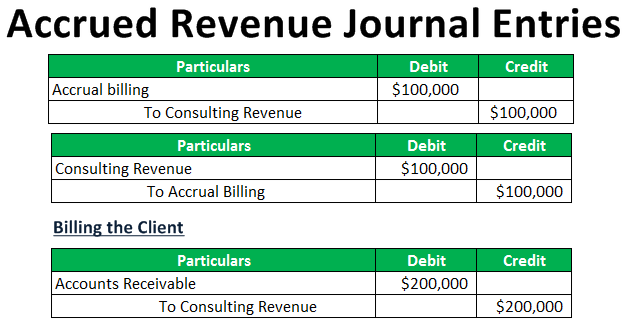

In accrual accounting expenses incurred in the same period that revenues are earned are also accrued for with a journal entry. Depending on an entity s existing accounting policies either of the following alternatives are acceptable. Revenue recognition accounting refers to the process of identifying the timing and amount of consideration that a business should record in its income statement as. Sec staff accounting bulletin topic 13 asc 605.

However since the business prepares financial statements on a periodic basis the transactions need to be allocated to a particular accounting period. The revenue recognition principle dictates the process and timing by which revenue is recorded and recognized as an item in a company s financial statements. A new journal type has been introduced for revenue recognition. An accrual journal entry is made to record the revenue on the transferred goods as long as collection of payment is expected.

Theoretically there are multiple points in time at which revenue could be recognized by companies.