Revenue Recognition Principle Exceptions

The blueprint breaks down the rrp.

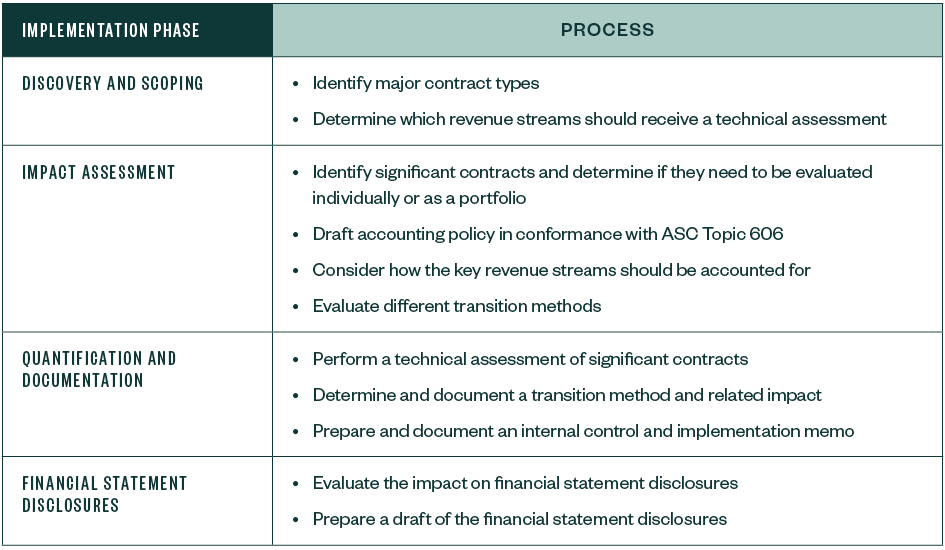

Revenue recognition principle exceptions. In this case the retailer would not earn the revenue until it transfers the ownership of the inventory to the customer. Generally after a sale or a transaction you can consider that money as revenue but there are exceptions. To start revenue can be recognized for projects that are expected to take a long time to finish but payment is received at. The number of fasb s revenue recognition rules has grown to more than 100 standards plus rule exceptions addressing over 20 different industries.

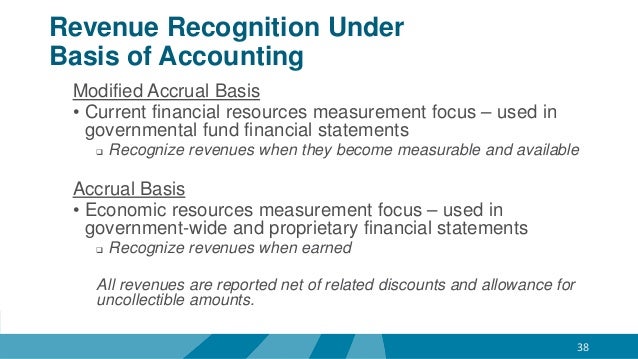

The revenue recognition principle or just revenue principle tells businesses when they should record their earned revenue. There are three major exceptions to the revenue recognition principle. In accounting the terms sales and revenue can be and often are used interchangeably to mean the same thing. Some manufacturers may recognize revenue during the production process.

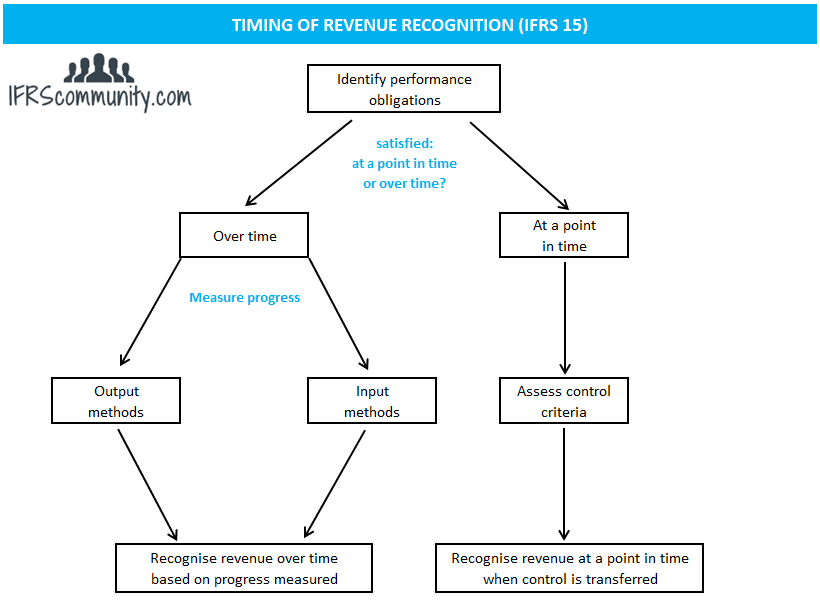

Firms dealing with such long term projects recognize revenues in two ways. There are three main exceptions to the revenue recognition principle. This is common in long. The revenue recognition principle details the conditions through which your business is able to recognize the revenue that it takes in.

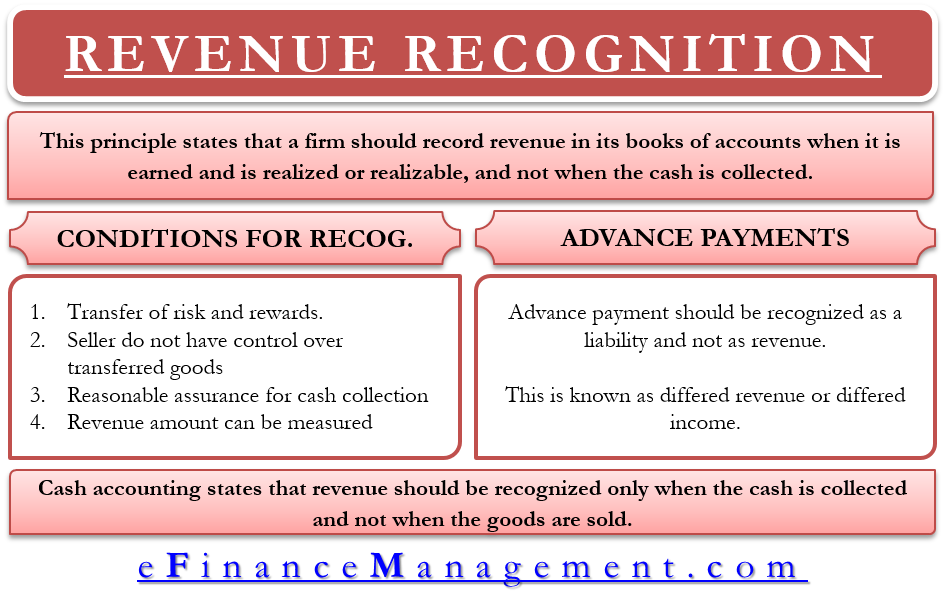

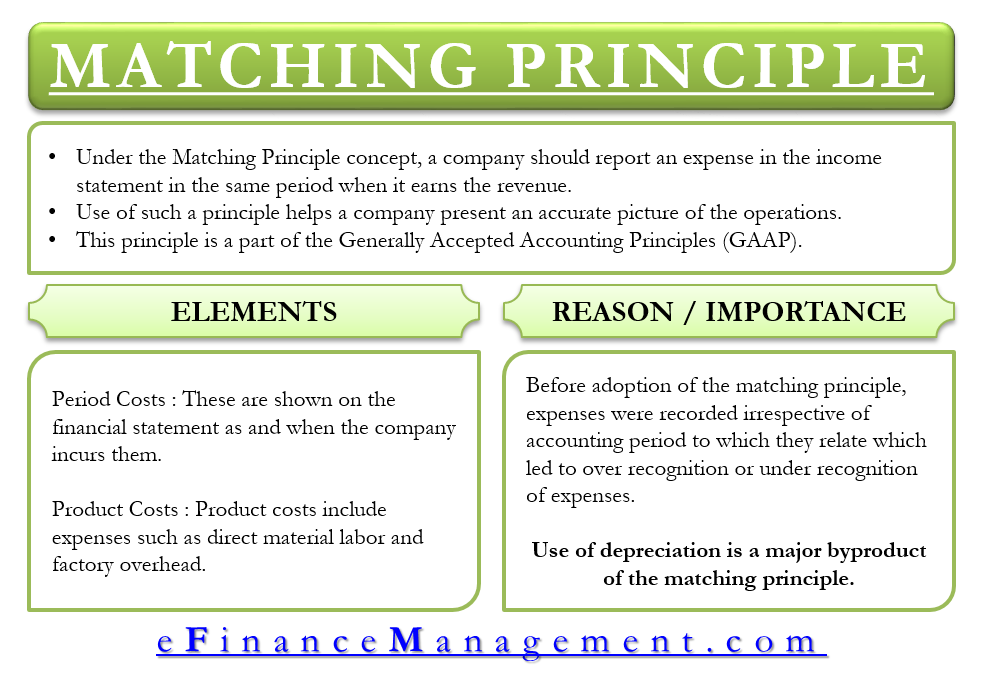

The revenue is not recorded however until it is earned. Revenue recognition is an accounting principle that outlines the specific conditions under which revenue sales revenue sales revenue is the income received by a company from its sales of goods or the provision of services. The revenue recognition principle using accrual accounting. In the case of long term construction and defense projects it takes years to complete the task.

A proportionate completion method in which a firm recognizes revenues at various stages of completion. Revenue recognition is a generally accepted accounting principle gaap that stipulates how and when revenue is to be recognized. Exceptions to revenue recognition principle.