Revenue Recognition Principle Of Companies

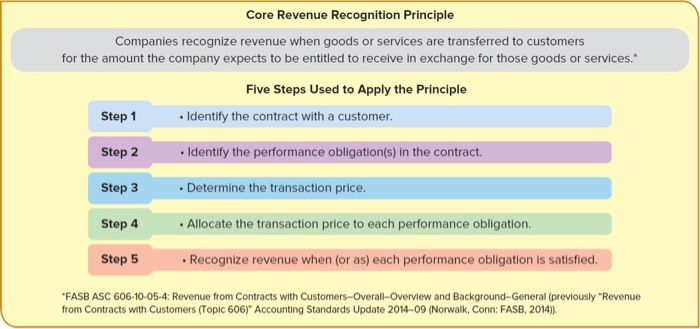

The revenue recognition principle of asc 606 requires that revenue is recognized when the delivery of promised goods or services matches the amount expected by the company in exchange for the.

Revenue recognition principle of companies. There are five major steps for revenue recognition. In other words companies shouldn t wait until revenue is actually collected to record it in their books. In other words companies don t have to wait until they receive cash. Steps in revenue recognition from contracts.

The revenue recognition principle states that revenue should be recognized and recorded when it is realized or realizable and when it is earned. Step 1 identifying the contract. The revenue recognition principle dictates the process and timing by which revenue is recorded and recognized as an item in a company s financial statements. The revenue recognition principle is a cornerstone of accrual accounting together with the matching principle they both determine the accounting period in which revenues and expenses are recognized.

The revenue recognition principle is an accounting principle that requires revenue to be recorded only when it is earned. The blueprint breaks down the rrp. In accounting the terms sales and revenue can be and often are used interchangeably to mean the same thing. Revenue should be recorded when the business has earned the revenue.

In terms of recognition of revenue it is the ifrs 15 s core principle that revenue recognition is dependent on the time when the performance obligation is satisfied and a performance obligation is satisfied when control of goods or service is transferred to the customer. To form a contract all the below conditions must be satisfied. It means that revenues or income should be recognized when the services or products are provided to customers regardless of when the payment takes place. Theoretically there are multiple points in time at which revenue could be recognized by companies.

Revenue recognition is an accounting principle that outlines the specific conditions under which revenue sales revenue sales revenue is the income received by a company from its sales of goods or the provision of services. The revenue recognition principle or just revenue principle tells businesses when they should record their earned revenue. Then as per the revenue recognition principle the company will need to realize only 500 in each of the next 4 accounting periods.