Revenue Recognition Principle Percentage Of Completion

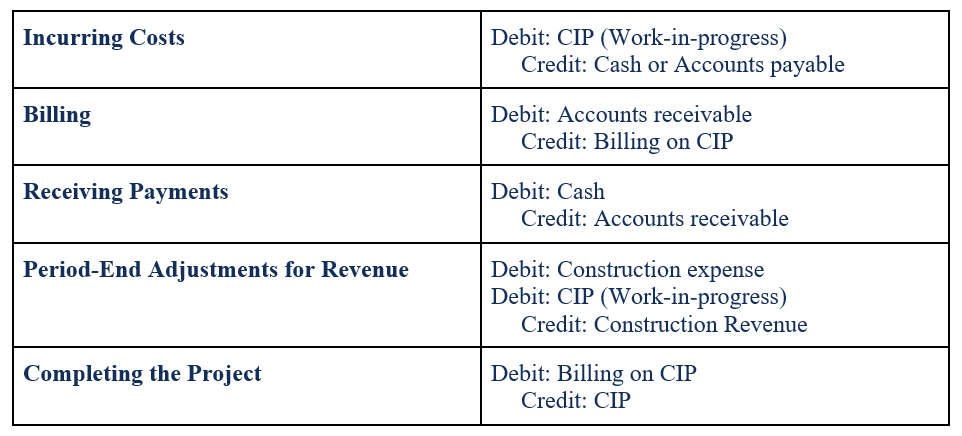

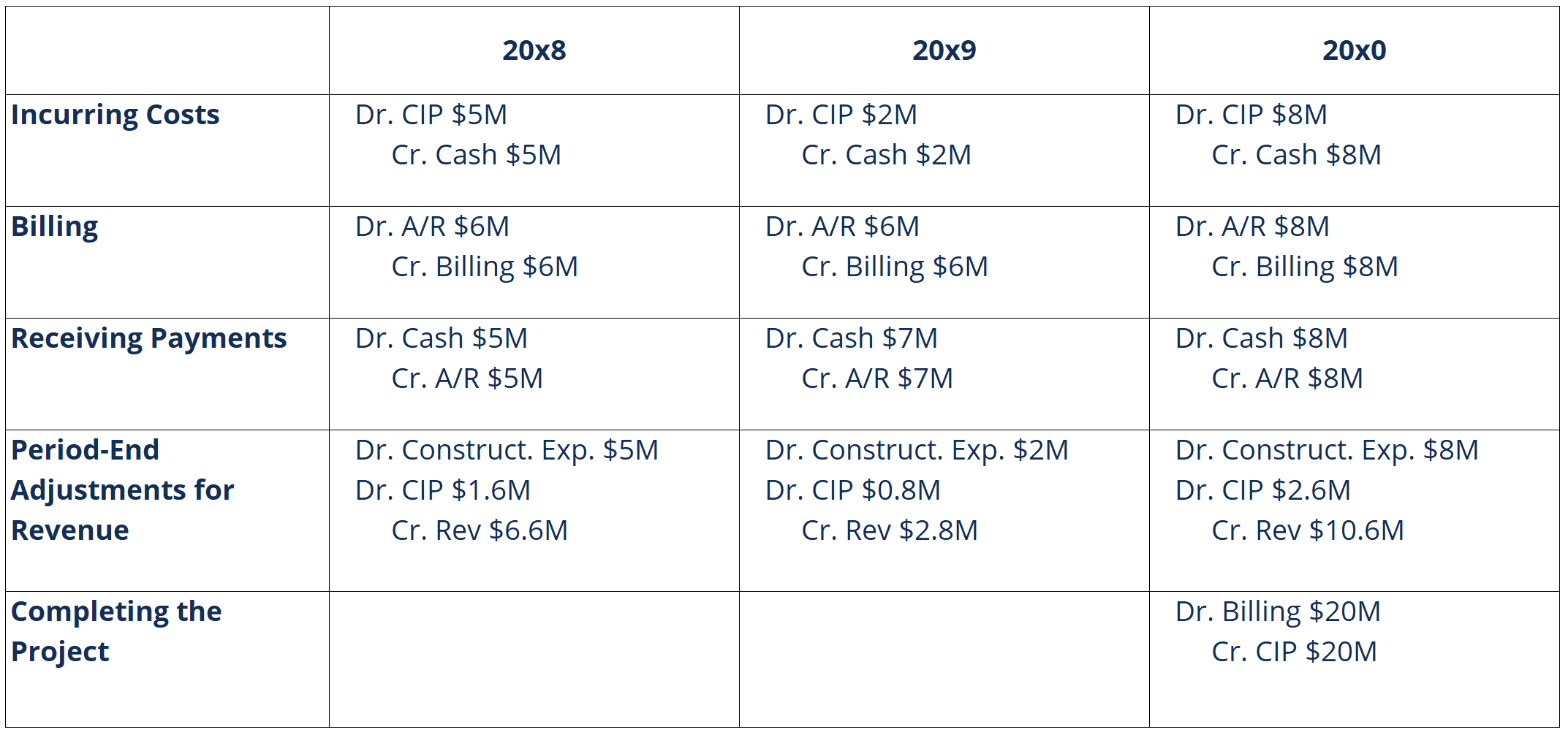

It is one of the revenue recognition methods in accounting to measure and record the revenue from long term contracts.

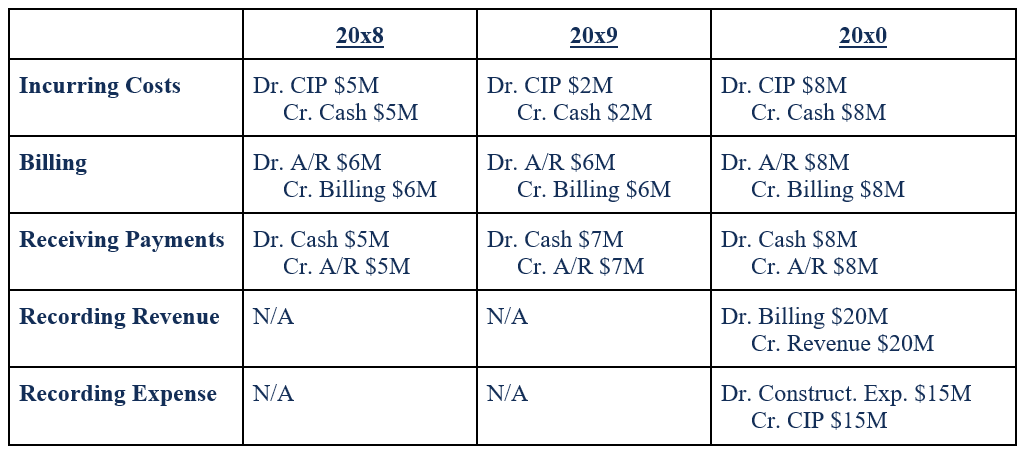

Revenue recognition principle percentage of completion. Gaap allows another method of revenue recognition for long term construction contracts the completed contract method. Dissimilar to the percentage of completion method the completed contract method only allows revenue recognition when the contract is completed. The costs incurred in reaching each stage of completion are matched to the revenue. Overview of the percentage of completion method.

Percentage of completion method is used by the business entities whose business accepts long term projects where they book the revenue and expenses related to that particular project in more than one accounting year taking the percentage of the project completed as the criterion or base for recognition of revenue and booking of expenses. By doing so the seller can recognize some gain or loss related to a project in every accounting period in which the project continues to be active. In case of long term contracts accountants need a basis to apportion the total contract revenue between the multiple accounting periods. Percentage of completion method is a basis for revenue recognition in long term construction contracts which span over more than one accounting periods.

Based on the revenue recognition framework the percentage of completion method is an accounting method that allows businesses to record revenues on an ongoing basis depending on the stage of project completion. What is percentage of completion method. The percentage of completion method calculates the ongoing recognition of revenue and expenses related to longer term projects based on the proportion of work completed. This method is typically used in the scenarios where the costs are recorded on a proportional basis revenue collection is.

Revenue expenses and gross profit are recognized each period based on the percentage of work completed or costs incurred. It is different from the basic revenue recognition principle. The percentage of completion method is a revenue recognition accounting concept that evaluates how to realize revenue periodically over a long term project or contract. Percentage of completion poc is an accounting method of work in progress evaluation for recording long term contracts.

We hope this has been a helpful guide to understanding the revenue recognition principle examples of how it works and why it s very important in accounting.

:max_bytes(150000):strip_icc()/GettyImages-1152447561-147c6353f25941d78b65f64ef9dc447c.jpg)