Revenue Recognition Principle Short Definition

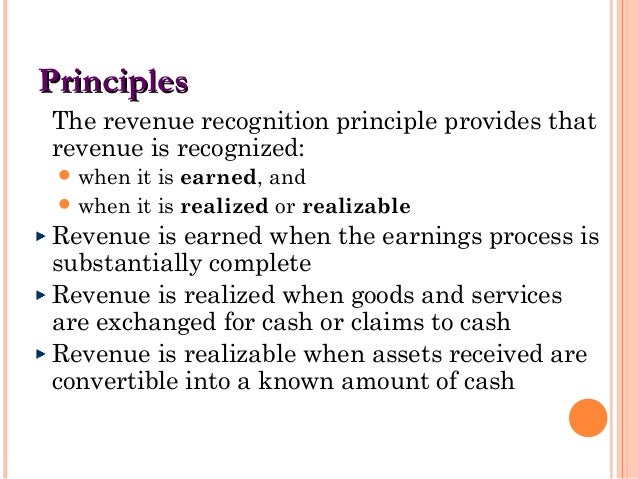

The revenue recognition principle is an accounting principle that requires revenue to be recorded only when it is earned.

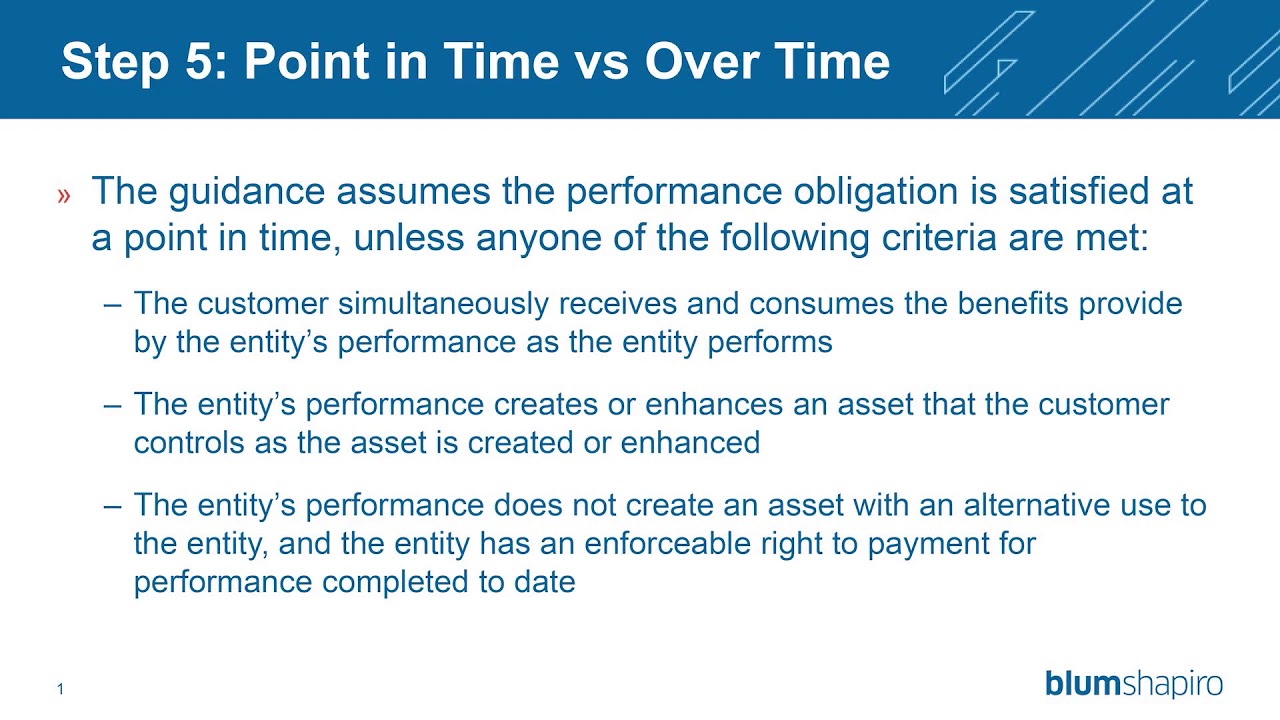

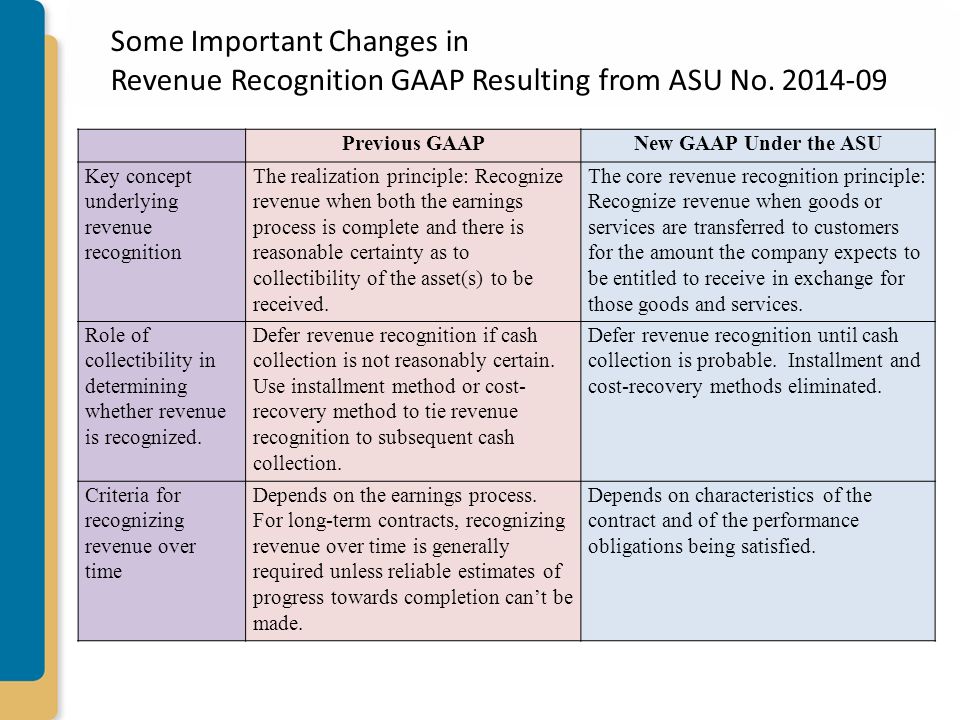

Revenue recognition principle short definition. It means that revenues or income should be recognized when the services or products are provided to customers regardless of when the payment takes place. The revenue recognition principle is a cornerstone of accrual accounting together with the matching principle they both determine the accounting period in which revenues and expenses are recognized. According to the principle revenues are recognized when they are realized or realizable and are earned usually when goods are transferred or services rendered no matter when cash is received.

Source : pinterest.com