Revenues Are Recognized When A Seller S Performance Obligation Is

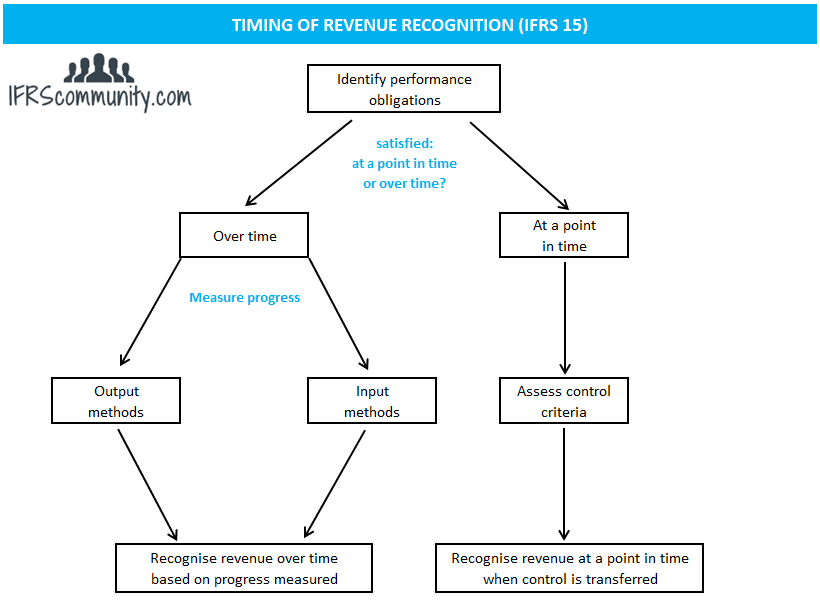

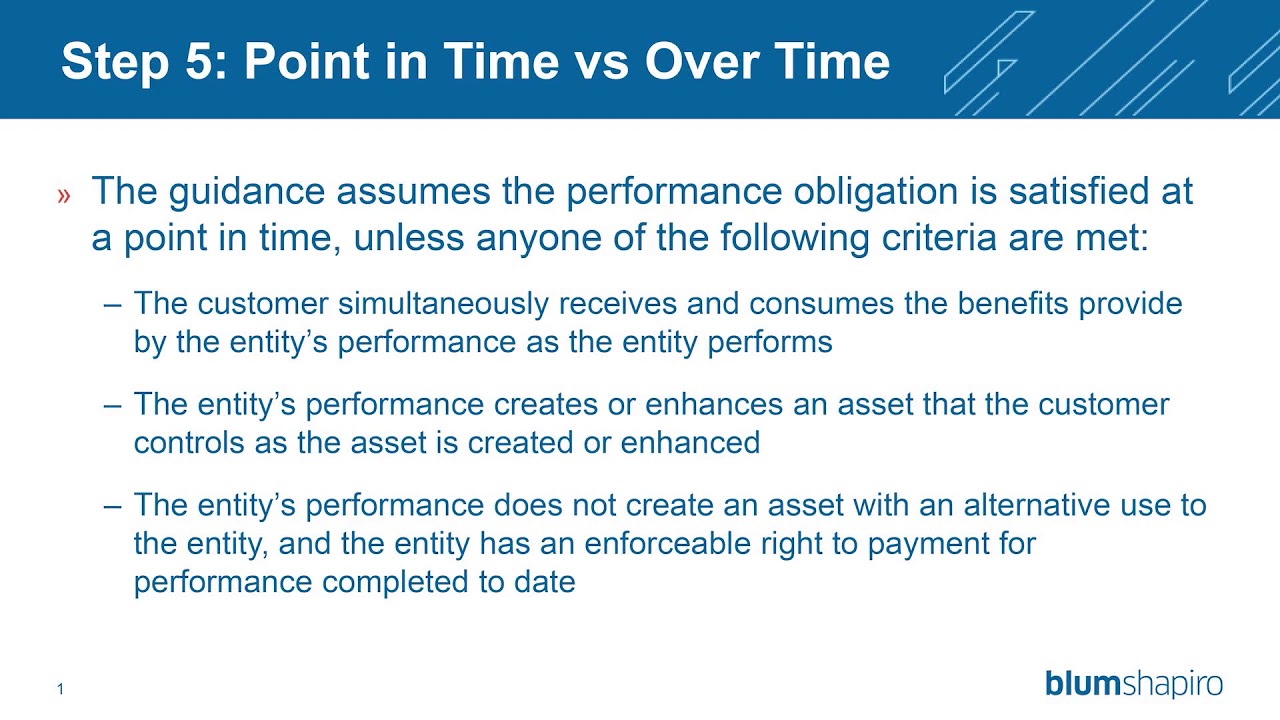

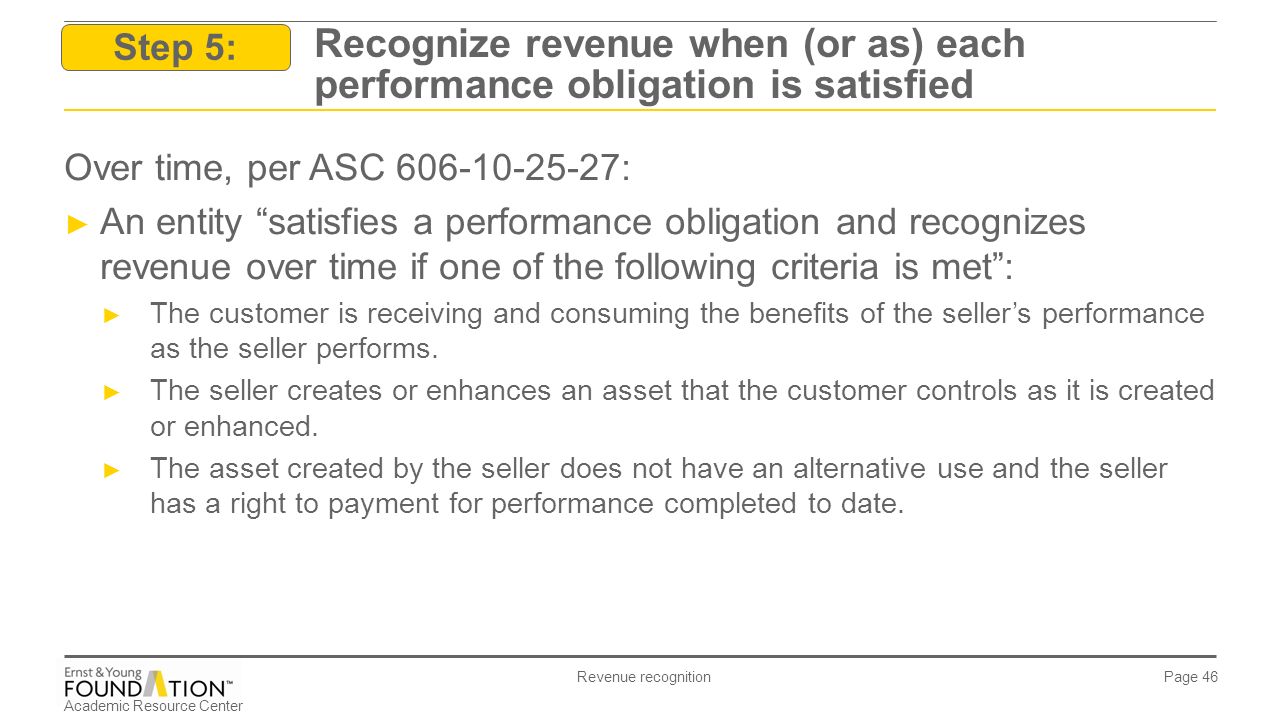

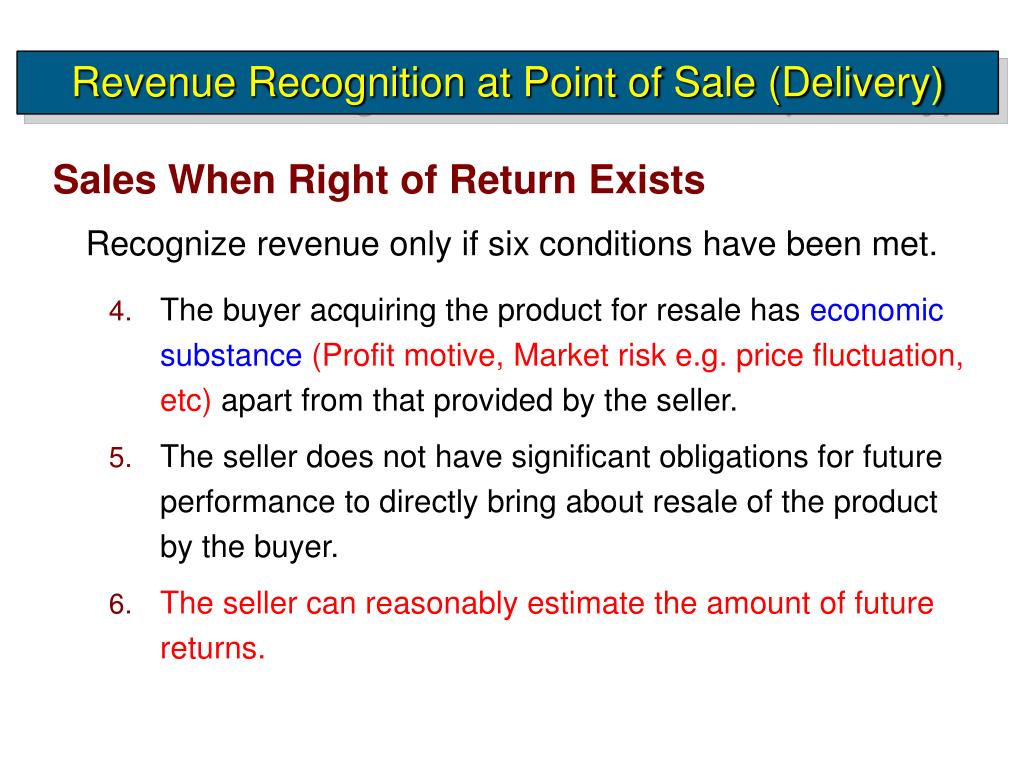

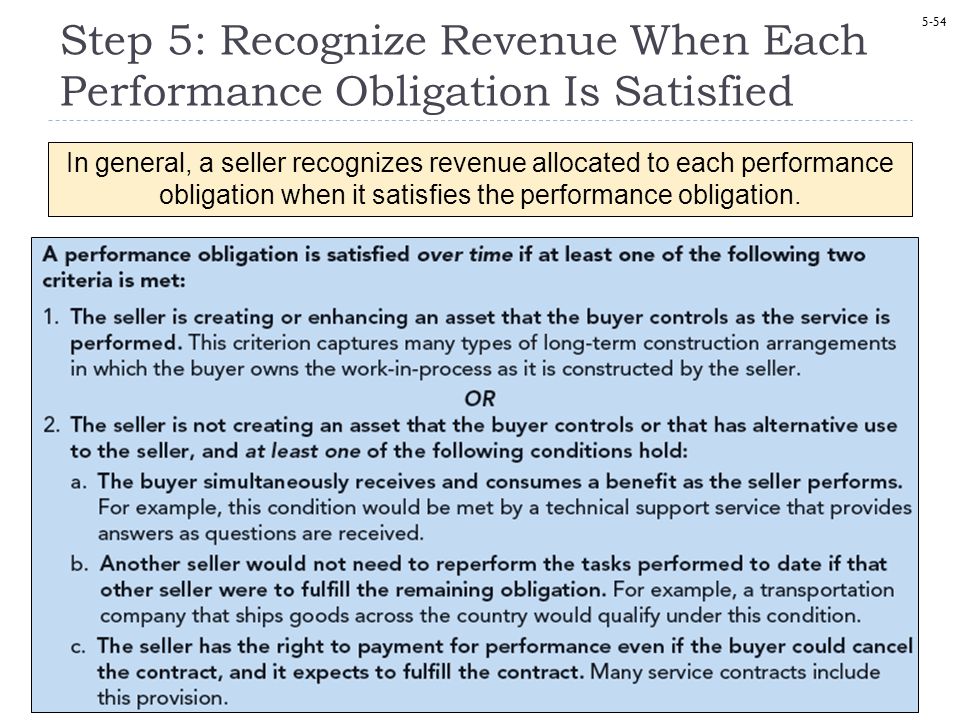

When the criteria to recognize revenue over time are not met then revenue should be recognized at a point in time the point when control is transferred.

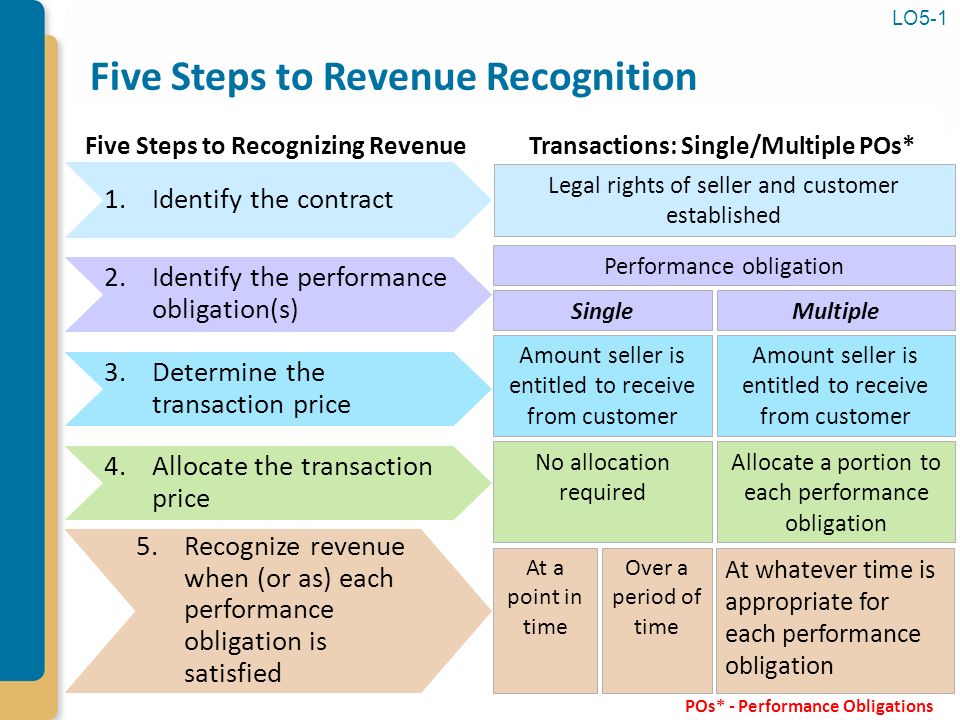

Revenues are recognized when a seller s performance obligation is. Allocate the transaction price to the performance obligation s in the contract. Recognize revenue recognition when the performance obligation is fulfilled. Revenues are recognized when. Recognizing revenue at a point in time or over a period of time.

When your customer has received the good or can access the service for the slotted amount of time and use it at their own discretion then the performance obligation is considered fulfilled. A seller s performance obligations are satisfied. Performance obligations in the contract the objective of identifying and separating performance obligations is to ensure revenue is recognized when the performance obligations are satisfied i e goods and services are transferred to the customer. Revenue recognition is a generally accepted accounting principle gaap that identifies the specific conditions in which revenue is recognized.

A seller s performance obligations are identified. A company should recognize revenue when. The aim of this paper is to investigate the gap between cost based and time based revenue recognition schemes in the accounting of ship owning corporations and to propose cost based revenue recognition as in general accounting practice in connection with the performance obligations for a comparative analysis of time based traditional approach and cost based schemes a sample of dry bulk. A contract is identified.

Recognize revenue when or as the entity satisfies a performance obligation. The last step of the process addresses at what time revenue from contracts with customers should be recognized. When to recognise revenue. Revenue is recognised when as performance obligations are satisfied in the amount of transaction price allocated to satisfied performance obligations ifrs 15 46.

Performance obligations satisfied at a point in time. A seller can only recognize revenue covering costs incurred if it cannot measure its completed progress of a performance obligation. Identifying performance obligations is the second step of the revenue model. C the seller satisfies the performance obligation.

Contracts must be evaluated to ensure that all performance obligations are identified. B the contract is signed. A performance obligation is satisfied by transferring a promised good or service to a customer ifrs 15 31.

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)