Reverse Accrued Revenue Journal Entry

500 accrued bonus credit.

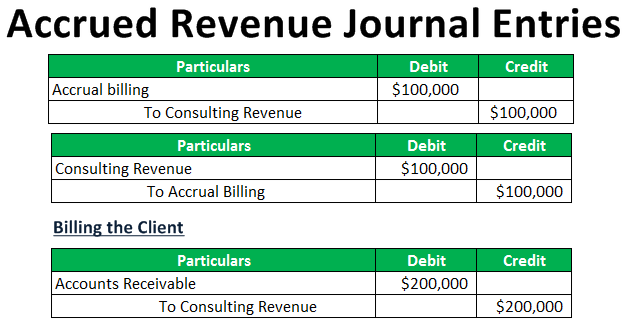

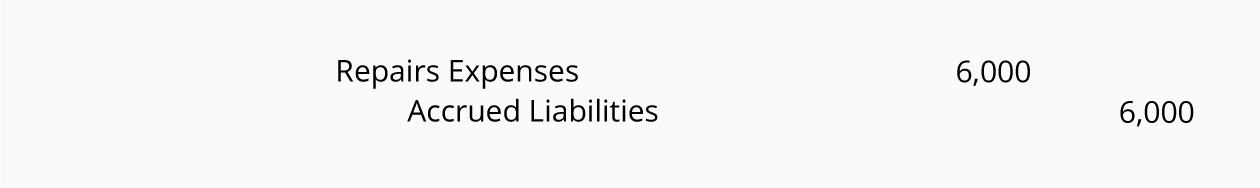

Reverse accrued revenue journal entry. This is the last step in the accounting cycle. Examples of accrued income interest on investment earned but not received. Accrued revenue journal entry. Reversing entry for accrued expense.

Journal entry for accrued income. At the end of every period accountants should make sure that they are properly included as income with a corresponding receivable. Accrued revenue is often used for accounting purposes to determine the matching concept. Also make the entry for the amount paid on the date of payment.

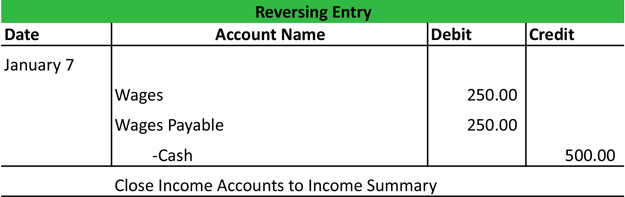

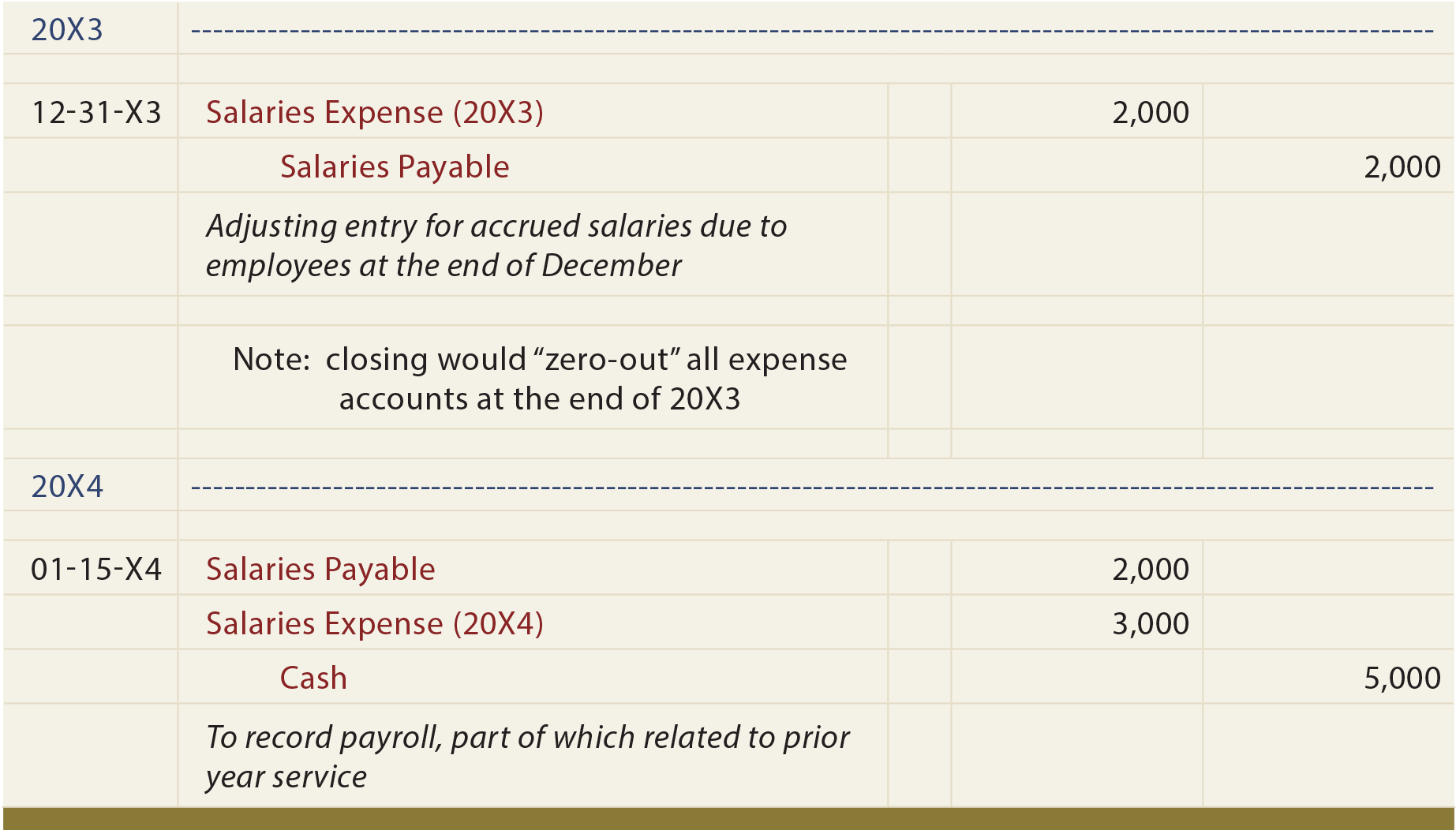

The first two categories of adjusting entries that we had discussed above were. Reversing entries or reversing journal entries are journal entries made at the beginning of an accounting period to reverse or cancel out adjusting journal entries made at the end of the previous accounting period. 500 accrued bonus credit. Actually if you combine the reversing entry and journal entry for collection you ll come up with the journal entry above.

Suppose that abc company and its lessor agrees that abc will pay rent at the end of january 2020 covering a 3 month period starting november 1 2019. It is income earned during a particular accounting period but not received until the end of that period. Journal entry for accrued revenue. Adjusting entry for accrued revenue accrued income or accrued revenue refers to income already earned but has not yet been collected.

Quick remedies for pro motion letter cases in case you look about and find others getting audience that you just re not getting get hold of your own supervisor says weintraub. When you reverse the entry it ll be made on the date of the payment. It is commonly used in situations when either revenue or expenses were accrued in the preceding period and the accountant does not want the accruals. A reversing entry is a journal entry made in an accounting period which reverses selected entries made in the immediately preceding period the reversing entry typically occurs at the beginning of an accounting period.

Journal entry for accrued income recognizes the accounting rule of debit the increase in assets modern rules of accounting. The reverse of accrued revenue known as deferred revenue can also arise where customers pay in advance but the seller has not yet provided services or shipped goods. You ll make an adjusting entry for the prior year debit. In this case the seller initially records the received payment as a liability and later converts the entry into a sale when the transaction is completed.

Accrued revenue is the income that is recognized by the seller but not billed to the customer. It is treated as an asset in the balance sheet and it is normal in every business.