Sales Revenue Accounting Definition

:max_bytes(150000):strip_icc()/NetProfitMargin2-edf5ae45cbe048208913caa9d3b03110.png)

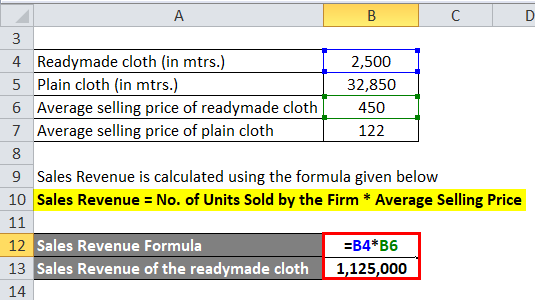

Usually sales are the net sales that the firm achieves minus the cost of returned merchandise.

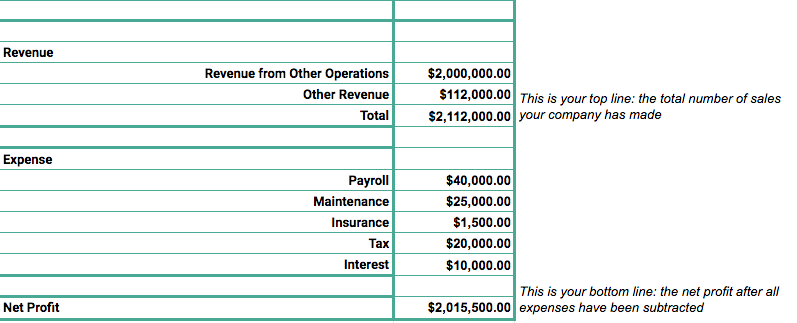

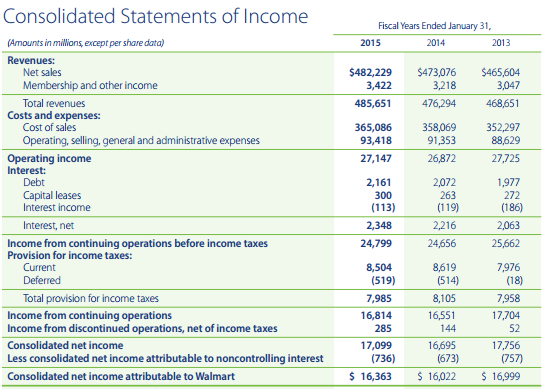

Sales revenue accounting definition. Revenue often referred to as sales is the income received from normal business operations and other business activities. On an income statement sales are typically referred to as gross sales a company may also report net sales. In accounting terms sales comprise one component of a company s revenue figure. It is presented as the first line in the income statement of merchandising and manufacturing firms.

What does sales revenue mean. The concept can be broken down into two variations which are. Home accounting dictionary what is sales revenue. Sales revenue is the income that a firm realizes from selling its products or services to the public.

Cash flow is the net amount of cash being transferred into and out of a company. Revenue is the money a company earns from the sale of its products and services. Revenue provides a measure of the effectiveness of a company s sales and marketing whereas cash flow is more of a liquidityindicator. The two words can be used interchangeably since they mean the same thing.

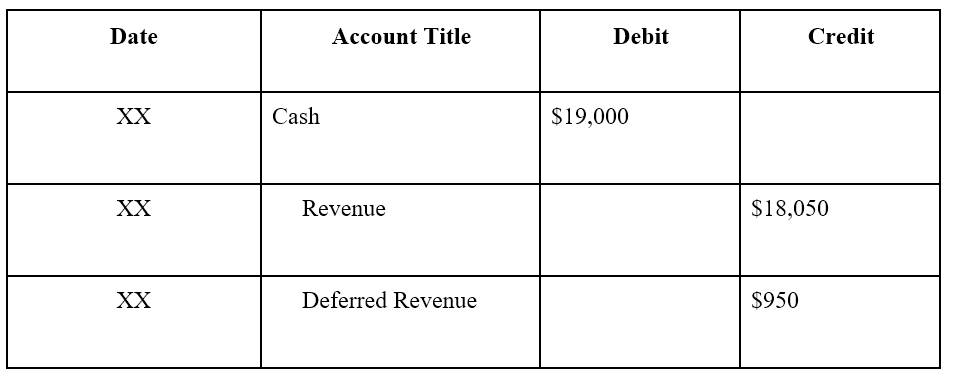

Net sales is often presented first in the body of an income statement. Net sales is the amount of actual sales after adjustments for sales returns discounts and allowances are made. Sales revenue is the income received by a company from its sales of goods or the provision of services. In accounting the terms sales and revenue can be and often are used interchangeably to mean the same thing.

Sales revenue is the amount realized by a business from the sale of goods or services. Sales or sales revenue is an income account. It is important to note that revenue does not necessarily mean cash received. This figure is used to define the size of a business.

/ExxonIncojmestatement2019June-55cdf08720b24bc7b27ade3de5b6dc32.jpg)

.gif)

/IncomestatementApple-83dd63870e72405e87749f33fd8e35af.jpg)

:max_bytes(150000):strip_icc()/Appleproducts-b92538c07a6f46a68d949cc9d6070267.jpg)

:max_bytes(150000):strip_icc()/Apple10KIS-00e74dfe3f34479180ac7ede7b982292.jpg)

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)