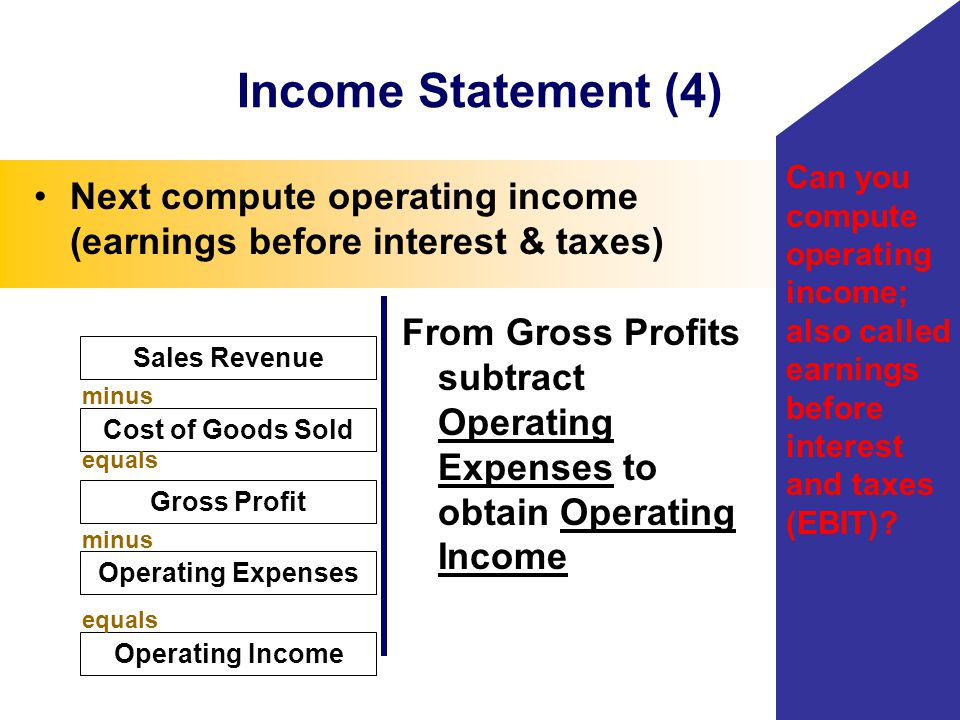

Sales Revenue Minus Cost Of Goods Sold And Operating Expenses

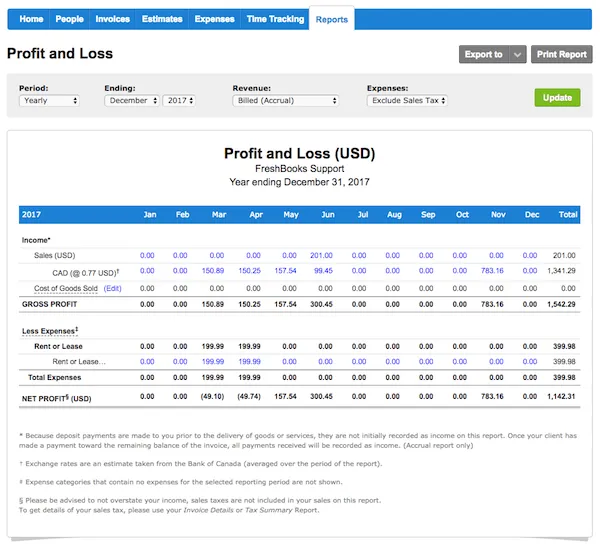

To understand this better let s take a look at an example.

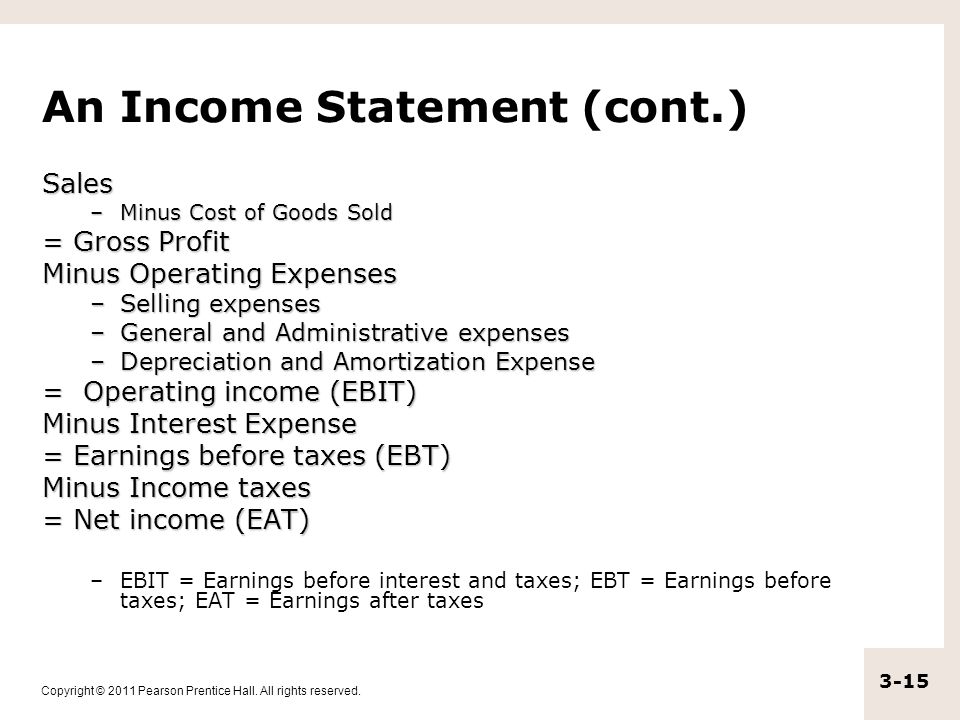

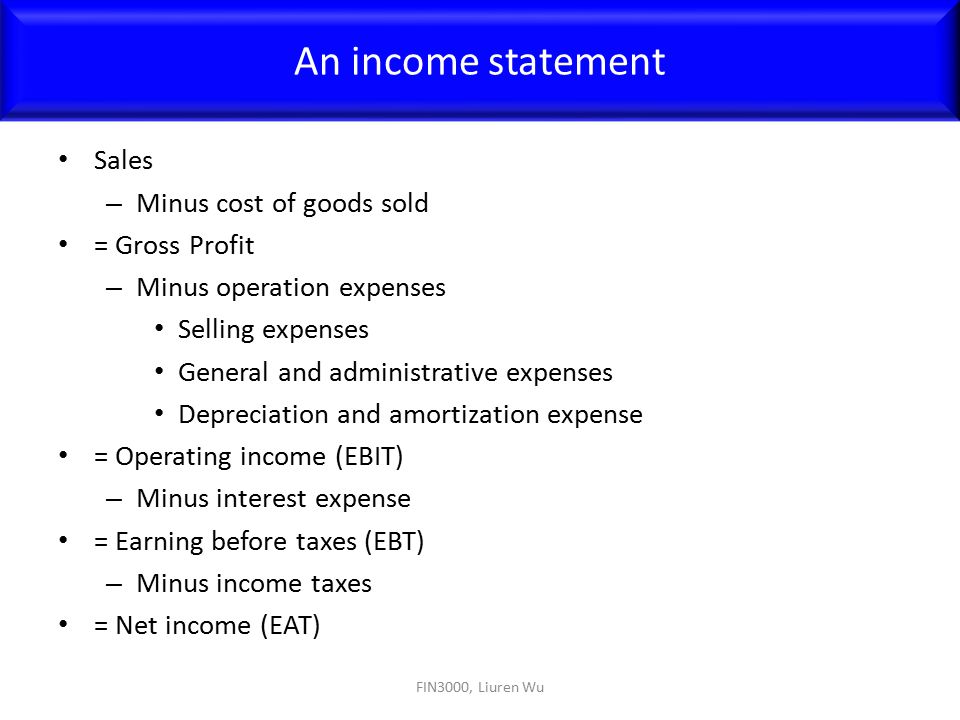

Sales revenue minus cost of goods sold and operating expenses. The contribution margin ratio is a. The contribution margin ratio is. These figures can be found on a company s income statement. To sum up it equals total revenue minus the cost of goods sold operating expenses interest taxes preferred stock and debt repayments.

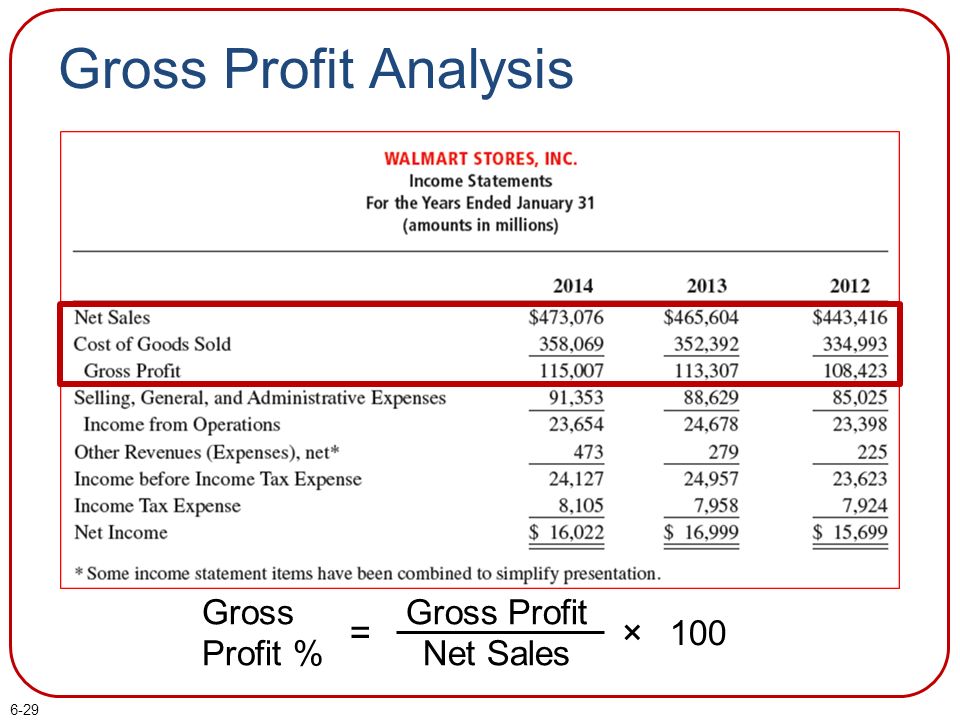

To understand the expenses and cost of goods sold better let s first establish that an expense is the cost of generating revenue but not all costs are expenses. This would result in a gross profit of 100 sales minus cost of sales. The three main profit margin metrics are gross profit total revenue minus cost of goods sold cogs operating profit revenue minus cogs and operating expenses and net profit revenue minus all expenses. In accounting and finance profit margin is a measure of a company s earnings relative to its revenue.

The right answer choice is ebit on the income statement sales revenue minus cost of goods sold and operati view the full answer previous question next question get more help from chegg. Gross gross profit is total revenue minus cost of goods sold cogs. Sales revenue minus fixed expenses. Sales revenue minus cost of goods sold b.

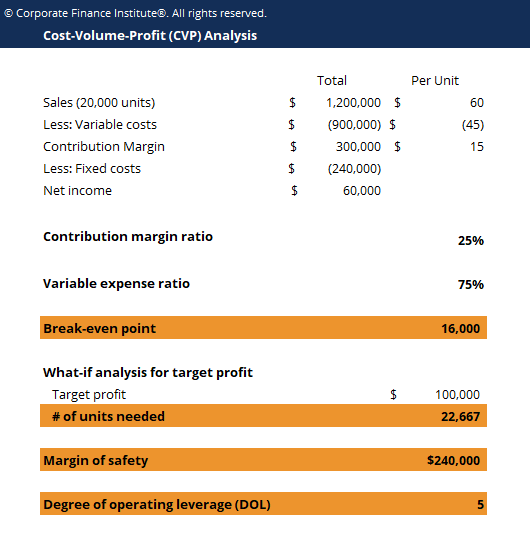

Sales revenue minus fixed expenses c. Cost of goods sold does not include general expenses such as wages and salaries to office staff advertising expenses etc. In accounting the terms sales and revenue can be and often are used interchangeably to mean the same thing. Sales revenue minus variable expenses.

Revenue does not necessarily mean cash received. Sales revenue minus variable expenses. Sales revenue minus variable expenses. However cost of goods sold is indeed an expense but we separate them on the income statement.

Now your net profit in this scenario amounts to 1 000. Operating income can also be calculated by deducting operating expenses from gross profit. Sales revenue minus operating expenses d. Gross profit will appear on a company s income statement and can be calculated by subtracting the cost of goods sold from revenue sales.

Fixed expenses divided by variable expenses b. Sales revenue minus cost of goods sold b. Sales revenue is the income received by a company from its sales of goods or the provision of services. So our sales would be 400 and our cost of the goods we sold cost of sales would amount to 300.

Fixed expenses divided by variable expenses b.

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

/TeslaQ2-19IncomeStatementInvestopedia-1466e66b056d48e6b1340bd5cae64602.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

/ExxonIncojmestatement2019June-55cdf08720b24bc7b27ade3de5b6dc32.jpg)

/JCPIncomestatementMay2019Investopedia-ef93846733094d2cbd1fdfe97126b3bc.jpg)