Sales Revenue Minus Operating Expenses Equals

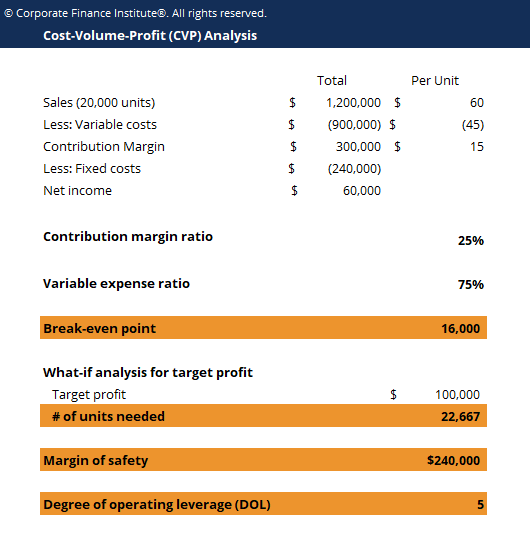

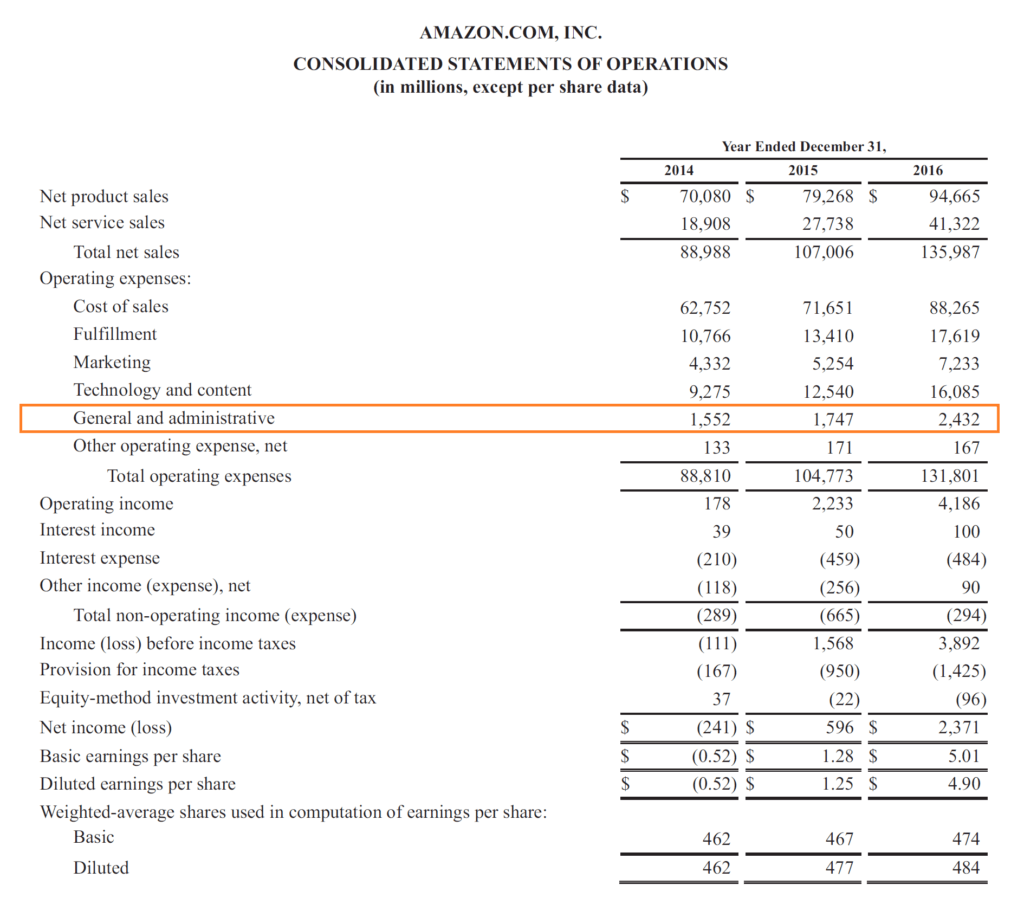

In accounting and finance profit margin is a measure of a company s earnings relative to its revenue.

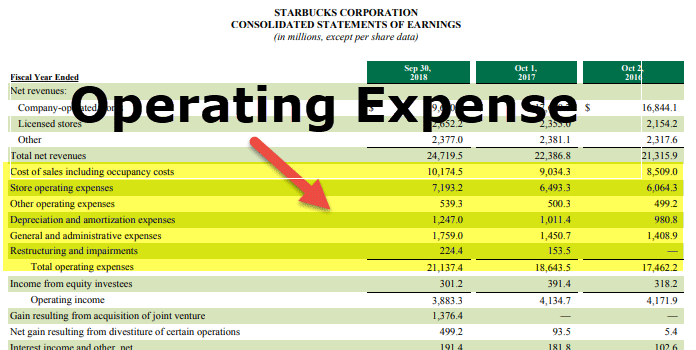

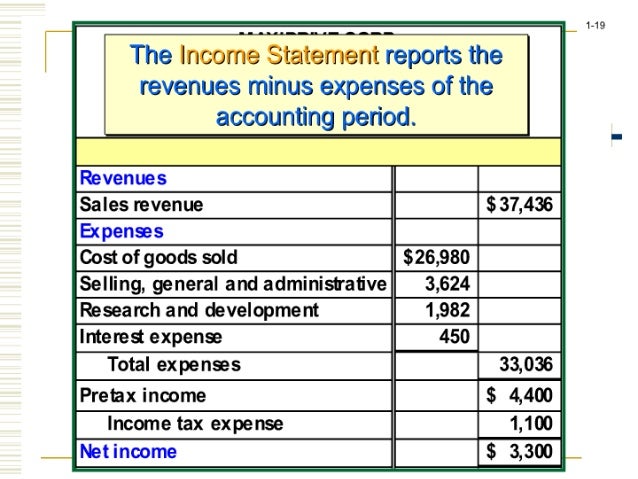

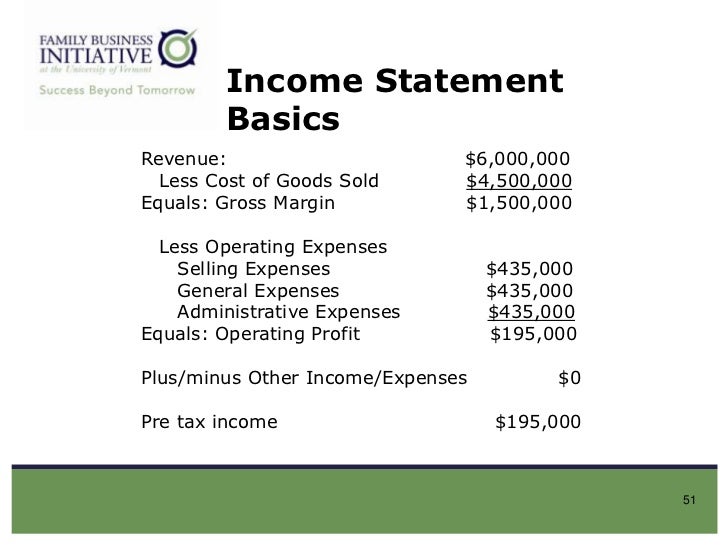

Sales revenue minus operating expenses equals. In accounting the terms sales and revenue can be and often are used interchangeably to mean the same thing. Cost of sales net profit revenue expenses or in words. Gross profit is the total revenue minus the expenses directly related to the production of goods for sale called the cost of goods sold. Sales revenue is the income received by a company from its sales of goods or the provision of services.

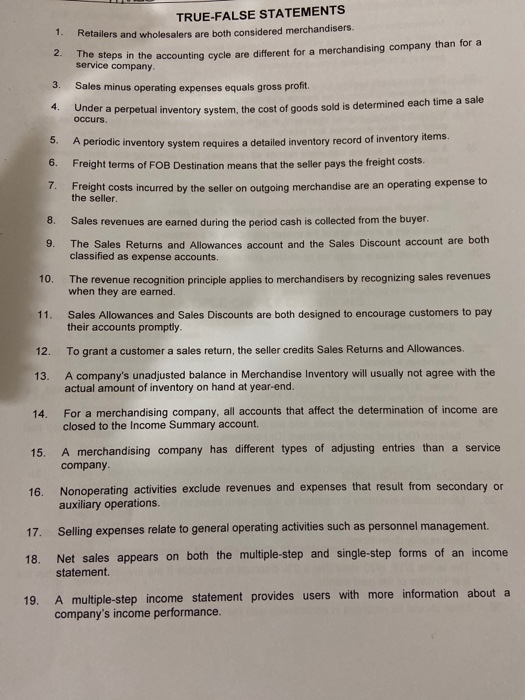

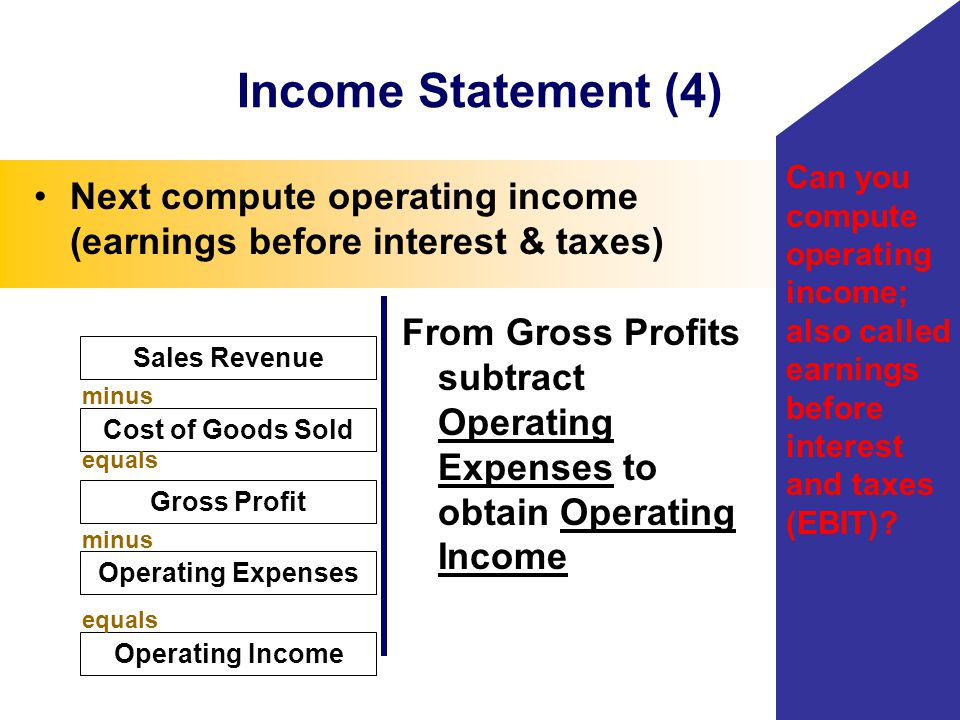

On the income statement sales revenue minus cost of goods sold and operating expenses equals which of the following. Asked by wiki user. Gross p solutioninn. Sales revenue minus operating expenses non operating revenues and expenses equals gross profit that totals million.

Revenue does not necessarily mean cash received. Net sales gross sales customer discounts returns allowances gross profit net sales cost of goods sold operating profit gross profit total operating expenses net profit operating profit taxes interest net profi. Retained earnings net profit net income available to preferred shareholders ebit. Sales revenue minus operating expenses equals gross profit.

A periodic inventory system does not require a detailed record of inventory items. Under a perpetual inventory system the cost of goods sold is determined each time a sale occurs. The three main profit margin metrics are gross profit total revenue minus cost of goods sold cogs operating profit revenue minus cogs and operating expenses and net profit revenue minus all expenses.

/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

:max_bytes(150000):strip_icc()/IncomestatementApple-83dd63870e72405e87749f33fd8e35af.jpg)

/TeslaQ2-19IncomeStatementInvestopedia-1466e66b056d48e6b1340bd5cae64602.jpg)