Tax Revenue History Definition

While the civil war led to the creation of the first income tax in the u s the federal income tax.

Tax revenue history definition. Income tax is used to fund public services pay government. A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer an individual or legal entity by a governmental organization in order to fund government spending and various public expenditures. Tax revenue is defined as the revenues collected from taxes on income and profits social security contributions taxes levied on goods and services payroll taxes taxes on the ownership and transfer of property and other taxes. Taxation imposition of compulsory levies on individuals or entities by governments.

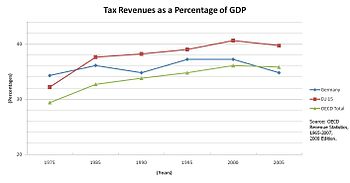

A failure to pay along with evasion of or resistance to taxation is punishable by law taxes consist of direct or indirect taxes and may be paid in money or as its labour. Total tax revenue as a percentage of gdp indicates the share of a country s output that. Taxes in the u s. Tax revenue is the income that is gained by governments through taxation taxation is the primary source of government revenue revenue may be extracted from sources such as individuals public enterprises trade royalties on natural resources and or foreign aid an inefficient collection of taxes is greater in countries characterized by poverty a large agricultural sector and large amounts of.

The constitution gave congress the power to impose taxes and other levies on the general public. Tax systems vary widely among nations and it is important for individuals and corporations to carefully study a new locale s tax laws before earning income or doing business there. Federal tax revenue is the total tax receipts received by the federal government each year. Most of it is paid either through income taxes or payroll taxes.

Learn more about taxation in this article. In fiscal year fy 2021 income taxes will account for 50 payroll taxes make up 36 and corporate taxes supply 7.