Sap Revenue Accounting And Reporting Add On

Revenue accounting and reporting sap rar.

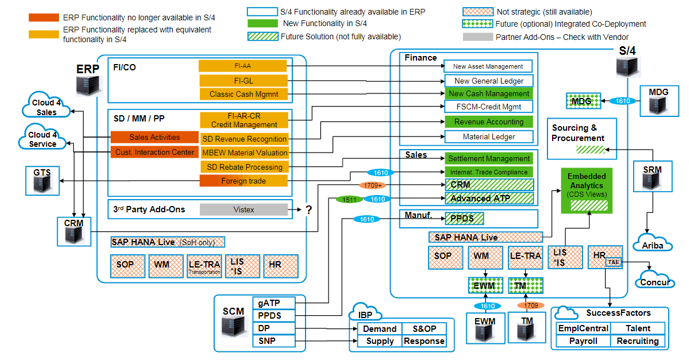

Sap revenue accounting and reporting add on. Cost object controlling can only run on the same instance as sap revenue accounting and reporting if it is integrated with revenue accounting. Sap revenue accounting reporting. Handle orders invoices and events from multiple sap and non sap systems and gain flexibility by decoupling revenue recognition rules from order entry and billing. Sap revenue accounting and reporting rar was built from the ground up to handle the new revenue recognition regulations announced may 28 2014 ifrs 15 asc 606 to be effective january 1 2018 in countries adhering to both us gaap and ifrs.

Sap ecc based sd revenue recognition application component sd bil rr will not be available within sap s 4hana. During the period end. Sap revenue accounting and reporting has a separate license fee. Comply with new statutory regulations for revenue recognition such as ifrs 15 while supporting existing requirements with the sap revenue accounting and reporting application.

In this step you create revenue accounting contracts corresponding to operational documents that are created on a back end operational system. In rar system data obtained from different source applications are processed to identify the pob and their recognizable revenue. This new functionality supports the new revenue accounting standard as outlined in ifrs15 and adapted by local gaaps. Instead of this functionality the newly available sap revenue accounting and reporting functionality should be used.

Sap revenue accounting and reporting is an add on which runs on sap erp 6 ehp 5 or higher sfinancials or sap s 4hana. This sap rar is available as an add on and can be implement ed in sap ecc 6 0 with enhancement package 5 or sap s 4hana. Sap revenue accounting and reporting component is based on the 5 step model of ifrs 15. Sap has launched revenue accounting reporting an add on that has been developed primarily to reflect the requirements driven by a new revenue recognition standard and which acts as a dedicated subledger for revenue accounting.