Tax Revenue Definition Economics

Taxation imposition of compulsory levies on individuals or entities by governments.

Tax revenue definition economics. Revenue in economics the income that a firm receives from the sale of a good or service to its customers. The ar curve is the same as the demand curve. Average revenue ar price per unit total revenue output. It gives a detailed report on revenue collected from different items like corporation tax income tax wealth tax customs union excise service taxes on union territories like land revenue stamp.

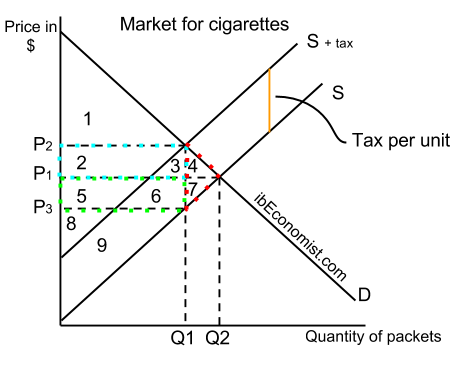

In economics taxes fall on whomever pays the burden of the tax whether this is the entity being taxed such as a business or the end consumers of the business s goods. The table below shows the demand for a product where there is a. Determinants of price elasticity and the total revenue rule our mission is to provide a free world class education to anyone anywhere. Learn more about taxation in this article.

Tax revenue is defined as the revenues collected from taxes on income and profits social security contributions taxes levied on goods and services payroll taxes taxes on the ownership and transfer of property and other taxes. Technically revenue is calculated by multiplying the price p of the good by the quantity produced and sold q in algebraic form revenue r is defined as r p q. The partial derivative of log y with respect to logx 1 b 1 is the constant tax buoyancy while the partial derivative of log y with respect to x 2 b 2 is the degree of responsiveness of tax revenue to the changes in tax rates this helps to understand whether the laffer curve an inverted u shape relationship between the revenue from direct. Tax revenue forms part of the receipt budget which in turn is a part of the annual financial statement of the union budget.

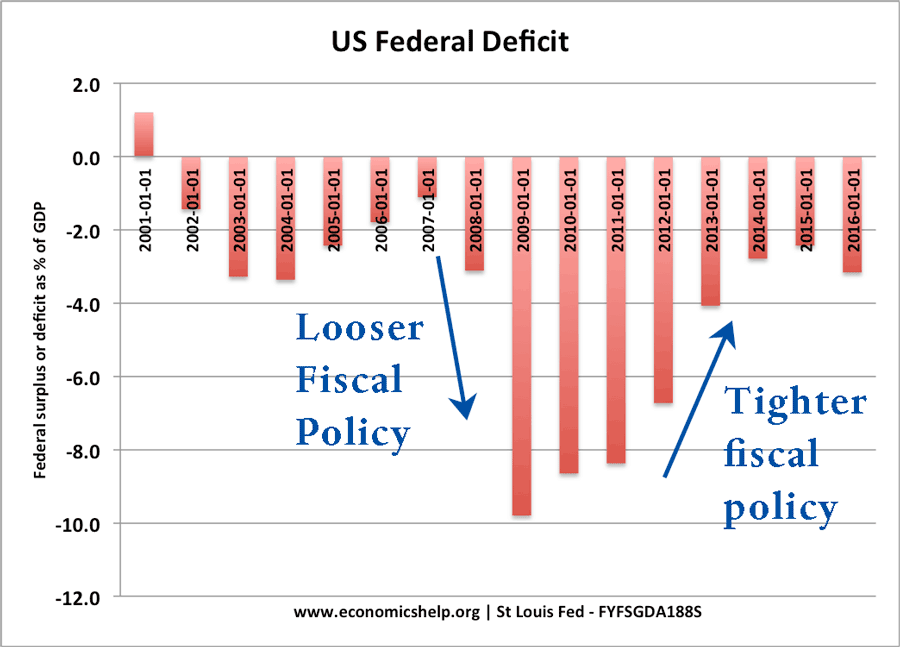

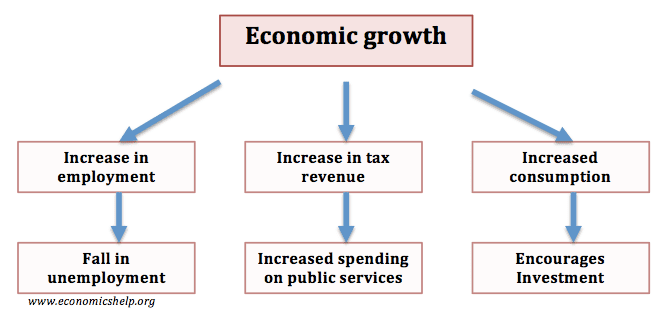

Revenue is the income generated from the sale of goods and services in a market. Definition of tax revenue. Tax revenue is the income that is gained by governments through taxation taxation is the primary source of government revenue revenue may be extracted from sources such as individuals public enterprises trade royalties on natural resources and or foreign aid an inefficient collection of taxes is greater in countries characterized by poverty a large agricultural sector and large amounts of. Marginal revenue mr the change in revenue from selling one extra unit of output.

Total tax revenue as a percentage of gdp indicates the share of a country s output that. Total revenue tr price per unit x quantity.

:max_bytes(150000):strip_icc()/graph_laffercurve-dfef22d55c9c4bb19d461cd95d546cb4.png)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)