The Revenue Recognition Principle Requires One To Record Revenue When It Is

The matching principle along with revenue recognition aims to match revenues and expenses in the correct accounting period.

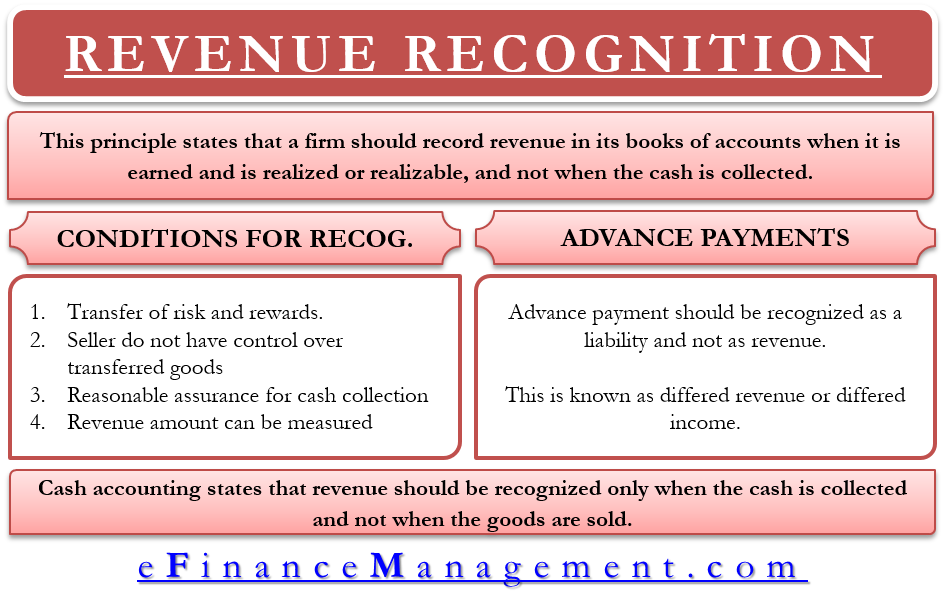

The revenue recognition principle requires one to record revenue when it is. According to the revenue recognition principle jw should record the revenue in december because the revenue was realized and earned in december even though it was not received until january. It means that revenues or income should be recognized when the services or products are provided to customers regardless of when the payment takes place. The revenue recognition principle or just revenue principle tells businesses when they should record their earned revenue. The matching principle states that expenses should be matched with the revenues they help to generate.

The client does not pay for the consulting time until the following january. The landscaping company records revenue earnings each month and provides service as planned. The blueprint breaks down the rrp. The revenue recognition principle is an accounting principle that requires revenue to be recorded only when it is earned.

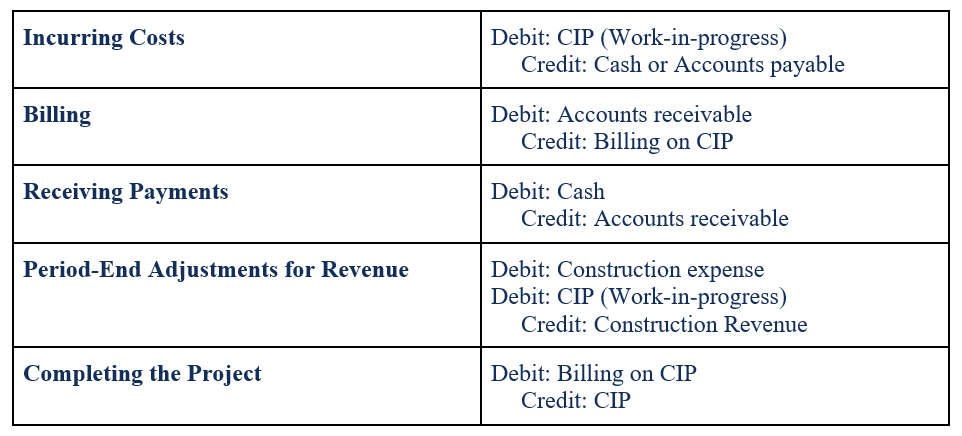

During december jw provides 2 000 of consulting work to one of its clients. The revenue recognition principle a feature of accrual accounting requires that revenues are recognized on the income statement in the period when realized and earned not necessarily when cash. Revenue recognition principle for the provision of services one important area of the provision of services involves the accounting treatment of construction contracts. Revenue recognition is a part of the accrual accounting concept that determines when revenues are recognized in the accounting period.

To align with the revenue recognition principle the landscaping company will record one month of revenue 100 each month as earned. Revenue recognition is an accounting principle that outlines the specific conditions under which revenue sales revenue sales revenue is the income received by a company from its sales of goods or the provision of services. They provided service for that month even though the customer has not yet paid cash for the service.