The Revenue Recognition Principle Requires Quizlet

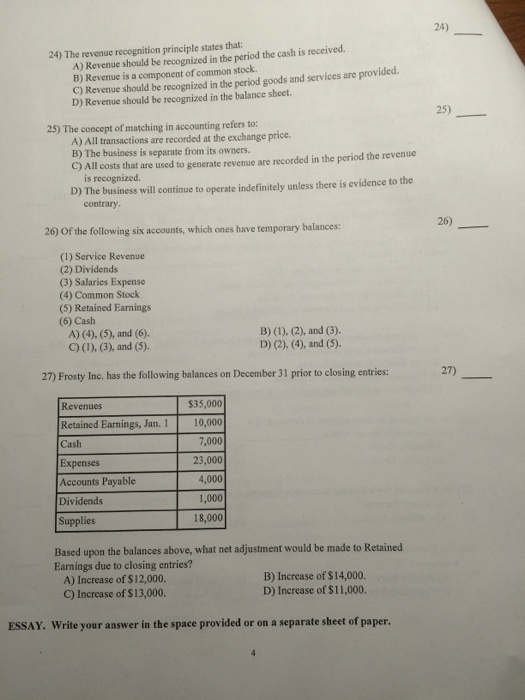

Revenue should be recognized in the period the cash is received.

The revenue recognition principle requires quizlet. Matching principle the matching principle states that an expense must be recorded in the same accounting period in which it was used to produce revenue. The revenue recognition principle requires that the reporting of revenue be included in the period when cash for the service is received. The revenue recognition principle requires that sales revenues be recognized. The revenue recognition principle dictates that revenue is recognized in the period in which the cash is received.

The economic life of a business can be divided into artificial time periods. The revenue recognition principle requires a time to be divided into annual periods to measure revenue properly b revenue to be recorded only after the business has earned it c expenses to be matched with revenue of the period d revenue to be recored only after the cash is received. Revenue should be recognized in the period earned. Common sources of revenue and point at which recognition occurs.

Updating the accounts at the end of the period. As of date of sale or delivery to customers. None of these answer choices are correct. When cash is received.

Revenue is a component of common stock. Revenue only to be recorded only after the business has earned it. Guides accounting for expenses ensures that all expenses are recorded when they are incurred during the period and matches those expenses against the revenues of the period. Sales of products.

When the merchandise is ordered. The revenue recognition principle requires that revenue must be recorded at the time the duties are performed regardless of when the cash is received. Revenue recognition principle a. Start studying accounting ch.

The revenue recognition principle dictates that revenue should be recognized in the accounting records. False what is the periodicity assumption. Requires companies to record revenue when it satisfies each performance obligation matching principle c. Learn vocabulary terms and more with flashcards games and other study tools.

Revenue recognition principle requires companies to record revenue when it has been earned and determines the amount of revenue to record. False the expense recognition principle requires that expenses be recognized in the same period that they are paid. Revenue recognition principle states that revenue is recognized when it is realized received in cash or realizable will be received in cash and earned the firm has performed its part of the deal. Put quizlet study sets to work.

Revenue should be recognized in the balance sheet.