Does Interest Revenue Increase With Debit Or Credit

How to increase cash with a debit.

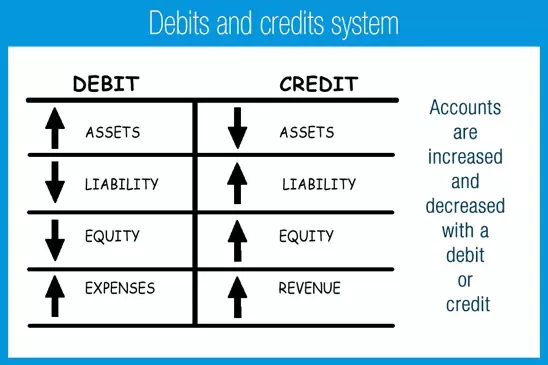

Does interest revenue increase with debit or credit. Asset a liability l or equity e increases with a debit dr or credit cr explanation. Interest revenue is the earnings that an entity receives from any investments it makes or on debt it owns. In accounting a debit or credit can either increase or decrease an account depending on the type of account. This is credited because.

The accounting entry to record accrued interest requires a debit and a credit to different accounts. Examples of debits and credits. Accounting works on a double entry bookkeeping system. For example you would debit the purchase of a new computer by entering the asset gained on the left.

On the income. It either increases an asset or expense account or decreases equity liability or revenue accounts. Arnold corporation sells a product to a customer for 1 000 in cash. This results in revenue of 1 000 and cash of 1 000.

If a debit increases an account you will decrease the opposite account with a credit. Credits lower assets on the balance sheet and raise liabilities. Debit loans payable account credit cash account. Every entry consists of a debit and a credit.

For dividends it would be an equity account but have a normal debit balance meaning debit will increase and credit will decrease. Revenue is the money. In a t account their balances will be on the right side. We also learned that net income is revenues expenses and calculated on the income statement.

Revenues and gains are recorded in accounts such as sales service revenues interest revenues or interest income and gain on sale of assets. Arnold must record an increase of the cash asset account with a debit and an increase of the revenue account with a credit. A debit is an entry made on the left side of an account. Recording changes in income statement accounts.

On the balance sheet debits increase assets and reduce liabilities. When you pay the interest in december you would debit the interest payable account and credit the cash account. This is done with an accrual journal entry under the cash basis of accounting interest revenue is only. We learned that net income is added to equity.

Under the accrual basis of accounting a business should record interest revenue even if it has not yet been paid in cash for the interest as long as it has earned the interest.