How To Calculate Tariff Revenue

Suppose the government enacts a 400 tariff on imports to restrict competition.

How to calculate tariff revenue. Regulator chooses a tariff structure which allows the company to obtain enough revenues to cover its cost and earn a reasonable return alternatively regulator revises a tariff structure proposed by the company. Net welfare for the home country rises by b d e g h i. A tariff is a tax imposed on important goods or services. The 196 is normally the amount found on the top line of the income statement.

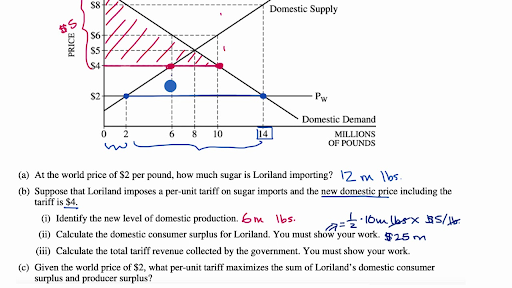

So if you multiply this amount which went from six million pounds to 10 million pounds so this is going to be four million pounds times the tariff which is 2 per pound per pound you re going to get this area which would be the government revenue. The item s hs or schedule b number its country of origin its destination and the value of the shipment in many cases the value includes shipping costs. Regulator determines the revenue requirements for the regulated company 2. A tutorial on how import prices increases consumer surplus and decreases producer surplus the impact of tariffs and the deadweight loss to society.

Calculating tax revenue is not difficult provided you know which tax rate to charge against a tax base. The company s net revenue will be equal to 200 0 98 196. The tax rate is the legally defined percentage to be charged against the legally defined tax base. Since these data are regularly reported by many countries this is a common way to report average tariffs.

While this price is still below the domestic equilibrium more domestic firms are now able to compete. The most simple formula for calculating revenue is. The simple way to calculate a trade weighted average tariff rate is to divide the total tariff revenue by the total value of imports. In the empirical part the paper presents results of simulations of tariff revenue and welfare effects using the linear and swiss tariff reduction formulas for a sample of 24 developing countries.

The tax base is the legally defined measure upon which the assessment or determination of tax liability is based. How to calculate tariffs calculating taxes can be difficult and time consuming especially when you want to ship multiple items in multiple orders to multiple countries. To calculate a tariff you ll need four pieces of information. Formally tariff revenue rises from c f to e f g h i for a net change of e h i g c e i g since c h.