List Of Capital Expenditure And Revenue Expenditure

Revenue expenditures tend to be small.

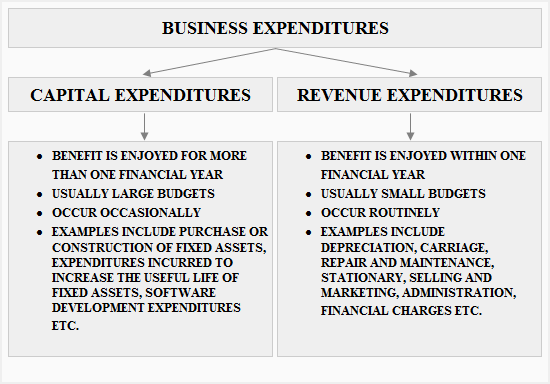

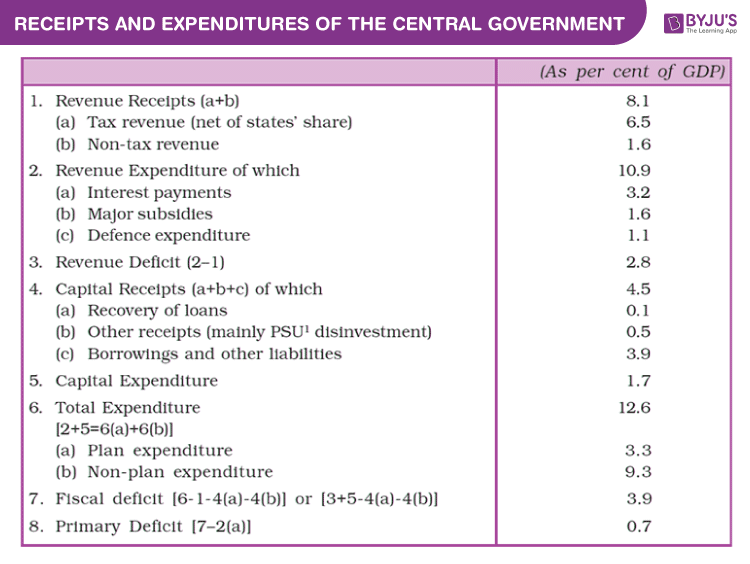

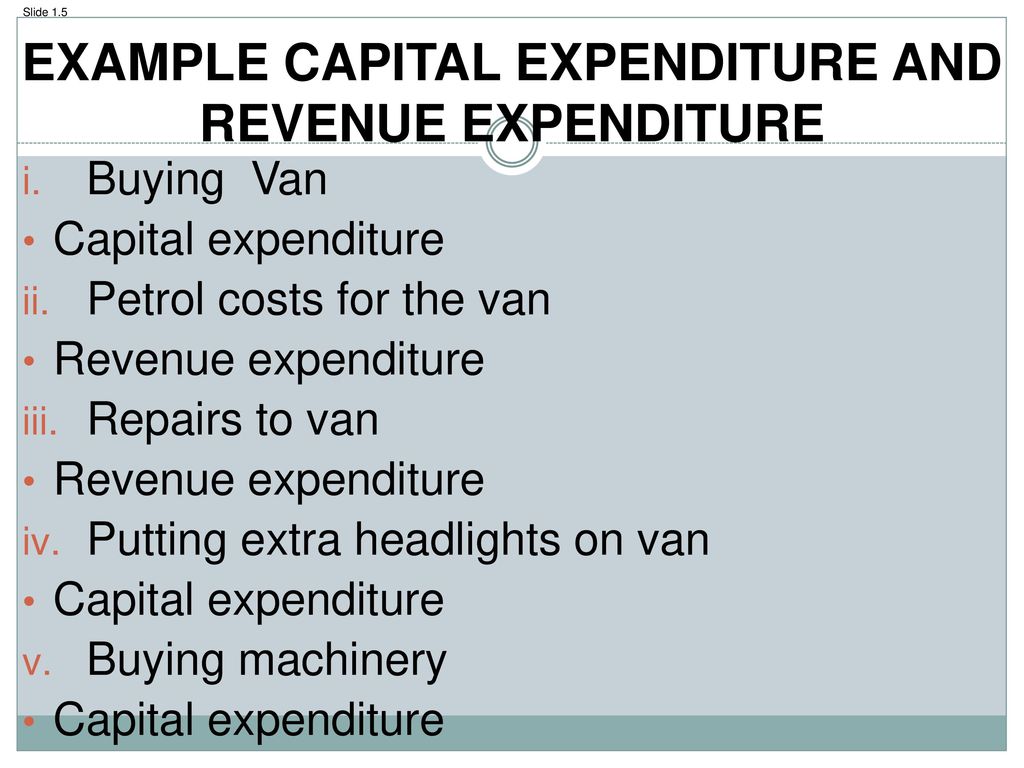

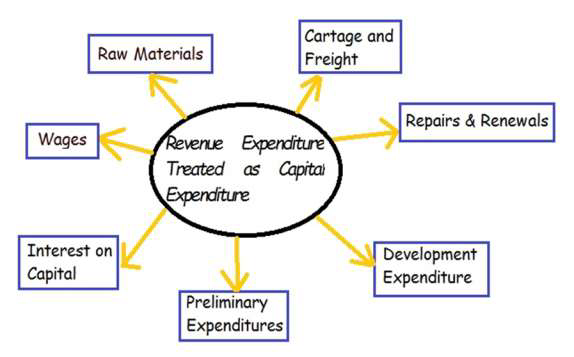

List of capital expenditure and revenue expenditure. Revenue expenditure and capital expenditure of india. Revenue expenditure is a periodic investment of money that does not benefit the business nor leads to any loss in any way. Revenue expenditure refers to those expenditures which are incurred during normal business operation by the company benefit of which will be received in the same period and the example of which includes rent expenses utility expenses salary expenses insurance expenses commission expenses manufacturing expenses legal expenses postage and printing expenses. The business expenditures are of two types capital expenditures revenue expenditures capital expenditures definition and explanation of capital expenditures.

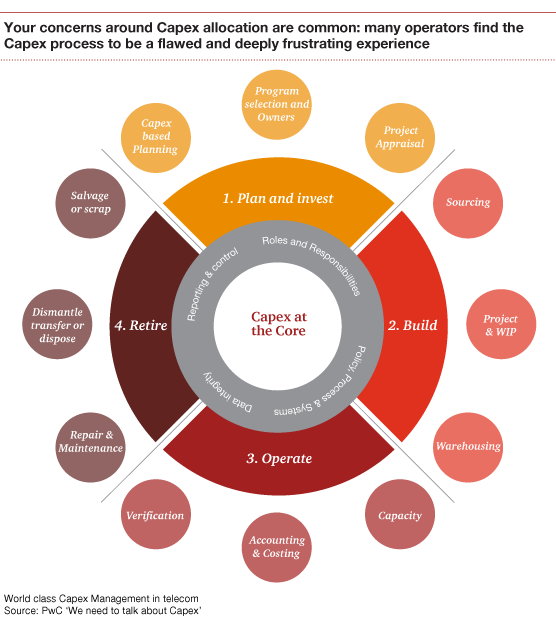

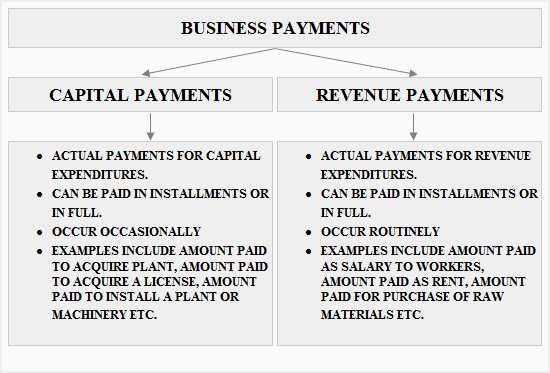

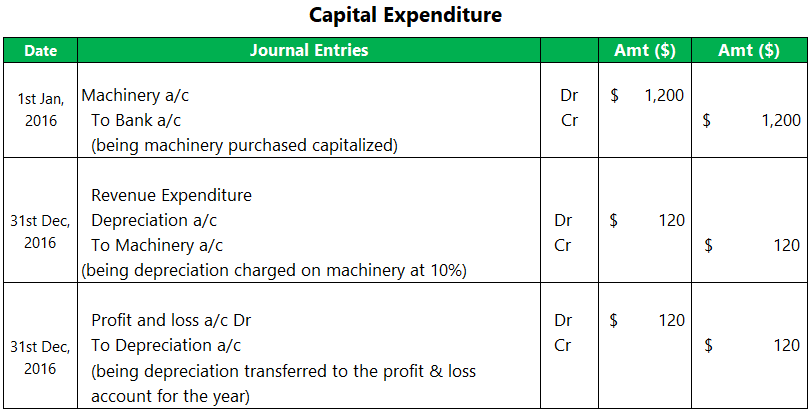

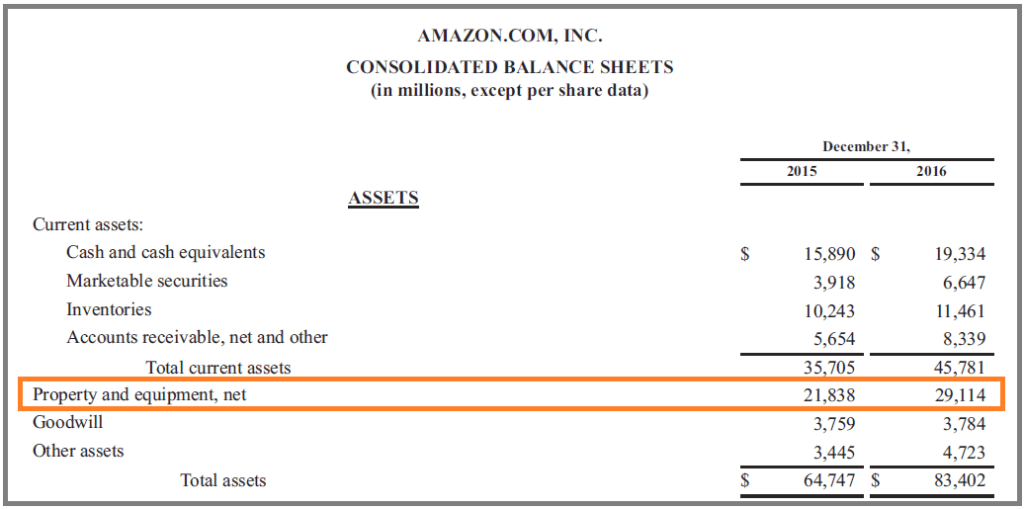

Capital expenditure and revenue expenditure both are important for business for earning a profit in the present as well as in subsequent years. Meaning of revenue expenditure. In some cases an accounting department may choose to impose an internal threshold limit for revenue expenditure anything above a certain price will be treated as a capital expenditure and will be expensed as such. Capital expenditure may include the following expenditures expenditure incurred on the acquisition of fixed assets tangible.

A business expenditure is an outflow of economic resources mostly in the form of cash and cash equivalents as a result of undertaking various activities during the normal course of business and to further the. For acquiring fixed assets such as land building plant and machinery furniture and fitting and motor vehicles. An expenditure that neither creates assets nor reduces a liability is categorised as revenue expenditure. Furniture and fixtures including the cost of furniture that is.

Buildings including subsequent costs that extend the useful life of a building. An expenditure is a capital expenditure if the benefit of the expenditure extends to several trading years. Capital and revenue expenditures are two different types of business expenditures that we often find in financial accounting and reporting. Any expenditure incurred for the following purposes is capital expenditure.

This is the basis of classification between revenue expenditure and capital expenditure. In the case of a capital expenditure an asset has been purchased by the company which generates revenue for upcoming years. These assets should not be acquired with a view to resell them at a profit but to retain in the business. If it creates an asset or reduces a liability it is categorised as capital expenditure.

While on the other hand capital expenditure is the long term investment that only benefits the business.

:max_bytes(150000):strip_icc()/dotdash_Final_Capital_Expenditures_vs_Revenue_Expenditures_Whats_the_Difference_2020-02-0538cfc8437b4b2ba4724c9443c6d393.jpg)

/TSLACF-----063329aec6ea4dabb3170b1e65b8246d.jpg)