Revenue Accounts Are Increased By Credits Only When

Increases with increased expenses c.

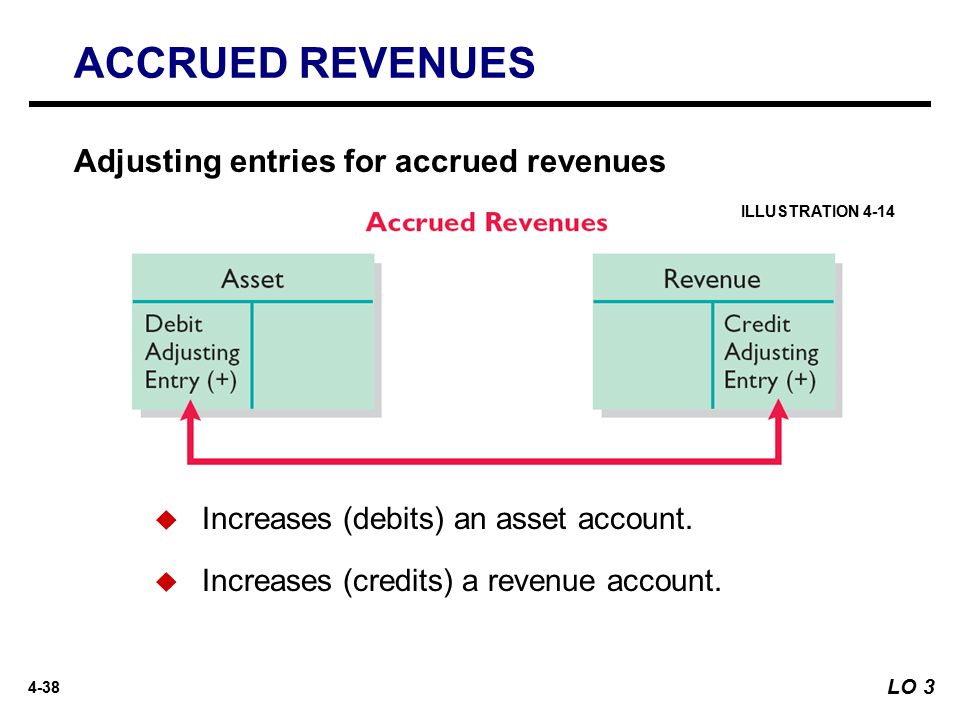

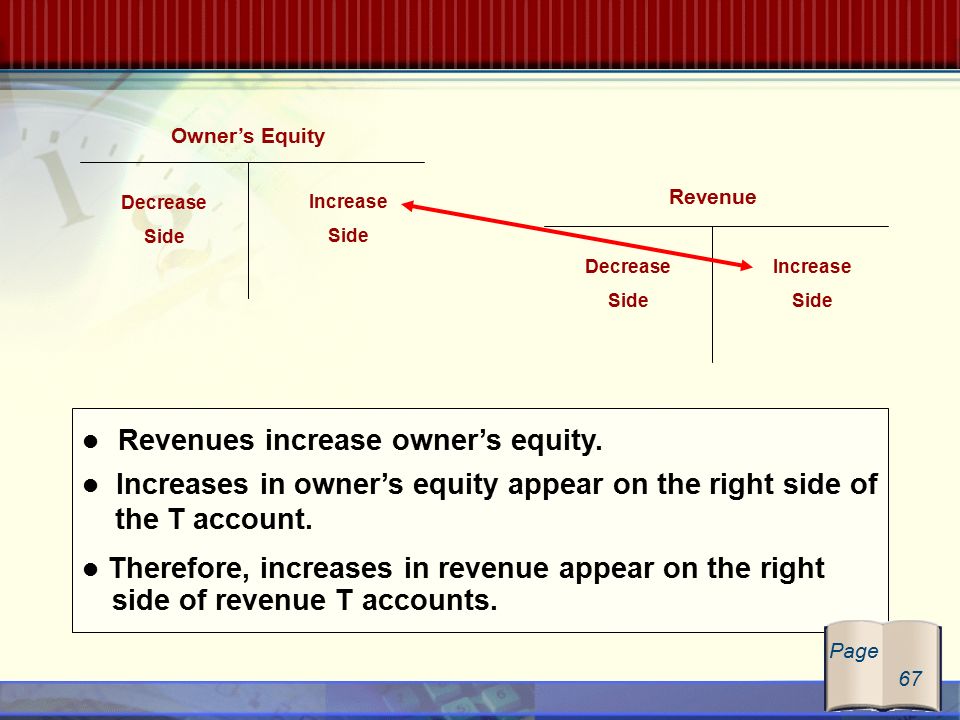

Revenue accounts are increased by credits only when. This means that a credit in the revenue t account increases the account balance. On the other hand increases in revenue liability or equity accounts are credits or right side entries and decreases are left side entries or debits. The rule for asset accounts says they must increase with a debit entry and decrease with a credit entry. Decreases with increased revenue b.

The accounting requirement that each transaction be recorded by an entry that has equal debits and credits is called double entry procedure or duality. Shows only credit balances d. Unlike other accounts revenue accounts are rarely debited because revenues or income are usually only generated. When we debit one account or accounts for 100 we must credit another account or accounts for a total of 100.

How this works is explained in calculating your income tax. The normal balance of an asset account is debit. Assets expenses and dividends 109. The types of accounts to which this rule applies are liabilities revenues and equity.

In recording an accounting transaction in a double entry system the amount of the debits must equal the amount of the credits. As shown in the expanded accounting equation revenues increase equity. Has a normal balance of a debit d. All those account types increase with debits or left side entries.

All accounts that normally contain a credit balance will increase in amount when a credit right column is added to them and reduced when a debit left column is added to them. Tax credits what tax credits are and the different types of tax credit. The usual sequence of steps in the transaction recording process is analyze journalize post to the ledger. Lists only accounts that are used to prepare the balance sheet.

Which accounts normally have debit balances. Tax credits reduce the amount of tax you pay. The revenue account is an equity account with a credit balance. The normal balance of any account is the entry type debit or credit which increases the account when recording transactions in the journal and posting to the company s ledger.

Debits increase assets with credits increasing liabilities and equity. Accountants follow the equation of assets liabilities owner s equity. Conversely a decrease to any of those accounts is a credit or right side entry. The capital account a.

A credit is always entered on the right side of a. A credit is an accounting transaction that increases a liability account such as loans payable or an equity account such as capital.