Revenue Accounts Do Not Include Which Of The Following

/IncomestatementApple-83dd63870e72405e87749f33fd8e35af.jpg)

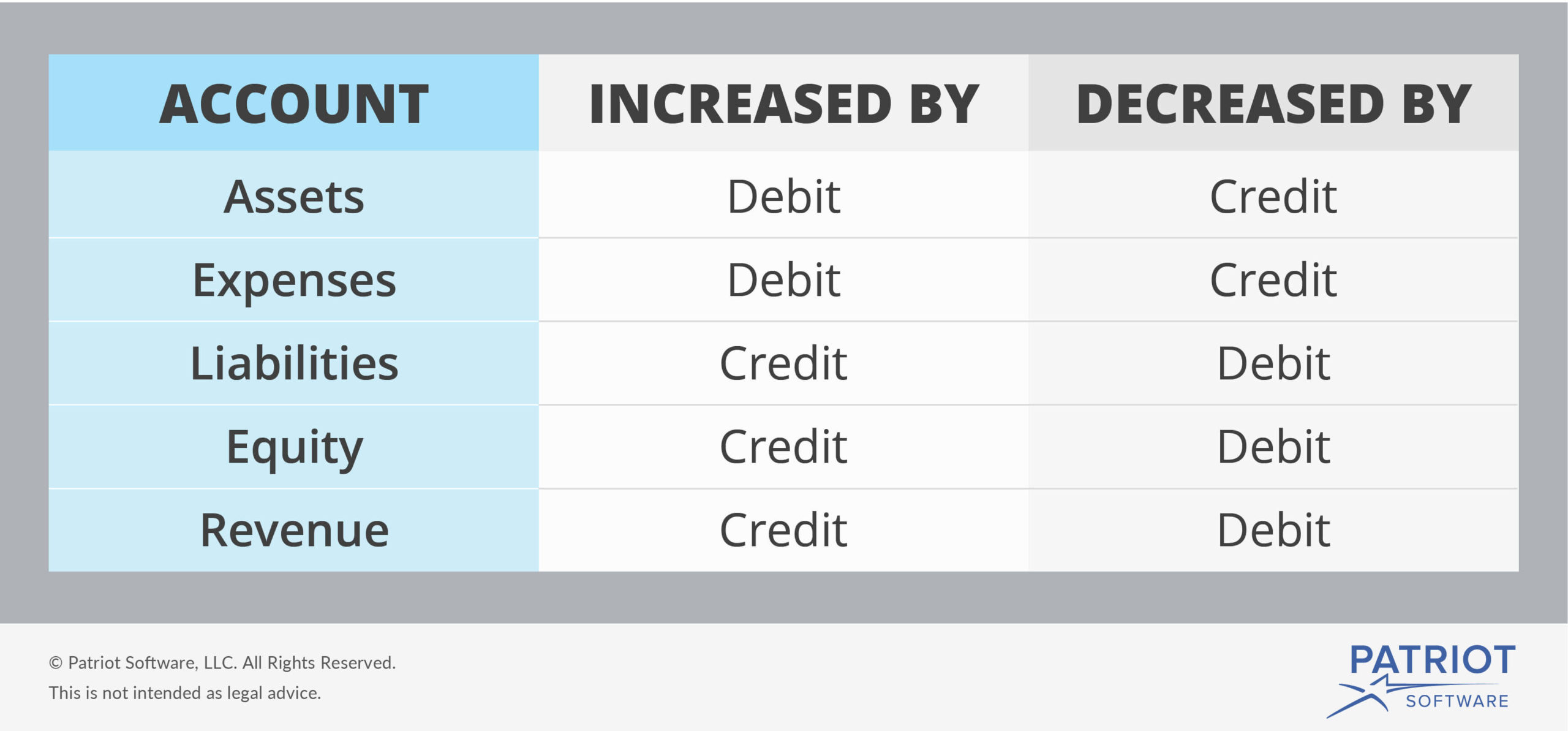

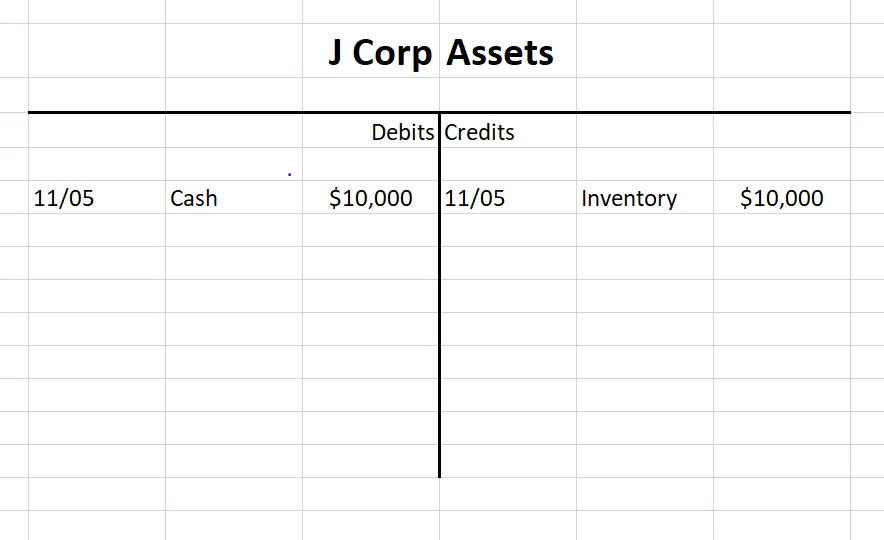

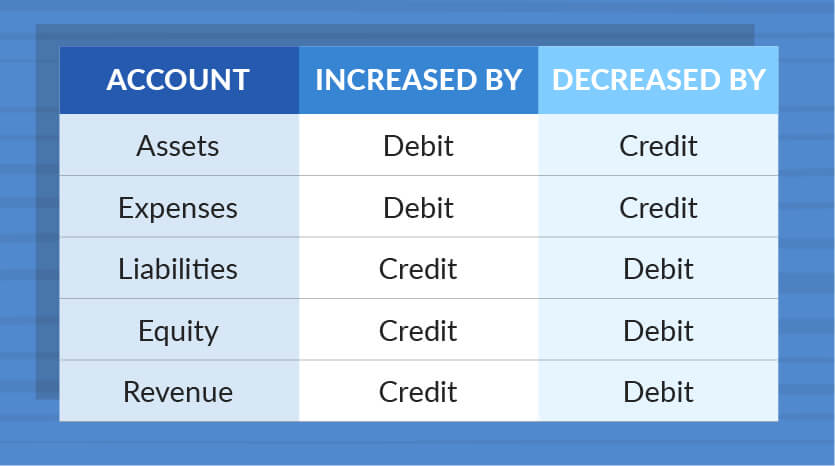

This means that a credit in the revenue t account increases the account balance.

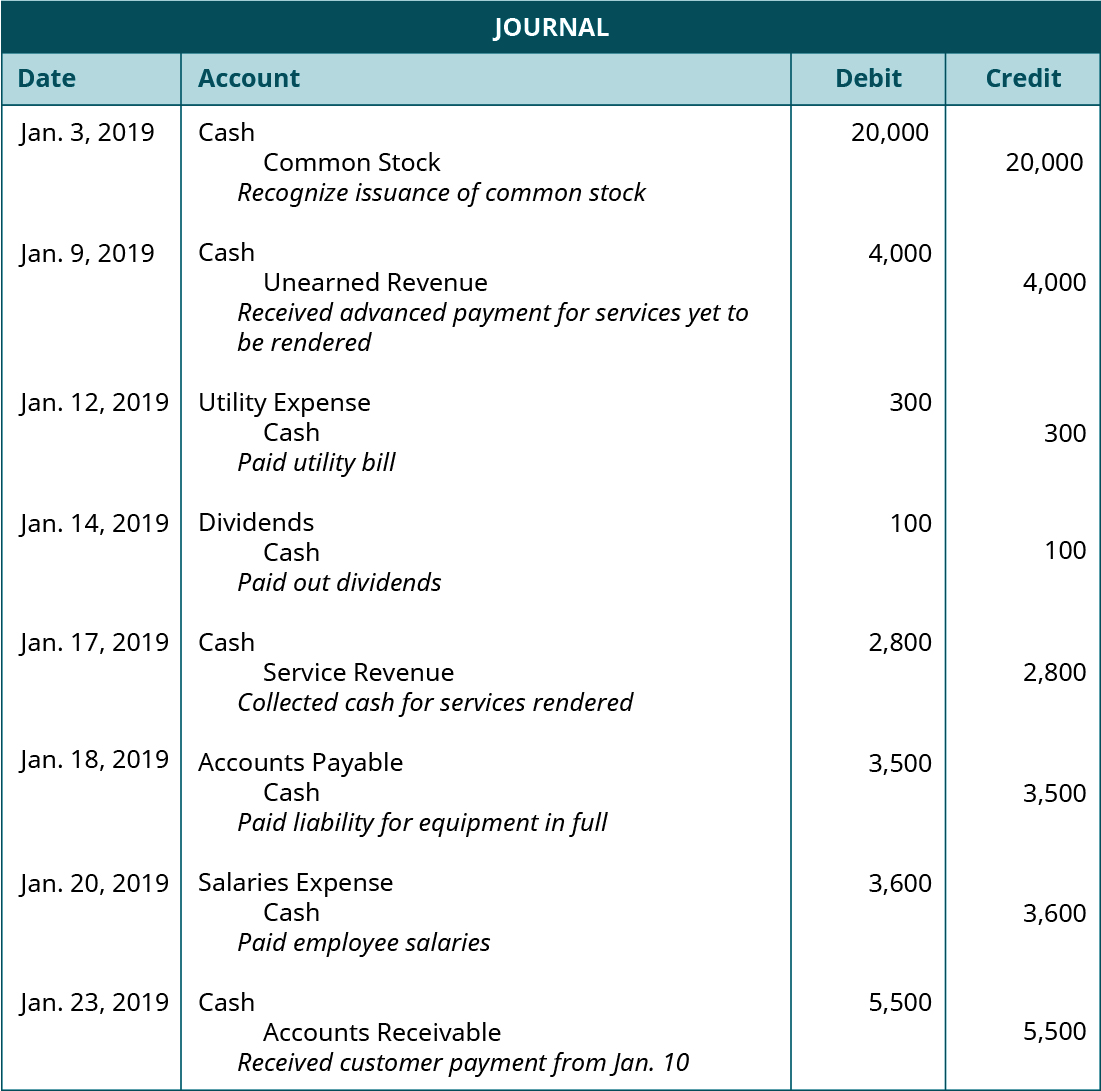

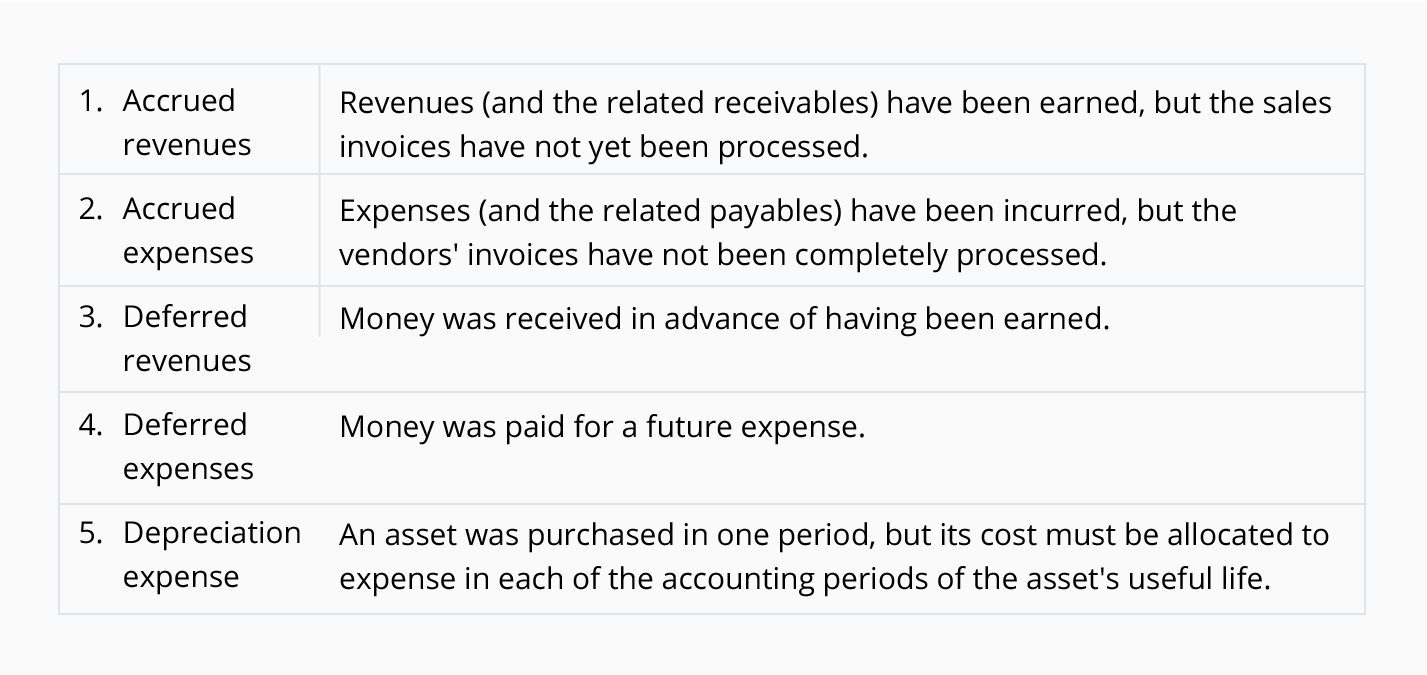

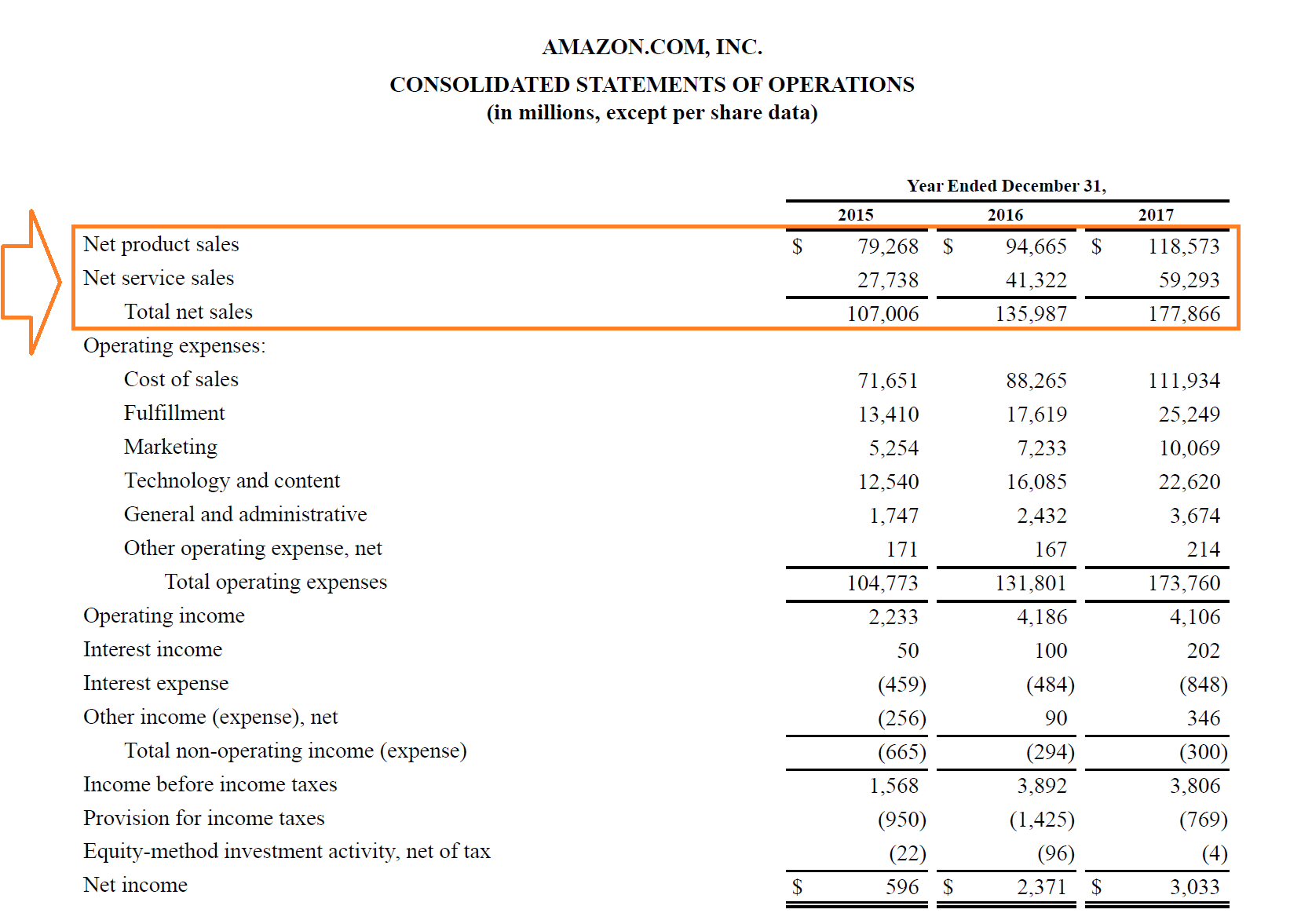

Revenue accounts do not include which of the following. Service revenue revenue earned from rendering services. As expected the main account in the revenue cycle is the revenue or sales account. Revenue accounts do not appear on the post closing trial balance. Contra revenue accounts increase the amount of operating expenses.

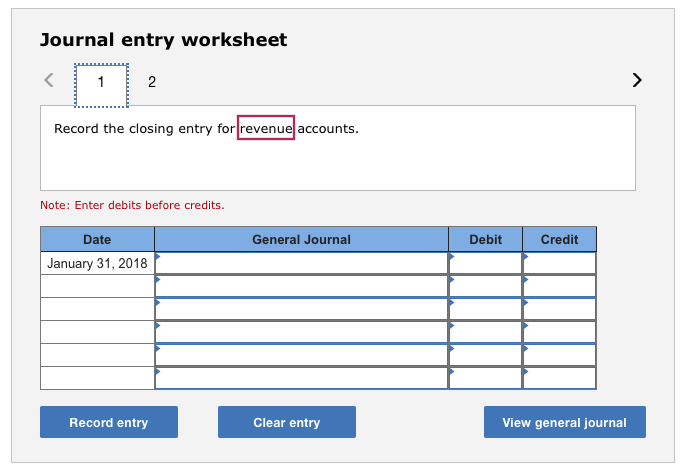

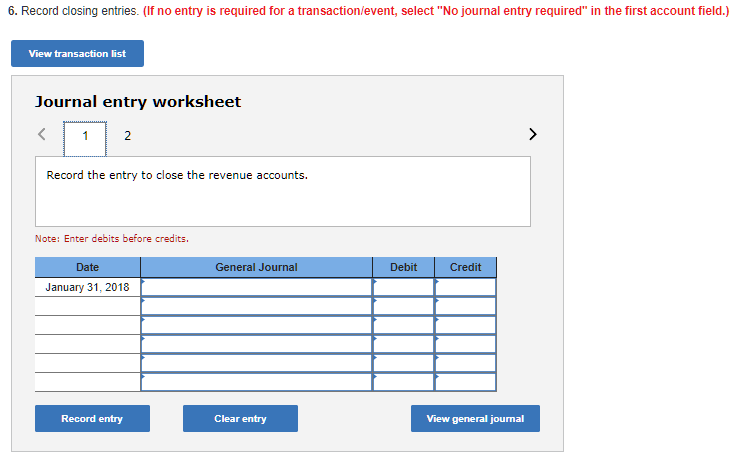

Other account titles may be used depending on the industry of the business such as professional fees for professional practice and tuition fees for schools. The journal entry to close the revenue account would include which of the following. Contra revenue accounts are useful when in bookkeeping terms a business needs to keep the two accounts separate so as not to lose information but for presentation reasons in the financial statements it is necessary to offset them against each other and show a net balance. Since the revenues start fresh each period the accountant finds the balance for each revenue account and posts it in the income statement.

A debit to the revenue account and a credit to the retained earnings account. The revenue account is an equity account with a credit balance. Question 1 of 15 1 0 1 0 points examples of revenue accounts include all of the following except a. The entry required to close the revenue accounts at the end of the period includes a d.

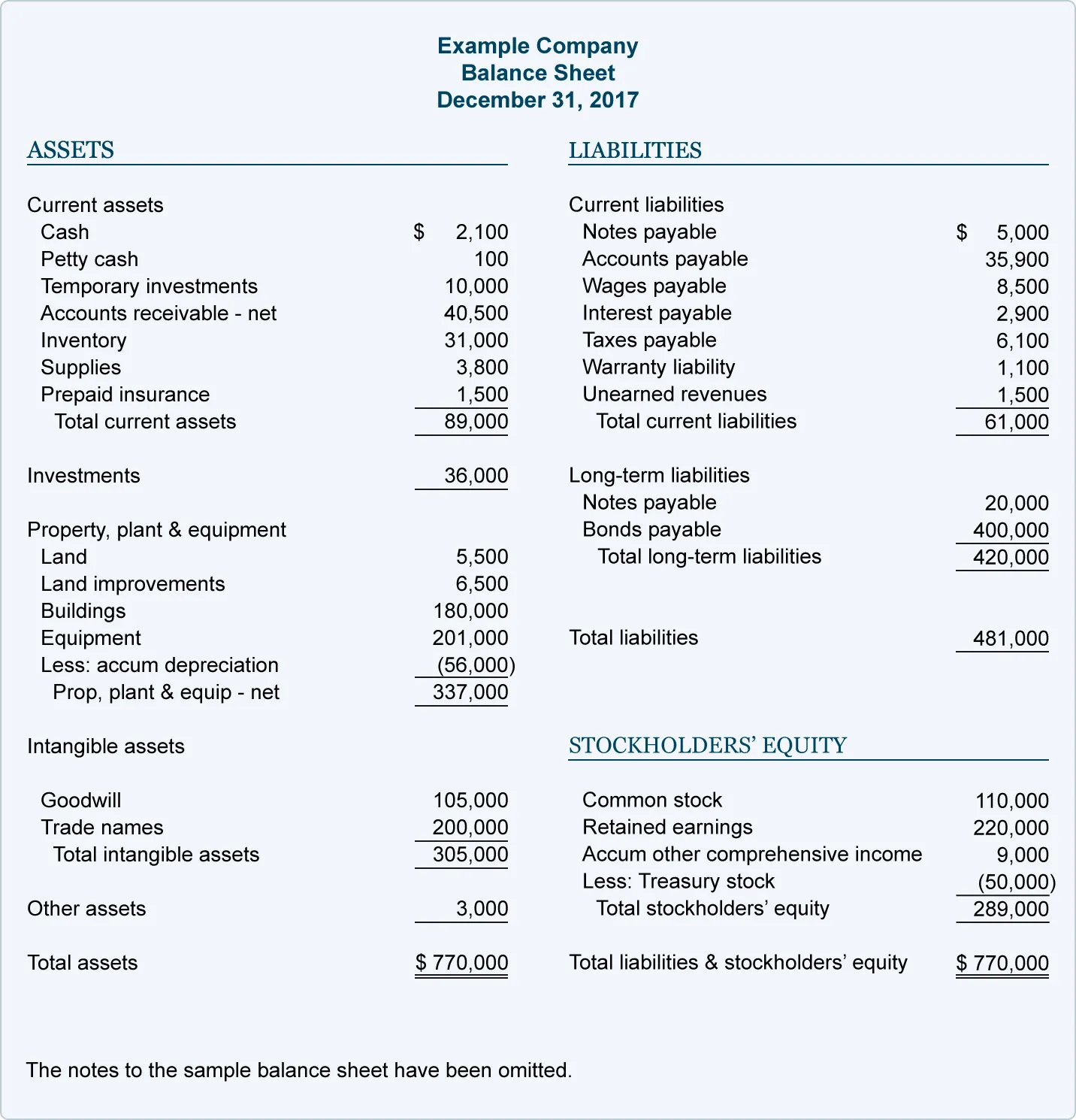

Credit to income summary for 38 300 the balance in the supplies account before adjustment at the end of the year is 6 250. Sales revenue from selling goods to customers. Accountre the sales or services still owed to the customer after the adjustments have been recorded unearned revenue on the balance sheet reports the amount of. Contra revenue accounts do not appear on the income statement.

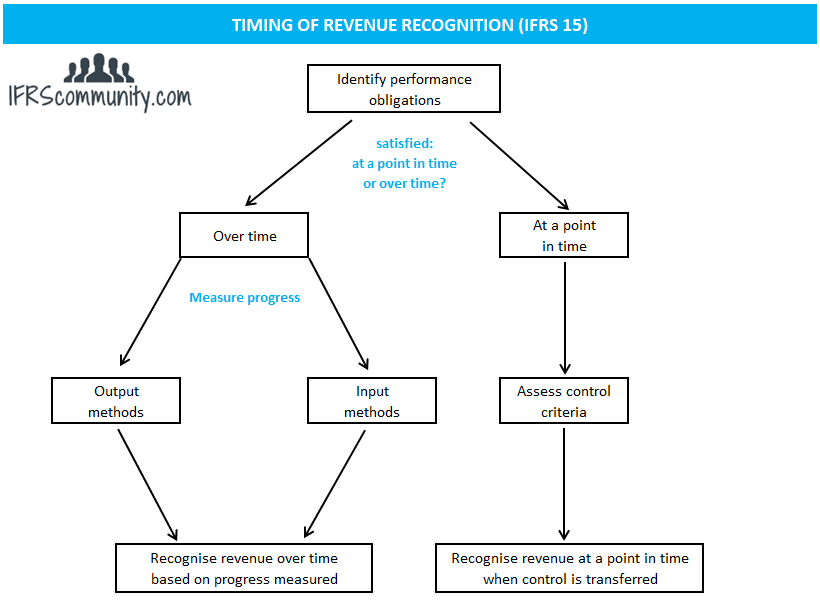

Generally accepted accounting principles have set strict criteria for the recognition of revenue. While some types of transactions have even more rules all transactions require four characteristics to be met before revenue can be booked. Accrual adjustments to record amounts earned but not yet collected include a debit to an asset account and a credit to a n. Sales discounts are included in the calculation of gross profit.

Expenses capital and. A credit to both the revenue and the retained earnings account. Revenues include professional service fees or merchandise sales. A debit to both the revenue and the retained earnings account.

Revenues are the assets earned by a company s operations and business activities. Capital liabilities and expenses. A question 2 of 15 1 0 1 0 points accounts that affect owner s equity are a. List of revenue accounts.

It is the principal revenue account of merchandising and manufacturing companies. In other words revenues include the cash or receivables received by a company for the sale of its goods or services.

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)