Revenue Online Vat Return

Advantages of submitting vat return online.

Revenue online vat return. The web based return system offers the following benefits. If the e filer s signature has not been captured in the tra afis system then the e filer is required to arrange for signature capturing at the tra office where the filer or the entity files its vat returns. A taxpayer or a taxable person who is a physical person may submit online forms in connection with his own personal tax and vat affairs using his personal e id only by using the personal services below. The national board of revenue nbr is the apex authority for tax administration in bangladesh.

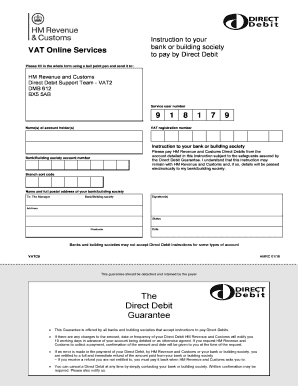

Revenue is committed to providing a wide range of online services to business and personal tax payers. Vat is payable on 20 th day of the following month of the business that is a due date of submitting the return. Please note that where the vat return is submitted after the due date mentioned above a penalty for late submission of rs 2 000 per month or part of the month up to a maximum of rs 20 000 rs 5 000 in the case of a small enterprise is applicable. It was established by the father of the nation bangabandhu sheikh mujibur rahman under president s order no.

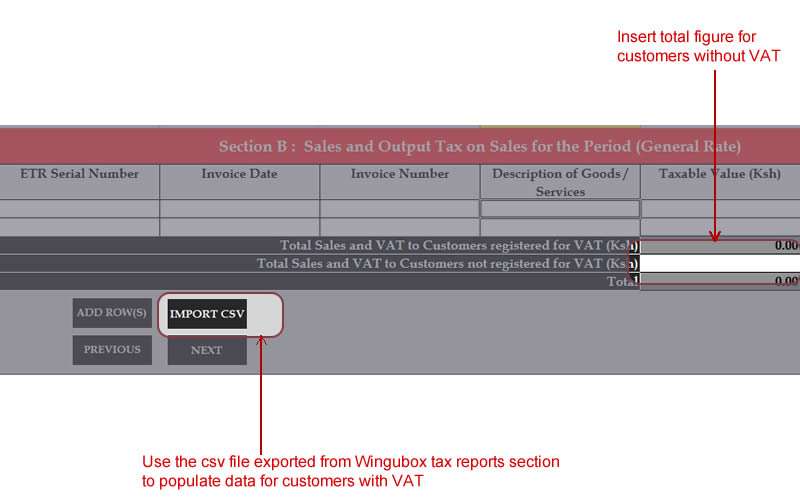

Currently vat registered traders are supposed to submit returns to tra online or in paper form. Once verified start using online tax services. Box 710 albert voight street mariental 264 63 240 487 264 63 240 460. Vat online services for maltese id card holders.