Revenue Recognition Principle Are Usually Met

In accounting the terms sales and revenue can be and often are used interchangeably to mean the same thing.

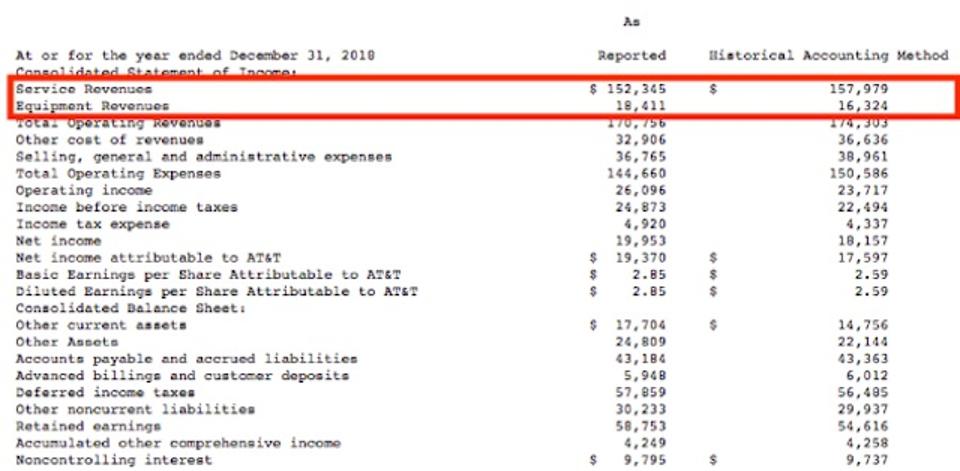

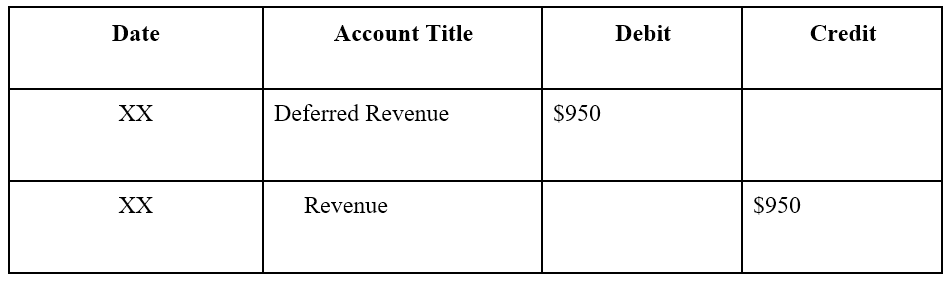

Revenue recognition principle are usually met. Revenues are monetary inflows accruing to an entity from business operations. The revenue is not recorded however until it is earned. Some manufacturers may recognize revenue during the production process. Revenue recognition is a generally accepted accounting principle gaap that stipulates how and when revenue is to be recognized.

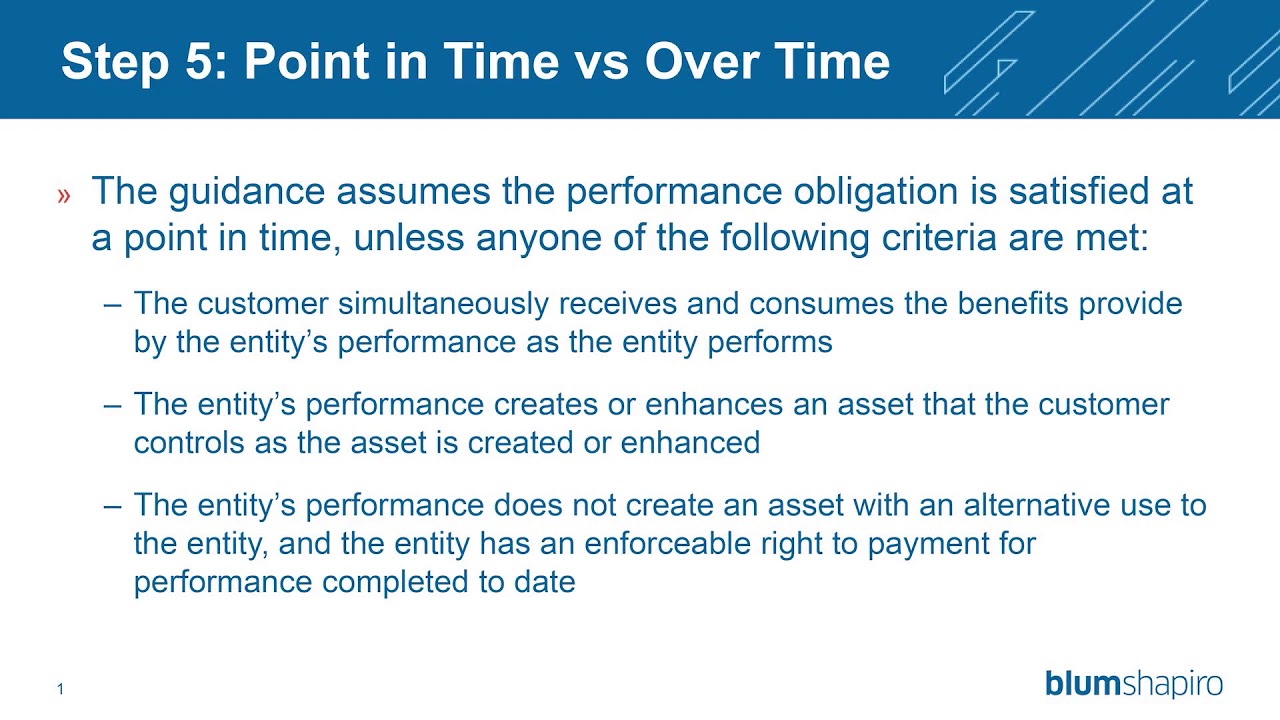

The revenue recognition principle using accrual accounting. This is common in long. Revenue recognition principle for the provision of services one important area of the provision of services involves the accounting treatment of construction contracts. There are three main exceptions to the revenue recognition principle.

Discuss when the requirements of the revenue recognition principle are usually met.

:max_bytes(150000):strip_icc()/GettyImages-1051929672-986f9246cdef4945889a2d1da90a6a57.jpg)