Where Is Interest Revenue Recorded On The Income Statement

What is interest income.

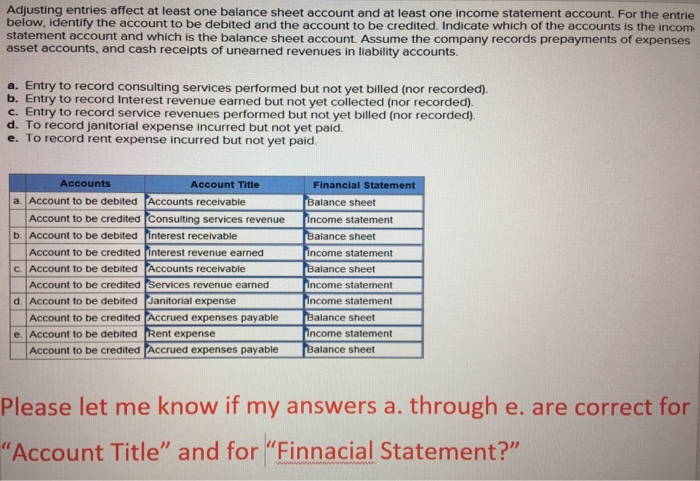

Where is interest revenue recorded on the income statement. We ll also explore which financial statement of interest revenue is shown on the income statement and where and how it s recorded. 23 a company provides services totaling 18 000 to one of its main customers then invoices the customer on sept. Put interest revenue income statement merchandising. Conversely it may the the income from operations if.

Interest expense represents an amount of interest payable on any borrowings which includes loans bonds or other lines of credit and its associated costs are shown on the income statement. Interest income is the revenue earned by lending money to other entities and the term is usually found in the company s income statement to report the interest earned on the cash held in the savings account certificates of deposits or other investments. These terms refer to the value of a company s sales of goods and services to its customers. Income statement accounts multi step format net sales sales or revenue.

1 with terms of net 15 meaning the payment is due within 15 days. Its depends for companies other then financial services its a income of other sources other income. In this lesson we ll define two types of interest revenue. For the best answers search on this site https shorturl im avjt3.

The main issue with interest revenue is where to record it on the income statement if an entity is in the business of earning interest revenue such as a lender then it should record interest. The amount of interest a company pays in relation to its revenue and earnings is tremendously important. Since this interest is not a part of the original investment it is separately recorded. Although a company s bottom.

To understand when revenue is recorded using the accrual basis of accounting assume that on aug.