Revenue Canada Home Office Expenses

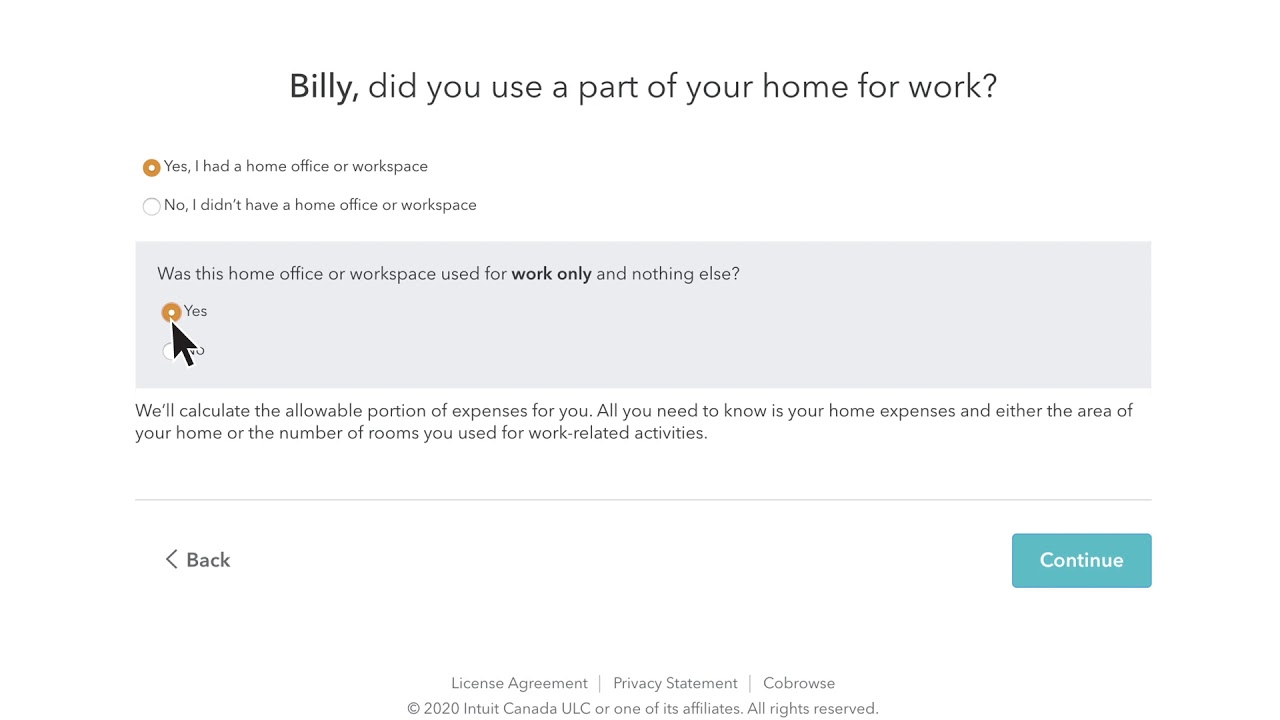

First determine if your workspace qualifies and then look at which expenses you can claim.

Revenue canada home office expenses. A spokesperson for the cra however says there is no increased effort this year to review home office expenses and no change to how it reviews employment expenses or t2200s. The expenses you claim cannot have been claimed elsewhere on form t2125. Enter on line 22900 the allowable amount of your employment expenses from the total expenses line of form t777. Enter the lower amount of line 24 or 25 of form t777 at line 9945.

This is a general list of deductible business expenses according to the cra canada revenue agency for canadian small businesses. The canada revenue agency cra has stringent conditions that determine whether a home business owner can claim business use of home expenses the home office tax deduction. To calculate your business use of home expenses complete the calculation of business use of home expenses section on form t2125 part 7. Complete the calculation of work space in the home expenses portion of form t777 statement of employment expenses.

However be sure to follow the rules otherwise your tax claim could be denied. Note that the expenses you. To help calculate your business use of home expenses complete the calculation of business use of home expenses on form t2125 part 7. Self employed individuals and qualified employees can claim expenses associated with having a home office.

Completing your tax return. The canada revenue agency allows you to deduct business use of home or workspace in the home expenses from your income lowering your taxable income and reducing your tax burden. Reduce your tax bill by 1 984 in 2021 by doing this. If your home is 1 000 square feet and your home office measures 200 square feet you ll be able to claim an amount equal to 20 200 1 000 20 of your related expenses on your return.

Trading in your cubicle at work for a home office means possible tax deductions. Because motley fool canada is offering a full 65. Unfortunately there are certain expenses that a salaried employee can t claim on their return. The good news is the canada revenue agency lets you claim your home office on your taxes.

With so many canadians newly working at home due to workplace closures we have encouraged the cra to streamline form t2200 declaration of conditions of employment and reduce the associated administrative burden of home office expense claims.