Taxation Government Revenue Definition

Learn more about taxation in this article.

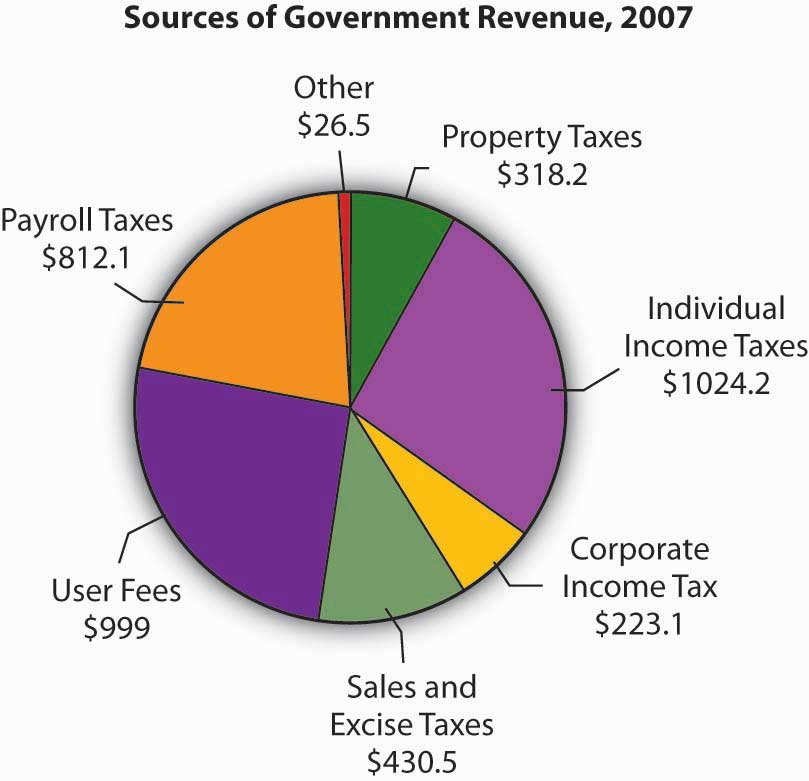

Taxation government revenue definition. Tax revenue is defined as the revenues collected from taxes on income and profits social security contributions taxes levied on goods and services payroll taxes taxes on the ownership and transfer of property and other taxes. Taxes are levied in almost every country of the world primarily to raise revenue for government expenditures although they serve other purposes as well. The mode by which government make exactions for revenue in order to support their existence and carry out their legitimate objective. The term taxation applies to all types of involuntary levies from income to capital gains to.

Another perspective of the definition has it that taxation is the compulsory payment levied by the government on its citizens to generate revenue and control economic activities hence it is backed by law. Income taxation reviewer definition of taxation this is the power by which the sovereign raises revenue to defray the necessary expenses of government. Taxation as an instrument of public policy is essentially concerned with the manipulation of financial operations of both the government anti private sectors with a view of furthering certain economic. Taxation is a term for when a taxing authority usually a government levies or imposes a tax.

Taxation has not only influenced the economy it has also become an important instrument of economic policy. The power of the state to collect revenue for public purposes. Taxation imposition of compulsory levies on individuals or entities by governments. Tax revenue forms part of the receipt budget which in turn is a part of the annual financial statement of the union budget.