Tax Revenue Definition Us History

Federal tax revenue is the total tax receipts received by the federal government each year.

Tax revenue definition us history. However one of the challenges to the validity of this tax reached the united states supreme court in 1880. During the civil war from 1861 to 1865 the government realized that tariffs and excise taxes alone could not generate enough revenue to both run the government and conduct the war against the confederacy. Like many nations the united states has a progressive tax system not a regressive one through which a higher percentage of tax revenues are collected from high income. In addition congress passed the internal revenue act in 1862 which created the bureau of internal revenue a predecessor to the modern day irs.

Taxes are levied in almost every country of the world primarily to raise revenue for government expenditures although they serve other purposes as well. The tax foundation is the nation s leading independent tax policy nonprofit. Taxation imposition of compulsory levies on individuals or entities by governments. Taxes in the u s.

This tax was repealed and replaced by another income tax in the revenue act of 1862. While the civil war led to the creation of the first income tax in the u s the federal income tax. Early income taxes came and went. Income taxes in america.

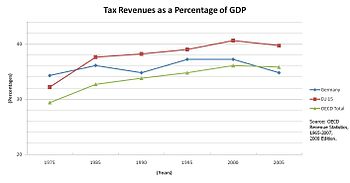

In the united states tax revenue is collected at each governmental level through federal state and local taxes. Most of it is paid either through income taxes or payroll taxes. The constitution gave congress the power to impose taxes and other levies on the general public. In 1862 congress established a limited income tax only on people who made more than 600 but abolished it in 1872 in favor of higher excise taxes on.

Since 1937 our principled research insightful analysis and engaged experts have informed smarter tax policy at the federal state and global levels. After the war when the need for federal revenues decreased congress in the revenue act of 1870 let the tax law expire in 1873. The history of income tax in america is an unusual one. The first federal income tax was created in 1861 during the civil war as a mechanism to finance the war effort.

In fiscal year fy 2021 income taxes will account for 50 payroll taxes make up 36 and corporate taxes supply 7.